Will provide a thumbs up if answered:)

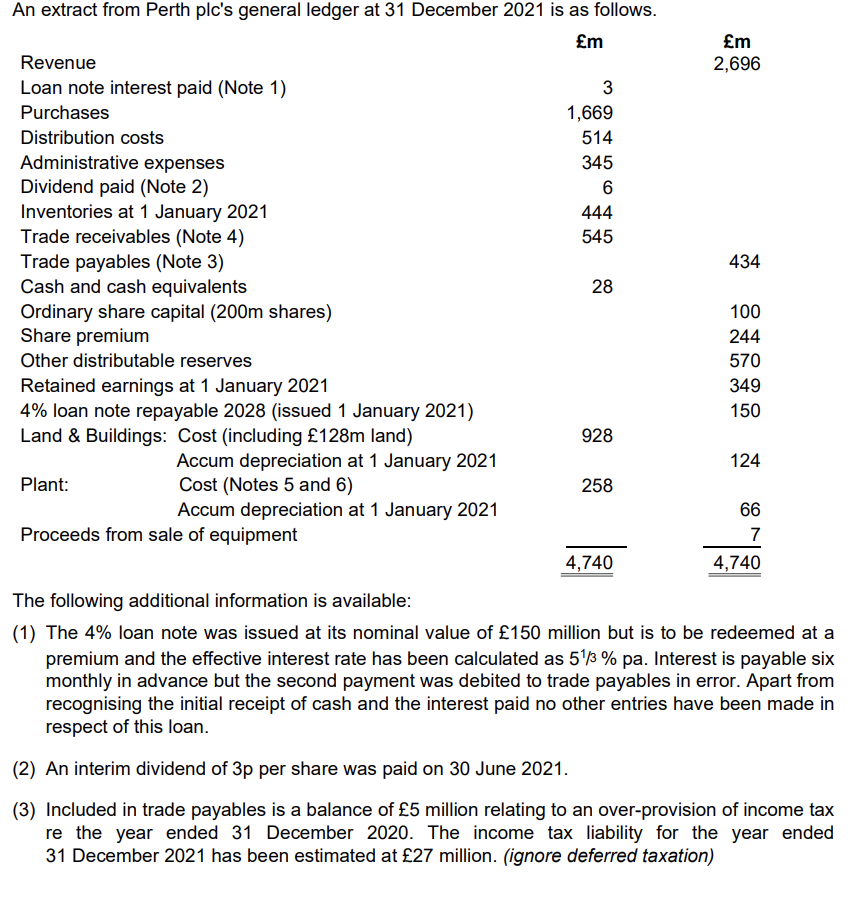

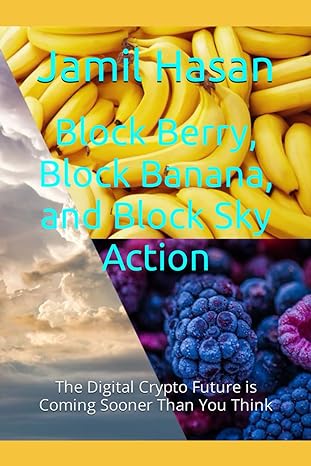

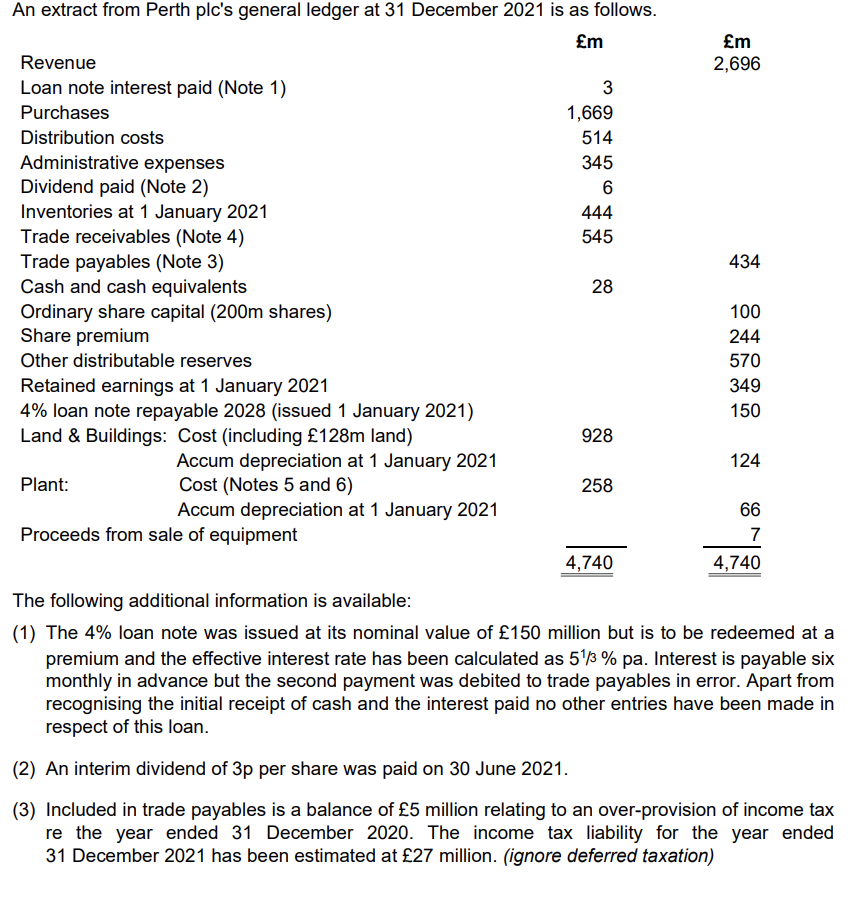

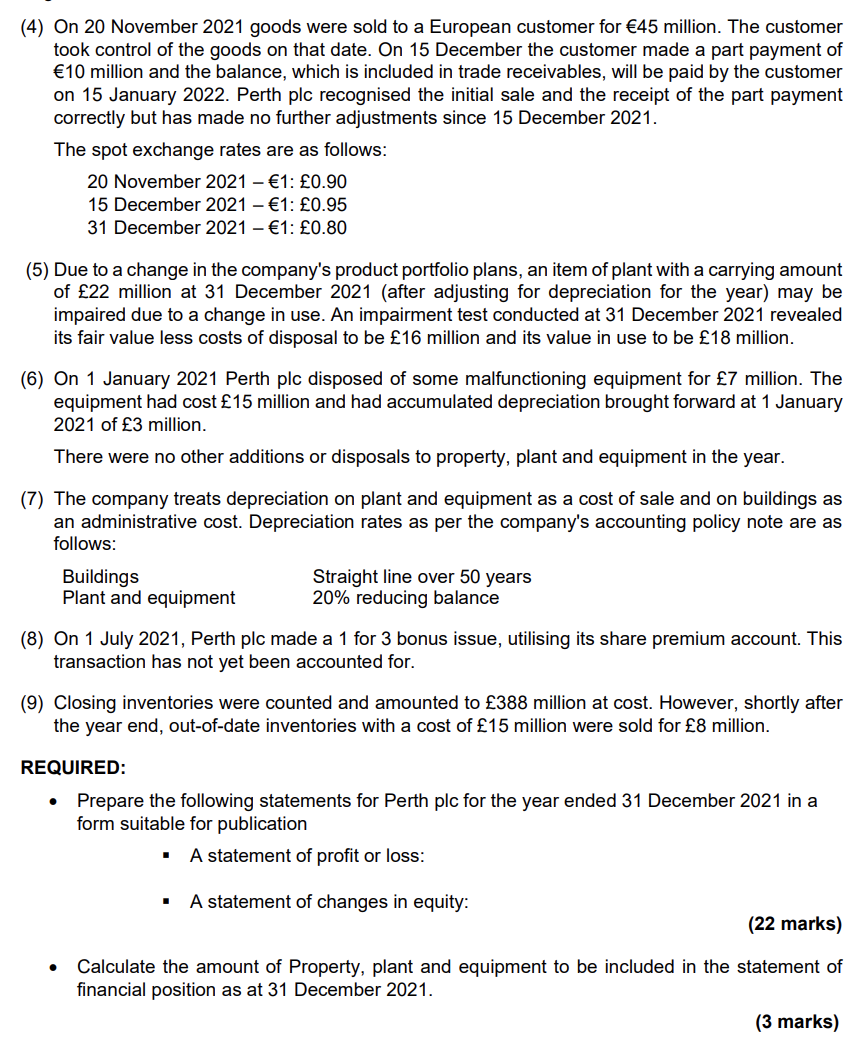

An extract from Perth plc's general ledger at 31 December 2021 is as follows. m Revenue Loan note interest paid (Note 1) 3 Purchases 1,669 Distribution costs 514 345 Administrative expenses Dividend paid (Note 2) 6 444 545 Inventories at 1 January 2021 Trade receivables (Note 4) Trade payables (Note 3) Cash and cash equivalents Ordinary share capital (200m shares) Share premium 28 Other distributable reserves Retained earnings at 1 January 2021 4% loan note repayable 2028 (issued 1 January 2021) Land & Buildings: Cost (including 128m land) 928 Accum depreciation at 1 January 2021 Cost (Notes 5 and 6) Plant: 258 Accum depreciation at 1 January 2021 Proceeds from sale of equipment 7 4,740 4,740 The following additional information is available: (1) The 4% loan note was issued at its nominal value of 150 million but is to be redeemed at a premium and the effective interest rate has been calculated as 513 % pa. Interest is payable six monthly in advance but the second payment was debited to trade payables in error. Apart from recognising the initial receipt of cash and the interest paid no other entries have been made in respect of this loan. (2) An interim dividend of 3p per share was paid on 30 June 2021. (3) Included in trade payables is a balance of 5 million relating to an over-provision of income tax re the year ended 31 December 2020. The income tax liability for the year ended 31 December 2021 has been estimated at 27 million. (ignore deferred taxation) m 2,696 434 100 244 570 349 150 124 66 (4) On 20 November 2021 goods were sold to a European customer for 45 million. The customer took control of the goods on that date. On 15 December the customer made a part payment of 10 million and the balance, which is included in trade receivables, will be paid by the customer on 15 January 2022. Perth plc recognised the initial sale and the receipt of the part payment correctly but has made no further adjustments since 15 December 2021. The spot exchange rates are as follows: 20 November 2021 - 1: 0.90 15 December 2021 - 1: 0.95 31 December 2021 - 1: 0.80 (5) Due to a change in the company's product portfolio plans, an item of plant with a carrying amount of 22 million at 31 December 2021 (after adjusting for depreciation for the year) may be impaired due to a change in use. An impairment test conducted at 31 December 2021 revealed its fair value less costs of disposal to be 16 million and its value in use to be 18 million. (6) On 1 January 2021 Perth plc disposed of some malfunctioning equipment for 7 million. The equipment had cost 15 million and had accumulated depreciation brought forward at 1 January 2021 of 3 million. There were no other additions or disposals to property, plant and equipment in the year. (7) The company treats depreciation on plant and equipment as a cost of sale and on buildings as an administrative cost. Depreciation rates as per the company's accounting policy note are as follows: Buildings Straight line over 50 years 20% reducing balance Plant and equipment (8) On 1 July 2021, Perth plc made a 1 for 3 bonus issue, utilising its share premium account. This transaction has not yet been accounted for. (9) Closing inventories were counted and amounted to 388 million at cost. However, shortly after the year end, out-of-date inventories with a cost of 15 million were sold for 8 million. REQUIRED: Prepare the following statements for Perth plc for the year ended 31 December 2021 in a form suitable for publication A statement of profit or loss: A statement of changes in equity: (22 marks) Calculate the amount of Property, plant and equipment to be included in the statement of financial position as at 31 December 2021. (3 marks) An extract from Perth plc's general ledger at 31 December 2021 is as follows. m Revenue Loan note interest paid (Note 1) 3 Purchases 1,669 Distribution costs 514 345 Administrative expenses Dividend paid (Note 2) 6 444 545 Inventories at 1 January 2021 Trade receivables (Note 4) Trade payables (Note 3) Cash and cash equivalents Ordinary share capital (200m shares) Share premium 28 Other distributable reserves Retained earnings at 1 January 2021 4% loan note repayable 2028 (issued 1 January 2021) Land & Buildings: Cost (including 128m land) 928 Accum depreciation at 1 January 2021 Cost (Notes 5 and 6) Plant: 258 Accum depreciation at 1 January 2021 Proceeds from sale of equipment 7 4,740 4,740 The following additional information is available: (1) The 4% loan note was issued at its nominal value of 150 million but is to be redeemed at a premium and the effective interest rate has been calculated as 513 % pa. Interest is payable six monthly in advance but the second payment was debited to trade payables in error. Apart from recognising the initial receipt of cash and the interest paid no other entries have been made in respect of this loan. (2) An interim dividend of 3p per share was paid on 30 June 2021. (3) Included in trade payables is a balance of 5 million relating to an over-provision of income tax re the year ended 31 December 2020. The income tax liability for the year ended 31 December 2021 has been estimated at 27 million. (ignore deferred taxation) m 2,696 434 100 244 570 349 150 124 66 (4) On 20 November 2021 goods were sold to a European customer for 45 million. The customer took control of the goods on that date. On 15 December the customer made a part payment of 10 million and the balance, which is included in trade receivables, will be paid by the customer on 15 January 2022. Perth plc recognised the initial sale and the receipt of the part payment correctly but has made no further adjustments since 15 December 2021. The spot exchange rates are as follows: 20 November 2021 - 1: 0.90 15 December 2021 - 1: 0.95 31 December 2021 - 1: 0.80 (5) Due to a change in the company's product portfolio plans, an item of plant with a carrying amount of 22 million at 31 December 2021 (after adjusting for depreciation for the year) may be impaired due to a change in use. An impairment test conducted at 31 December 2021 revealed its fair value less costs of disposal to be 16 million and its value in use to be 18 million. (6) On 1 January 2021 Perth plc disposed of some malfunctioning equipment for 7 million. The equipment had cost 15 million and had accumulated depreciation brought forward at 1 January 2021 of 3 million. There were no other additions or disposals to property, plant and equipment in the year. (7) The company treats depreciation on plant and equipment as a cost of sale and on buildings as an administrative cost. Depreciation rates as per the company's accounting policy note are as follows: Buildings Straight line over 50 years 20% reducing balance Plant and equipment (8) On 1 July 2021, Perth plc made a 1 for 3 bonus issue, utilising its share premium account. This transaction has not yet been accounted for. (9) Closing inventories were counted and amounted to 388 million at cost. However, shortly after the year end, out-of-date inventories with a cost of 15 million were sold for 8 million. REQUIRED: Prepare the following statements for Perth plc for the year ended 31 December 2021 in a form suitable for publication A statement of profit or loss: A statement of changes in equity: (22 marks) Calculate the amount of Property, plant and equipment to be included in the statement of financial position as at 31 December 2021