WILL GIVE MAJOR THUMBS UP! Need help!

Please be sure to write down any Assumptions.

Create and ER Model and a Relational Model.

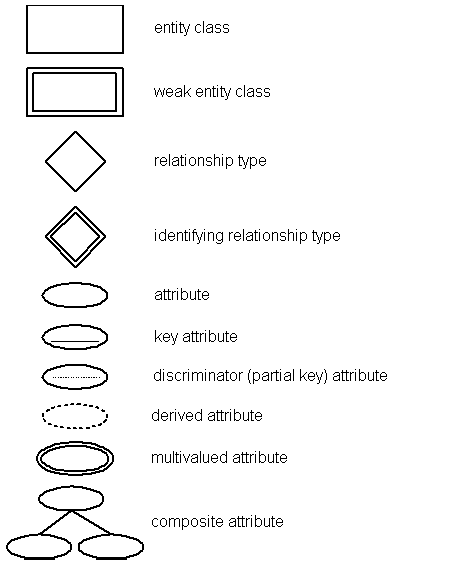

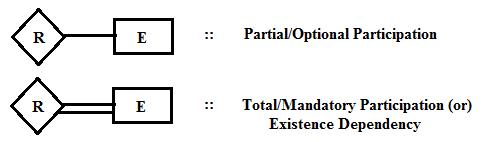

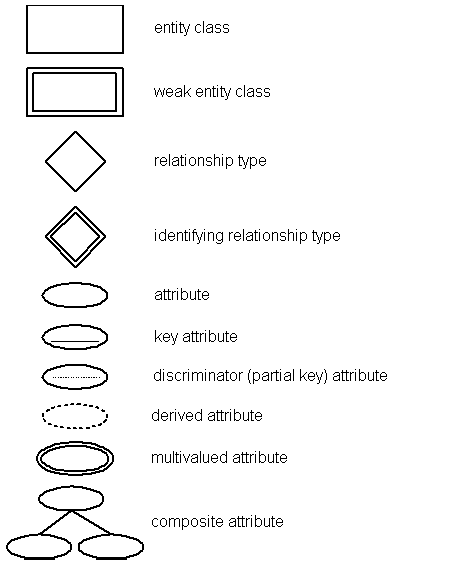

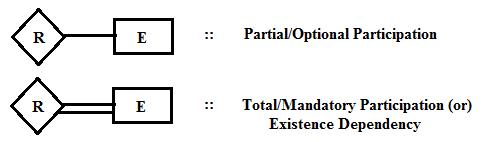

Must use Standard Notations for the ER model.

Standard Notation Below for ER Model!

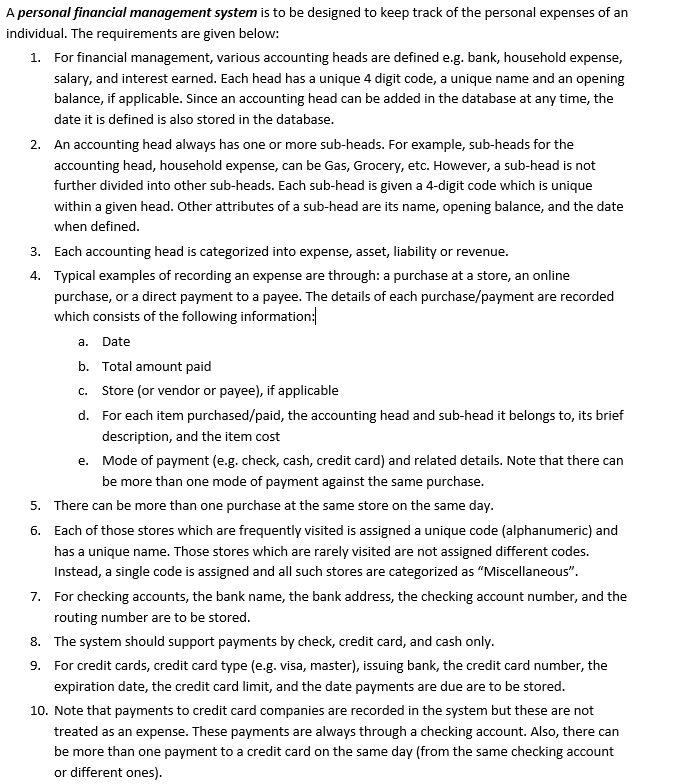

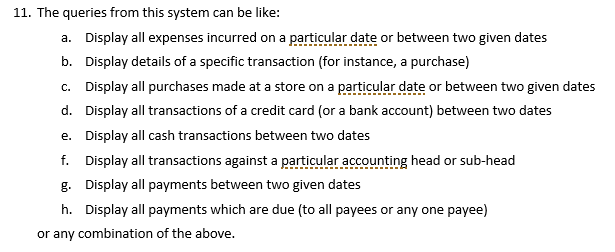

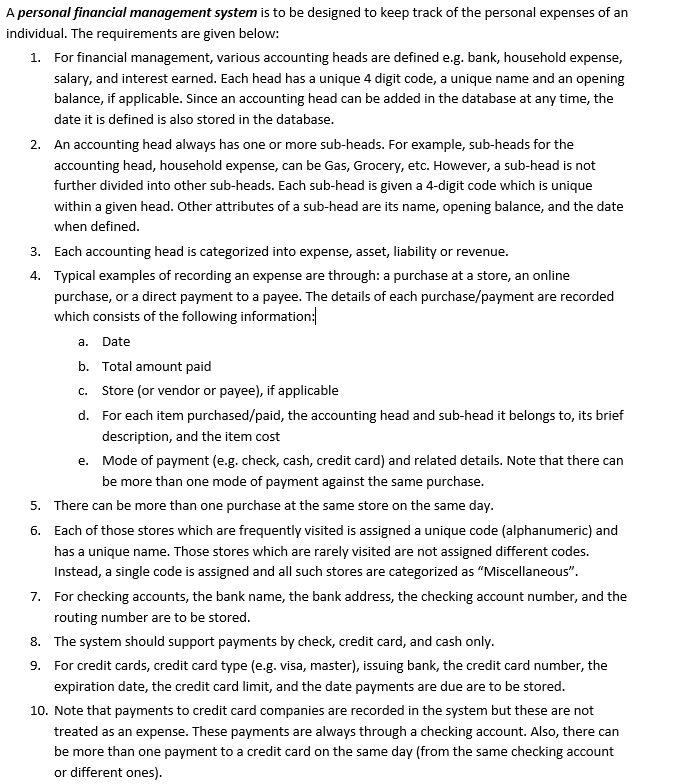

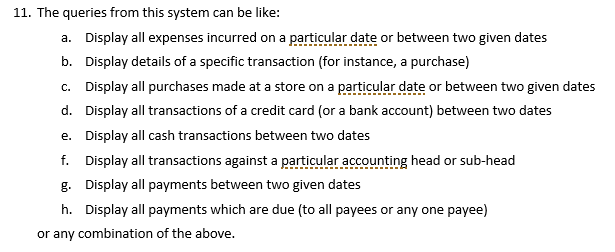

A personal financial management system is to be designed to keep track of the personal expenses of an individual. The requirements are given below: For financial management, various accounting heads are defined e.g. bank, household expense salary, and interest earned. Each head has a unique 4 digit code, a unique name and an opening balance, if applicable. Since an accounting head can be added in the database at any time, the date it is defined is also stored in the database An accounting head always has one or more sub-heads. For example, sub-heads for the accounting head, household expense, can be Gas, Grocery, etc. However, a sub-head is not further divided into other sub-heads. Each sub-head is given a 4-digit code which is unique within a given head. Other attributes of a sub-head are its name, opening balance, and the date when defined Each accounting head is categorized into expense, asset, liability or revenue Typical examples of recording an expense are through: a purchase at a store, an online purchase, or a direct payment to a payee. The details of each purchase/payment are recorded which consists of the following information: 1. 2. 3. 4. a. b. c. d. Date Total amount paid Store (or vendor or payee), if applicable For each item purchased/paid, the accounting head and sub-head it belongs to, its brief description, and the item cost Mode of payment (e.g. check, cash, credit card) and related details. Note that there can be more than one mode of payment against the same purchase e. 5. There can be more than one purchase at the same store on the same day Each of those stores which are frequently visited is assigned a unique code (alphanumeric) and has a unique name. Those stores which are rarely visited are not assigned different codes. Instead, a single code is assigned and all such stores are categorized as "Miscellaneous". For checking accounts, the bank name, the bank address, the checking account number, and the routing number are to be stored The system should support payments by check, credit card, and cash only For credit cards, credit card type (e.g. visa, master), issuing bank, the credit card number, the expiration date, the credit card limit, and the date payments are due are to be stored 6. 7. 8. 9. 10. Note that payments to credit card companies are recorded in the system but these are not treated as an expense. These payments are always through a checking account. Also, there can be more than one payment to a credit card on the same day (from the same checking account or different ones) A personal financial management system is to be designed to keep track of the personal expenses of an individual. The requirements are given below: For financial management, various accounting heads are defined e.g. bank, household expense salary, and interest earned. Each head has a unique 4 digit code, a unique name and an opening balance, if applicable. Since an accounting head can be added in the database at any time, the date it is defined is also stored in the database An accounting head always has one or more sub-heads. For example, sub-heads for the accounting head, household expense, can be Gas, Grocery, etc. However, a sub-head is not further divided into other sub-heads. Each sub-head is given a 4-digit code which is unique within a given head. Other attributes of a sub-head are its name, opening balance, and the date when defined Each accounting head is categorized into expense, asset, liability or revenue Typical examples of recording an expense are through: a purchase at a store, an online purchase, or a direct payment to a payee. The details of each purchase/payment are recorded which consists of the following information: 1. 2. 3. 4. a. b. c. d. Date Total amount paid Store (or vendor or payee), if applicable For each item purchased/paid, the accounting head and sub-head it belongs to, its brief description, and the item cost Mode of payment (e.g. check, cash, credit card) and related details. Note that there can be more than one mode of payment against the same purchase e. 5. There can be more than one purchase at the same store on the same day Each of those stores which are frequently visited is assigned a unique code (alphanumeric) and has a unique name. Those stores which are rarely visited are not assigned different codes. Instead, a single code is assigned and all such stores are categorized as "Miscellaneous". For checking accounts, the bank name, the bank address, the checking account number, and the routing number are to be stored The system should support payments by check, credit card, and cash only For credit cards, credit card type (e.g. visa, master), issuing bank, the credit card number, the expiration date, the credit card limit, and the date payments are due are to be stored 6. 7. 8. 9. 10. Note that payments to credit card companies are recorded in the system but these are not treated as an expense. These payments are always through a checking account. Also, there can be more than one payment to a credit card on the same day (from the same checking account or different ones)