Answered step by step

Verified Expert Solution

Question

1 Approved Answer

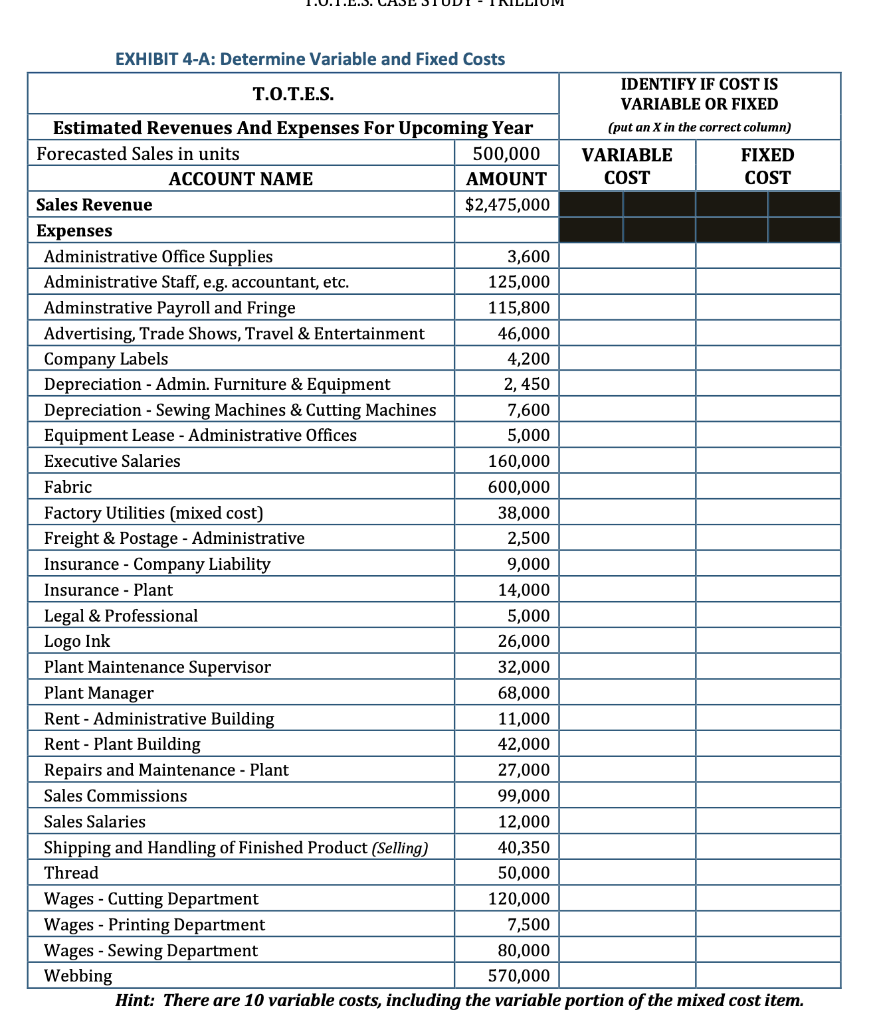

Will give positive rate if you can help. EXHIBIT 4-A: Determine Variable and Fixed Costs IDENTIFY IF COST IS T.O.T.E.S. VARIABLE OR FIXED Estimated Revenues

Will give positive rate if you can help.

EXHIBIT 4-A: Determine Variable and Fixed Costs IDENTIFY IF COST IS T.O.T.E.S. VARIABLE OR FIXED Estimated Revenues And Expenses For Upcoming Year (put an X in the correct column) Forecasted Sales in units 500,000 VARIABLE FIXED ACCOUNT NAME AMOUNT COST COST Sales Revenue $2,475,000 Expenses Administrative Office Supplies 3,600 Administrative Staff, e.g. accountant, etc. 125,000 Adminstrative Payroll and Fringe 115,800 Advertising, Trade Shows, Travel & Entertainment 46,000 Company Labels 4,200 Depreciation - Admin. Furniture & Equipment 2, 450 Depreciation - Sewing Machines & Cutting Machines 7,600 Equipment Lease - Administrative Offices 5,000 Executive Salaries 160,000 Fabric 600,000 Factory Utilities (mixed cost) 38,000 Freight & Postage - Administrative 2,500 Insurance - Company Liability 9,000 Insurance - Plant 14,000 Legal & Professional 5,000 Logo Ink 26,000 Plant Maintenance Supervisor 32,000 Plant Manager 68,000 Rent - Administrative Building 11,000 Rent - Plant Building 42,000 Repairs and Maintenance - Plant 27,000 Sales Commissions 99,000 Sales Salaries 12,000 Shipping and Handling of Finished Product (Selling) 40,350 Thread 50,000 Wages - Cutting Department 120,000 Wages - Printing Department 7,500 Wages - Sewing Department 80,000 Webbing 570,000 Hint: There are 10 variable costs, including the variable portion of the mixed cost itemStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started