Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will upvote answer asap! Henry is the owner of Les Habitants Inc. which is listed on the Toronto Stock Exchange. He is considering establishing a

will upvote answer asap!

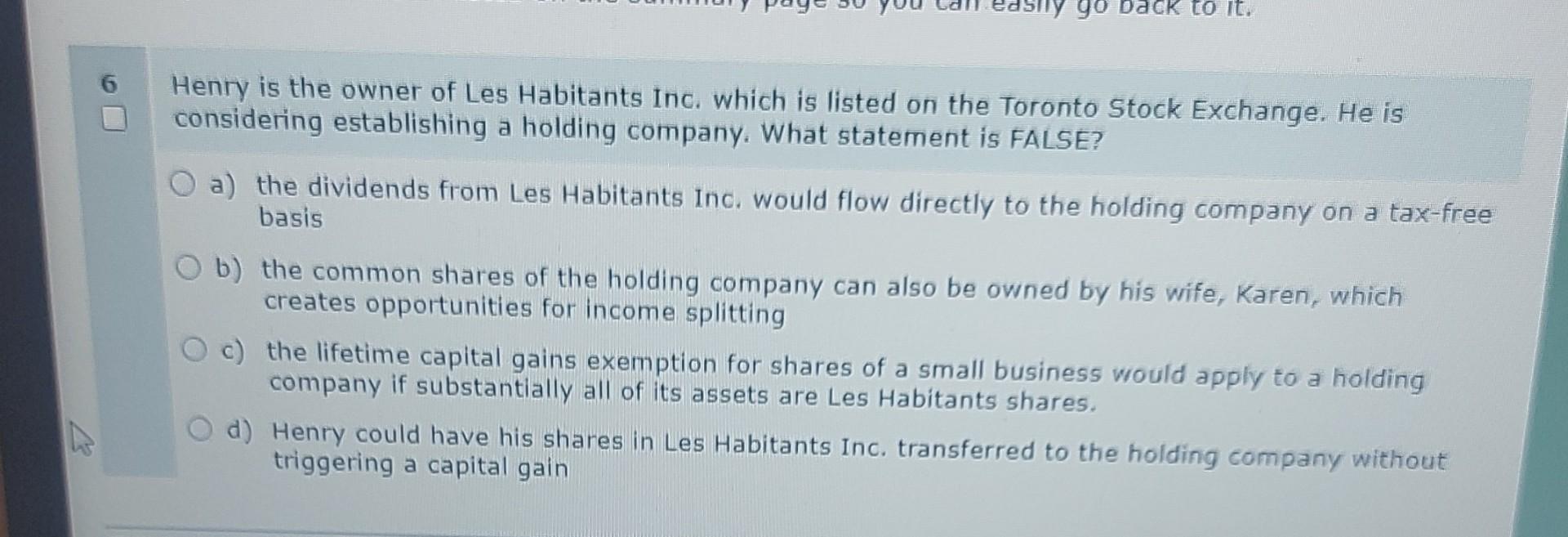

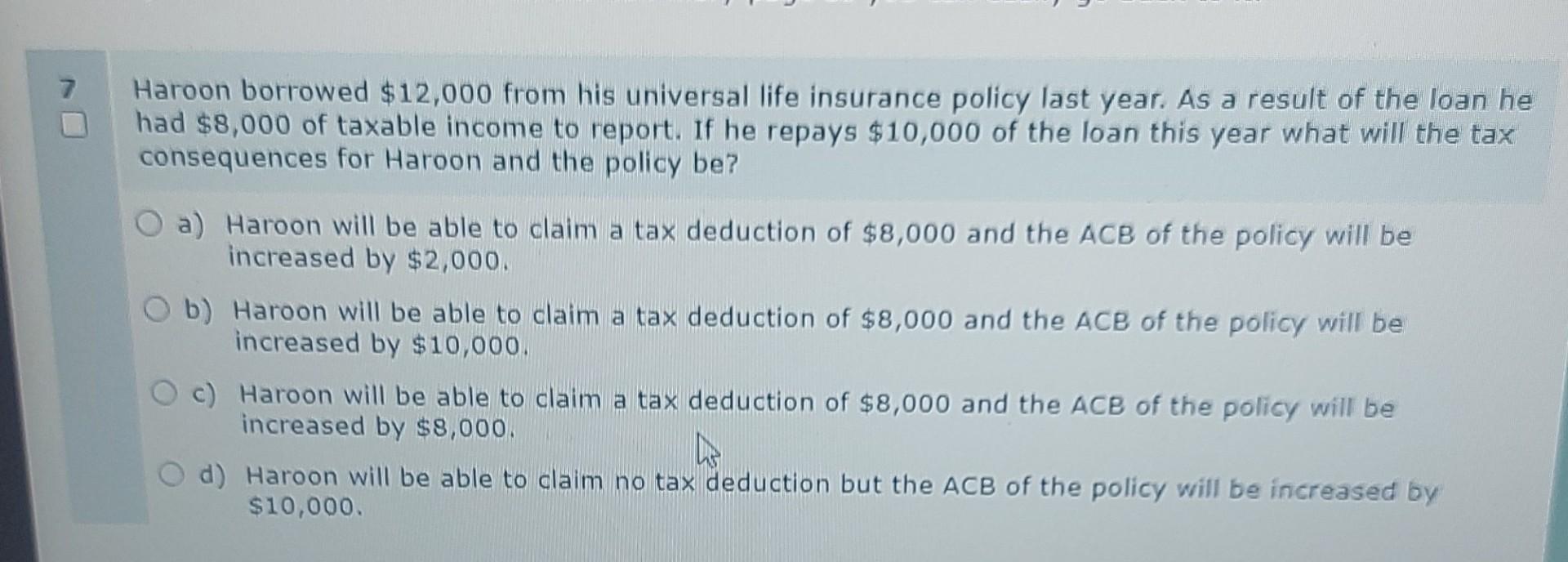

Henry is the owner of Les Habitants Inc. which is listed on the Toronto Stock Exchange. He is considering establishing a holding company. What statement is FALSE? a) the dividends from Les Habitants Inc. would flow directly to the holding company on a tax-free basis b) the common shares of the holding company can also be owned by his wife, Karen, which creates opportunities for income splitting c) the lifetime capital gains exemption for shares of a small business would apply to a holding company if substantially all of its assets are Les Habitants shares. d) Henry could have his shares in Les Habitants Inc. transferred to the holding company without triggering a capital gain Haroon borrowed $12,000 from his universal life insurance policy last year. As a result of the loan he had $8,000 of taxable income to report. If he repays $10,000 of the loan this year what will the tax consequences for Haroon and the policy be? a) Haroon will be able to claim a tax deduction of $8,000 and the ACB of the policy will be increased by $2,000. b) Haroon will be able to claim a tax deduction of $8,000 and the ACB of the policy will be increased by $10,000. c) Haroon will be able to claim a tax deduction of $8,000 and the ACB of the policy will be increased by $8,000. d) Haroon will be able to claim no tax deduction but the ACB of the policy will be increased by $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started