Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*** Will rate for a detailed solution. Note all of the information is given here. Thank you *** A plain vanilla interest rate swap is

*** Will rate for a detailed solution. Note all of the information is given here. Thank you ***

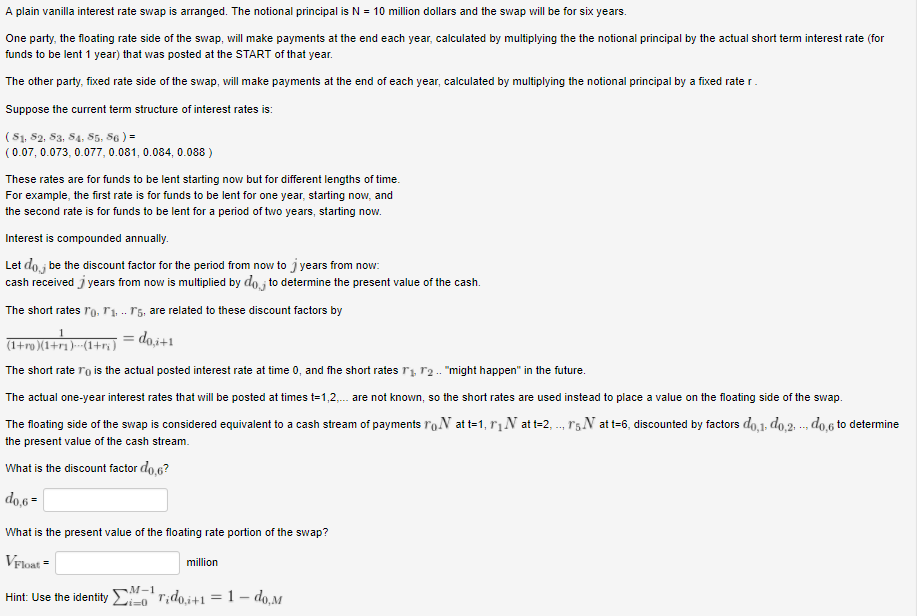

A plain vanilla interest rate swap is arranged. The notional principal is N 10 million dollars and the swap will be for six years One party, the floating rate side of the swap, will make payments at the end each year, calculated by multiplying the the notional principal by the actual short term interest rate (for funds to be lent 1 year) that was posted at the START of that year. The other party, fixed rate side of the swap, will make payments at the end of each year, calculated by multiplying the notional principal by a fixed rate r Suppose the current term structure of interest rates is ( 81, 82, s3, s4, s5, s6 ) = 0.07, 0.073, 0.077, 0.081, 0.084, 0.088) These rates are for funds to be lent starting now but for different lengths of time For example, the first rate is for funds to be lent for one year, starting now, and the second rate is for funds to be lent for a period of two years, starting now. Interest is compounded annually Let doj be the discount factor for the period from now to J years from now cash received years from now is multiplied by doj to determine the present value of the cash. The short rates ro, ri, ..rs, are related to these discount factors by (1+n)(1+ )--(1+r.) The short rate ro is the actual posted interest rate at time 0, and fhe short rates r1, r2"might happen" in the future The actual one-year interest rates that will be posted at times t=12 are not known, so the short rates are used instead to place a value on the floating side of the swap. i+1 The floating side of the swap is considered equivalent to a cash stream of payments r0N at t=1, ri the present value of the cash stream at t-2 5 at t-6 discounted by factors 0,1 d 0,2 d 0,6 to determine What is the discount factor do.6? 6 What is the present value of the floating rate portion of the swap? Float million Hint Use the identity --1 ridos+1-1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started