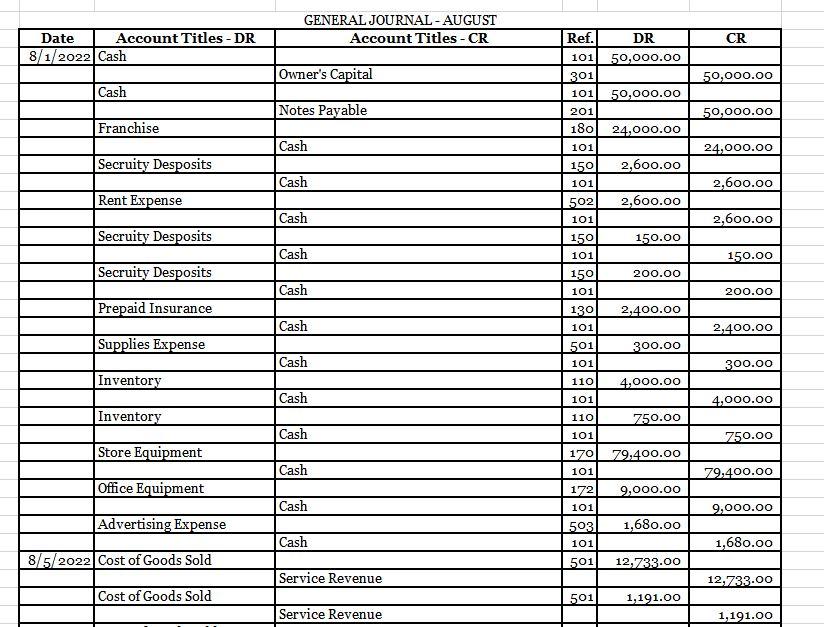

Will someone help check if I did this right and help me make a trial balance

all the information and I believe I did the restock of inventory correctly.

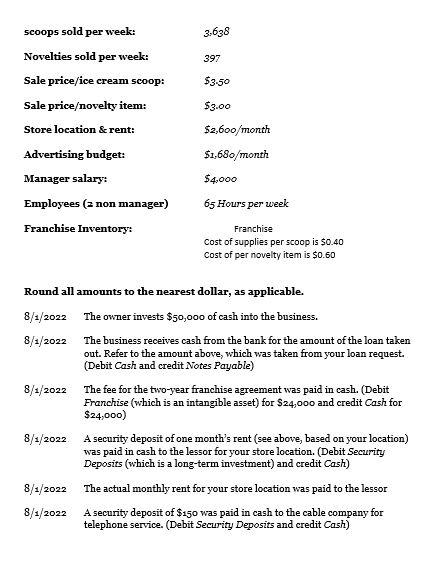

when making a first purchase I had to buy 10,000 x 0.40 and 1250 units of novelties x 0.60 and those are the answers for the stocking of inventory

All I need is for someone to make sure my general journal is correct and help make a trial balance

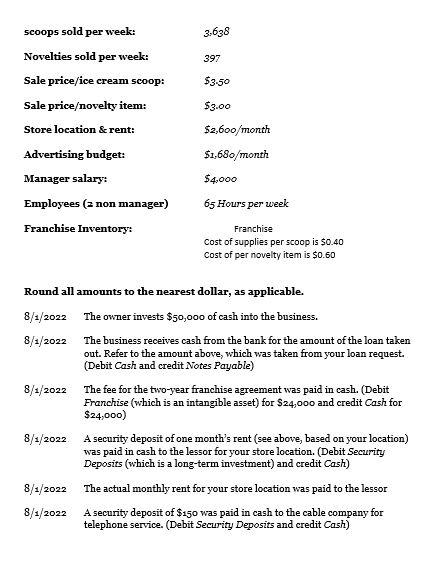

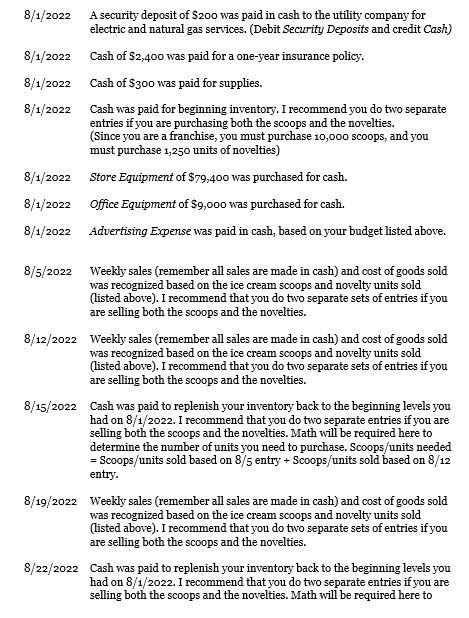

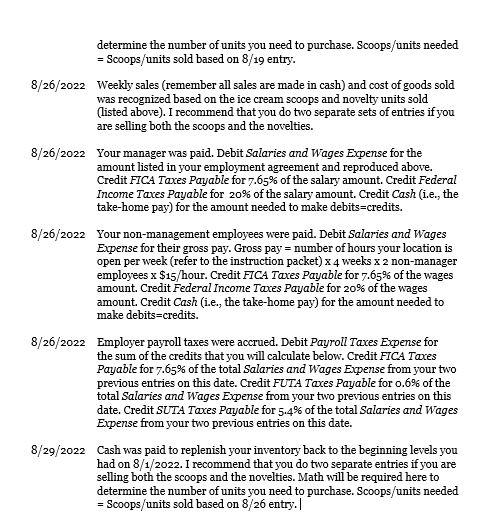

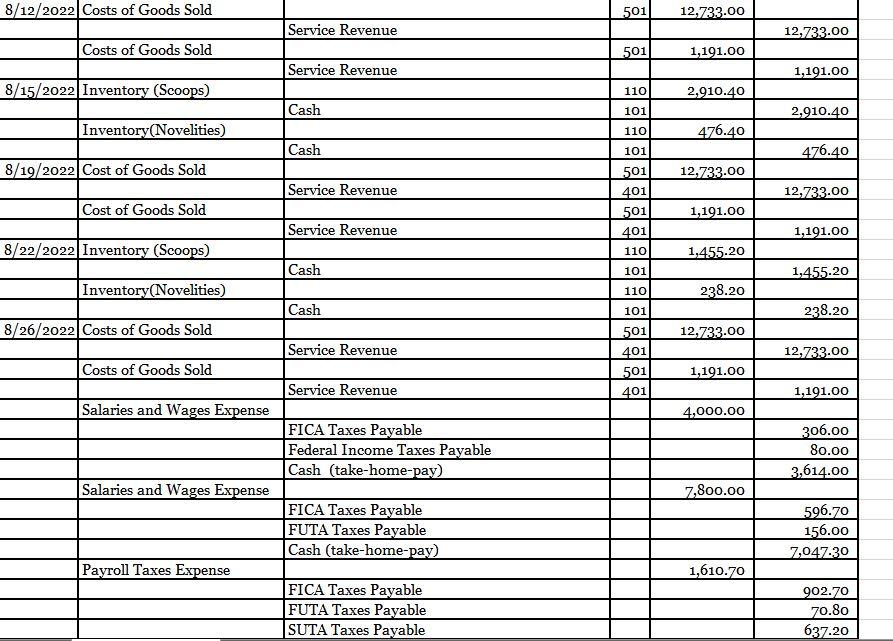

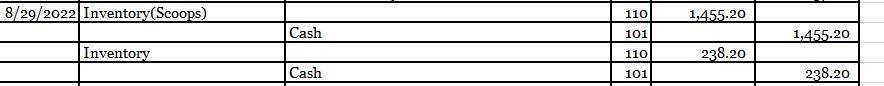

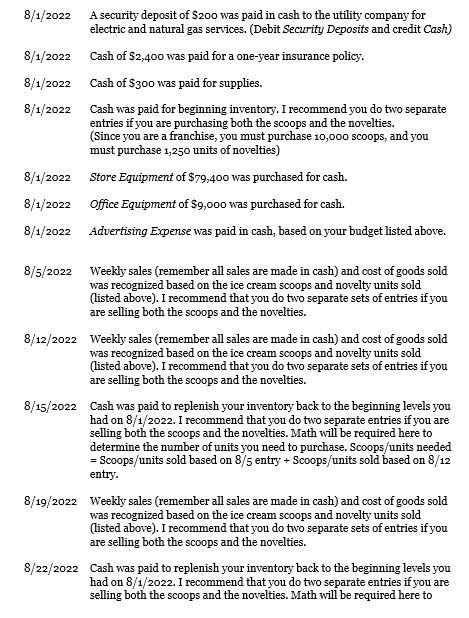

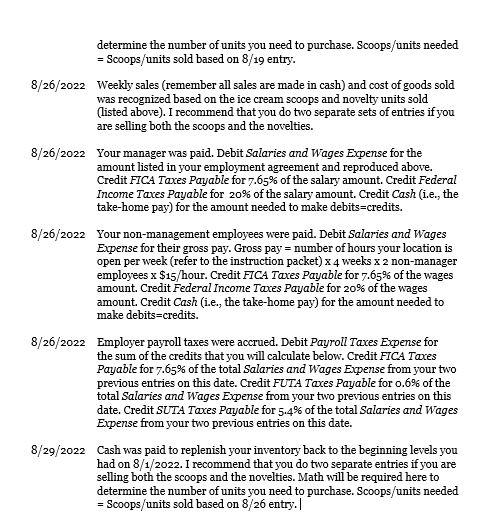

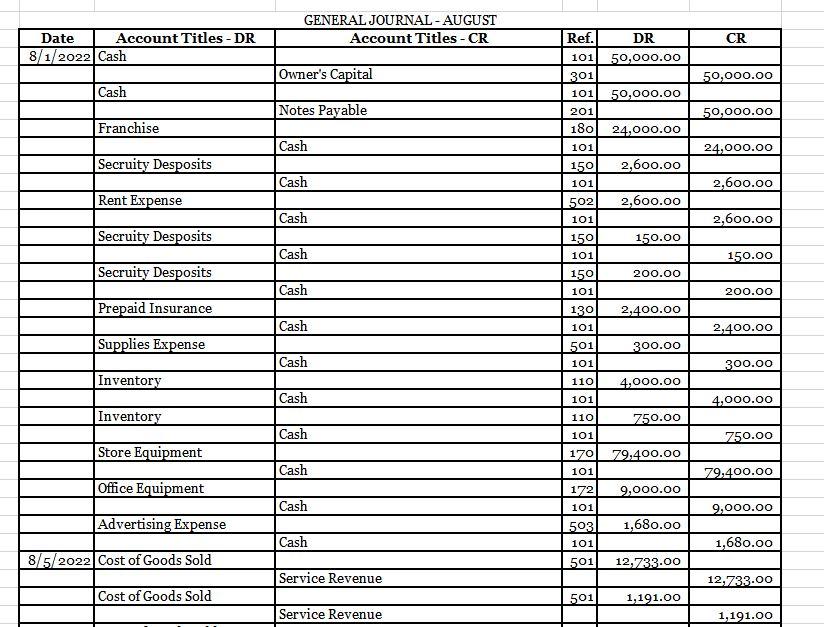

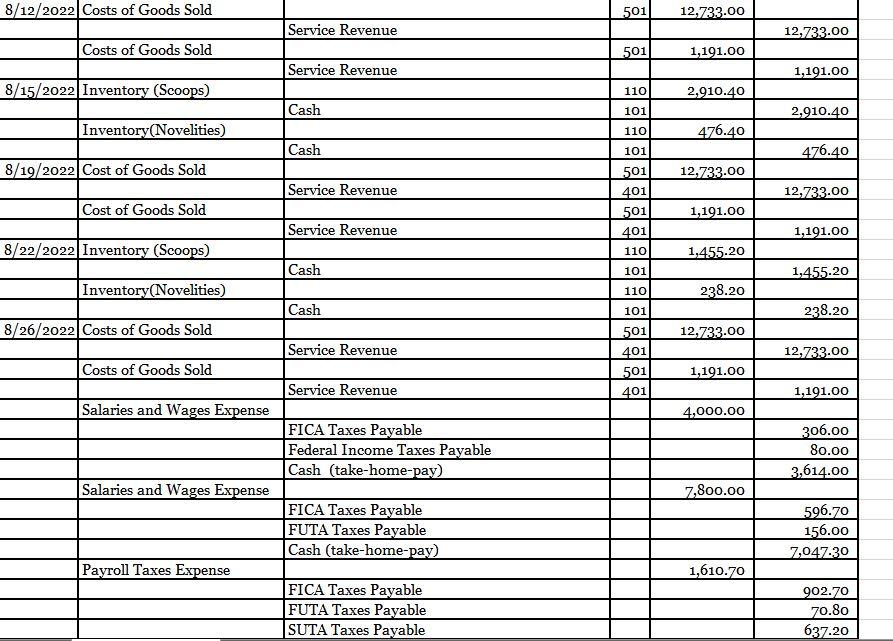

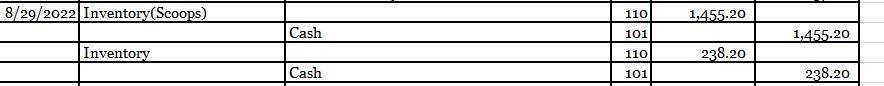

Round all amounts to the nearest dollar, as applicable. 8/1/2022 The owner invests $50,000 of cash into the business. 8/1/2022 The business receives cash from the bank for the amount of the loan taken out. Refer to the amount above, which was taken from your loan request. (Debit Cash and credit Notes Payable) 8/1/2022 The fee for the two-year franchise agreement was paid in cash. (Debit Franchise (which is an intangible asset) for $24,000 and credit Cash for $24,000) 8/1/2022 A security deposit of one month's rent (see above, based on your location) was paid in cash to the lessor for your store location. (Debit Security Deposits (which is a long-term investment) and credit Cash) 8/1/2022 The actual monthly rent for your store location was paid to the lessor 8/1/2022 A security deposit of $150 was paid in cash to the cable company for telephone service. (Debit Security Deposits and credit Cash) 8/1/2022 A security deposit of S200 was paid in cash to the utility company for electric and natural gas services. (Debit Security Deposits and credit Cash) 8/1/2022 Cash of $2,400 was paid for a one-year insurance policy. 8/1/2022 Cash of $300 was paid for supplies. 8/1/2022 Cash was paid for beginning inventory. I recommend you do two separate entries if you are purchasing both the scoops and the novelties. (Since you are a franchise, you must purchase 10,00o scoops, and you must purchase 1,250 units of novelties) 8/1/2022 Store Equipment of $79,400 was purchased for cash. 8/1/2022 Office Equipment of $9,000 was purchased for cash. 8/1/2022 Advertising Expense was paid in cash, based on your budget listed above. 8/5/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/12/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/15/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/5 entry + Scoops/units sold based on 8/12 entry. 8/19/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/22/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/19 entry. 8/26/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/26/2022 Your manager was paid. Debit Salaries and Wages Expense for the amount listed in your employment agreement and reproduced above. Credit FICA Taxes Payable for 7.65% of the salary amount. Credit Federal Income Taxes Payable for 20% of the salary amount. Credit Cash (i.e., the take-home pay) for the amount needed to make debits=credits. 8/26/2022 Your non-management employees were paid. Debit Salaries and Wages Expense for their gross pay. Gross pay = number of hours your location is open per week (refer to the instruction packet) x4 weeks x2 non-manager employees x$15/ hour. Credit FICA Taxes Payable for 7.65% of the wages amount. Credit Federal Income Taxes Payable for 20% of the wages amount. Credit Cash (i.e., the take-home pay) for the amount needed to make debits=credits. 8/26/2022 Employer payroll taxes were accrued. Debit Payroll Taxes Expense for the sum of the credits that you will calculate below. Credit FICA Taxes Payable for 7.65% of the total Salaries and Wages Expense from your two previous entries on this date. Credit FUTA Taxes Payable for 0.6% of the total Salaries and Wages Expense from your two previous entries on this date. Credit SUTA Taxes Payable for 5.4% of the total Salaries and Wages Expense from your two previous entries on this date. 8/29/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/26 entry. GENERAL JOURNAL - AUGUST \begin{tabular}{|l|l|l|r|r|r|} \hline 8/29/2022 & Inventory(Scoops) & & 110 & 1,455.20 & \\ \hline & & Cash & 101 & & 1,455.20 \\ \hline & Inventory & & 110 & 238.20 & \\ \hline & & Cash & 101 & & \\ \hline \end{tabular} Round all amounts to the nearest dollar, as applicable. 8/1/2022 The owner invests $50,000 of cash into the business. 8/1/2022 The business receives cash from the bank for the amount of the loan taken out. Refer to the amount above, which was taken from your loan request. (Debit Cash and credit Notes Payable) 8/1/2022 The fee for the two-year franchise agreement was paid in cash. (Debit Franchise (which is an intangible asset) for $24,000 and credit Cash for $24,000) 8/1/2022 A security deposit of one month's rent (see above, based on your location) was paid in cash to the lessor for your store location. (Debit Security Deposits (which is a long-term investment) and credit Cash) 8/1/2022 The actual monthly rent for your store location was paid to the lessor 8/1/2022 A security deposit of $150 was paid in cash to the cable company for telephone service. (Debit Security Deposits and credit Cash) 8/1/2022 A security deposit of S200 was paid in cash to the utility company for electric and natural gas services. (Debit Security Deposits and credit Cash) 8/1/2022 Cash of $2,400 was paid for a one-year insurance policy. 8/1/2022 Cash of $300 was paid for supplies. 8/1/2022 Cash was paid for beginning inventory. I recommend you do two separate entries if you are purchasing both the scoops and the novelties. (Since you are a franchise, you must purchase 10,00o scoops, and you must purchase 1,250 units of novelties) 8/1/2022 Store Equipment of $79,400 was purchased for cash. 8/1/2022 Office Equipment of $9,000 was purchased for cash. 8/1/2022 Advertising Expense was paid in cash, based on your budget listed above. 8/5/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/12/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/15/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/5 entry + Scoops/units sold based on 8/12 entry. 8/19/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/22/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/19 entry. 8/26/2022 Weekly sales (remember all sales are made in cash) and cost of goods sold was recognized based on the ice cream scoops and novelty units sold (listed above). I recommend that you do two separate sets of entries if you are selling both the scoops and the novelties. 8/26/2022 Your manager was paid. Debit Salaries and Wages Expense for the amount listed in your employment agreement and reproduced above. Credit FICA Taxes Payable for 7.65% of the salary amount. Credit Federal Income Taxes Payable for 20% of the salary amount. Credit Cash (i.e., the take-home pay) for the amount needed to make debits=credits. 8/26/2022 Your non-management employees were paid. Debit Salaries and Wages Expense for their gross pay. Gross pay = number of hours your location is open per week (refer to the instruction packet) x4 weeks x2 non-manager employees x$15/ hour. Credit FICA Taxes Payable for 7.65% of the wages amount. Credit Federal Income Taxes Payable for 20% of the wages amount. Credit Cash (i.e., the take-home pay) for the amount needed to make debits=credits. 8/26/2022 Employer payroll taxes were accrued. Debit Payroll Taxes Expense for the sum of the credits that you will calculate below. Credit FICA Taxes Payable for 7.65% of the total Salaries and Wages Expense from your two previous entries on this date. Credit FUTA Taxes Payable for 0.6% of the total Salaries and Wages Expense from your two previous entries on this date. Credit SUTA Taxes Payable for 5.4% of the total Salaries and Wages Expense from your two previous entries on this date. 8/29/2022 Cash was paid to replenish your inventory back to the beginning levels you had on 8/1/2022. I recommend that you do two separate entries if you are selling both the scoops and the novelties. Math will be required here to determine the number of units you need to purchase. Scoops/units needed = Scoops/units sold based on 8/26 entry. GENERAL JOURNAL - AUGUST \begin{tabular}{|l|l|l|r|r|r|} \hline 8/29/2022 & Inventory(Scoops) & & 110 & 1,455.20 & \\ \hline & & Cash & 101 & & 1,455.20 \\ \hline & Inventory & & 110 & 238.20 & \\ \hline & & Cash & 101 & & \\ \hline \end{tabular}