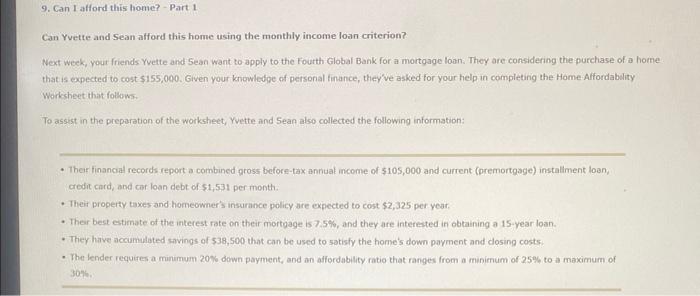

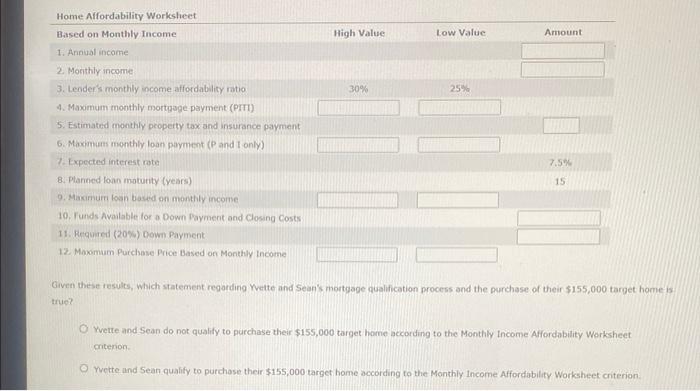

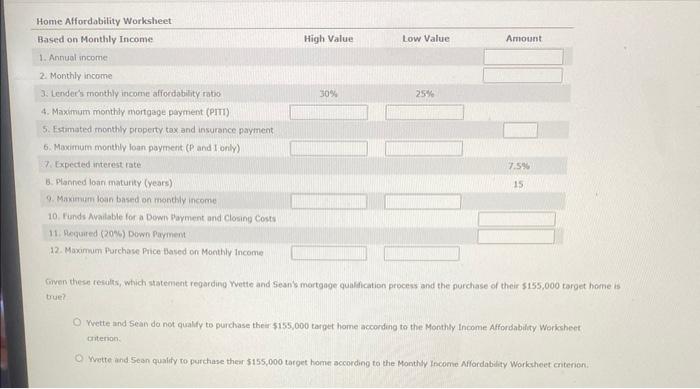

Can Yvette and Sean afford this home using the monthly income loan criterion? Next weck, yout friends Yvette and 5 ean want to apply to the fourth Global Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $155,000. Given your knowledpe of personal finance, they ve asked for your help in completirig the Home. Alfordabelity Worksheet that follows. To assist in the preparation of the worksheet, Yvette and 5 ean also collected the following information: - Their financial records report a combined pross before-tax annual income of 5105,000 and current (premortgage) installiment loan, credit card, and cer loan debt of $1,531 per month. - Their property taxes and homeowner's insurance policy are expected to cost $2,325 per year, - Ther best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15 -year loan. - They have accumulated savings of $38,500 that can be used to satisfy the home's down payment and dosing costs: - The lender requiges a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 3096. Given these results, which statement regarding Yette and Sean's mortgage qualification process and the purchase of their $155,000 target home is tries Yvette and Sean do not qualify to purchase their $155,000 target home according to the Monthly Income Affordability Worksheet critenion. Yvette and Sean qualify to purchase their $155,000 target hame according to the Monthly Income Affordability Worksheet criterion. Can Yvette and Sean afford this home tsing the monthly income loan criterion? Next week, your friends twette and Sean want to opply to the Fourth Global Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost 5155,000 , Given your knowledge of personal finance, they've asked for your help in completing the Horne Affordabilay Worksheet that follows: To assus in the preparation of the worksheet, Tvette and Sean also collected the following information: - Ther finanoal records repoet a combined gross before-tax annual income of 5:05,000 and current (premortgage) mataliment loon, crest card, and car loan debt of $1,531 per month. - Their property takes and homeowner's insurance policy are expected to cost $2,325 per yeat. - Ther best estimate of the interent rate on their martgage is 7.5%, and they are interested in abtaining a 15 -year loan. - They have acoumulated savengs of $38,500 that can be used to Lativfy the home's down payment and dosing costs. - Thun fender requires a minimuin 20% down payment, and an affordabiliey ratio that ranges from a minimum of 25% to a maxumum of 30% Given these resciths, which satement regarding Wette and Siean's mortgage qualfication process and the purchase of their $155,000 target home is true? Wrette and Sean do not qualify to purchase their 5155,000 tarpet home accordeng to the Monthly Income Affordability Worksheet triterion. Wrette and 5 ean qualify to purchase then $155,000 tatget homet according to the Monthly Income Affordability Workaheet criterion