Answered step by step

Verified Expert Solution

Question

1 Approved Answer

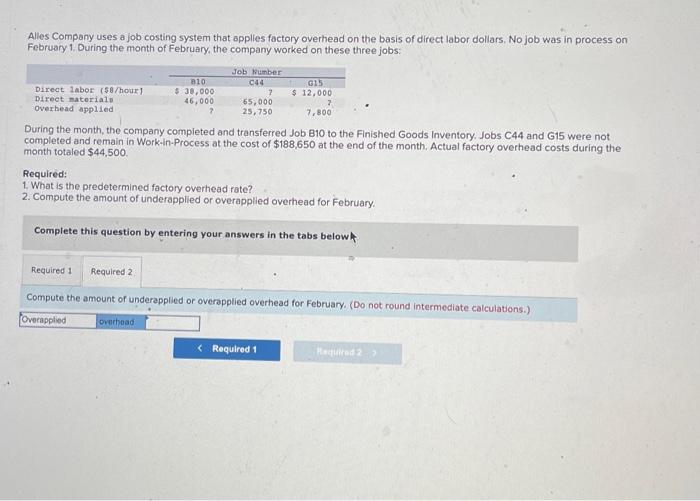

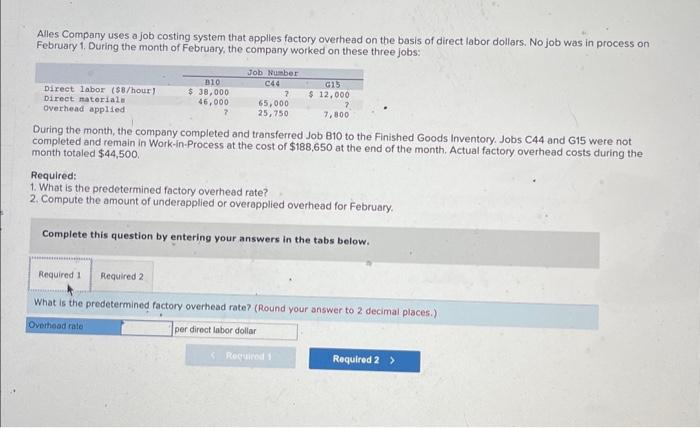

Alles Company uses a job costing system that applies factory overhead on the basis of direct labor dollars. No job was in process on

Alles Company uses a job costing system that applies factory overhead on the basis of direct labor dollars. No job was in process on February 1. During the month of February, the company worked on these three jobs: 810 Job Number C44 G15 Direct labor (58/hour) $ 38,000 7 $ 12,000 Direct materials 46,000 Overhead applied 7 65,000 25,750 7 7,800 During the month, the company completed and transferred Job B10 to the Finished Goods Inventory. Jobs C44 and G15 were not completed and remain in Work-in-Process at the cost of $188,650 at the end of the month. Actual factory overhead costs during the month totaled $44,500. Required: 1. What is the predetermined factory overhead rate? 2. Compute the amount of underapplied or overapplied overhead for February Complete this question by entering your answers in the tabs below Required 1 Required 2 Compute the amount of underapplied or overapplied overhead for February. (Do not round intermediate calculations.) Overapplied overhead. < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started