Will upvote if correct. Thank you for helping!

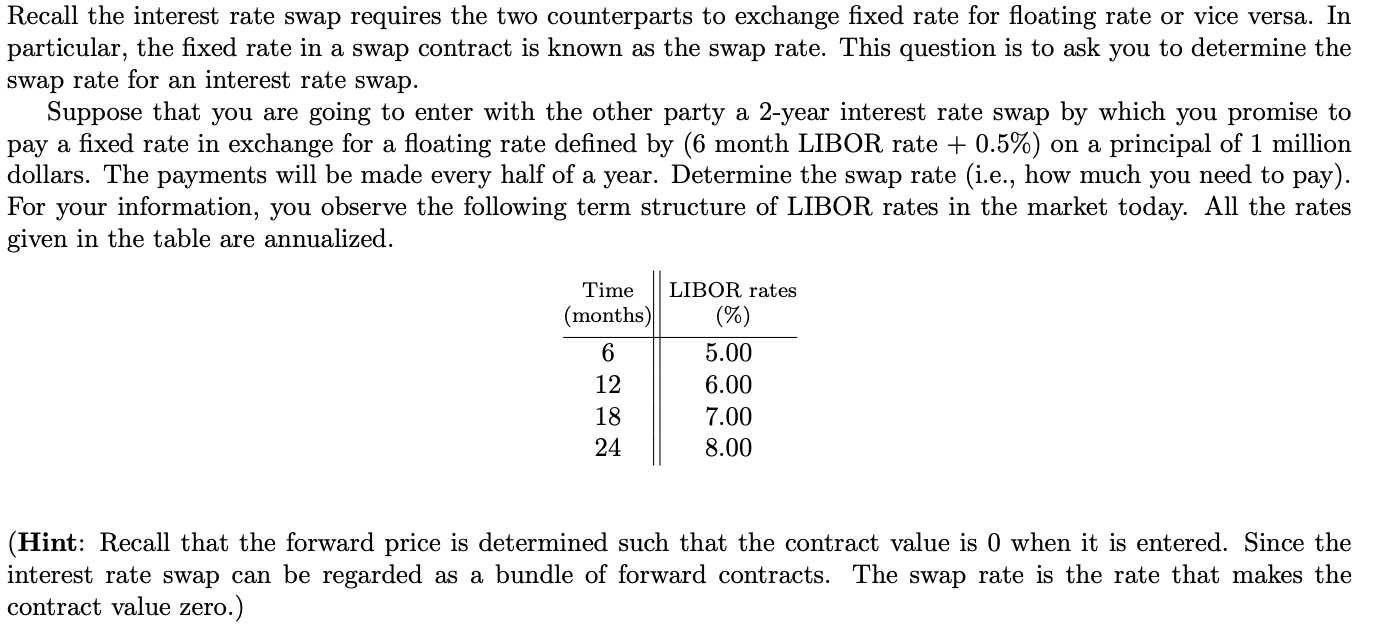

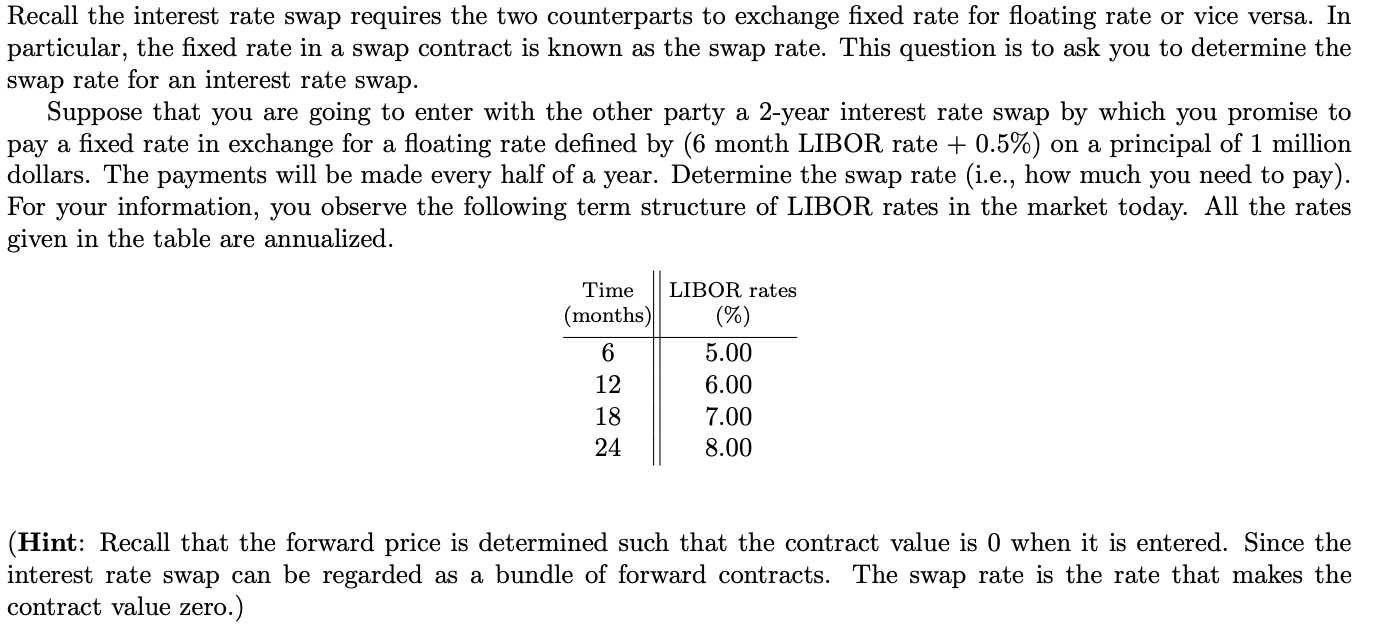

Recall the interest rate swap requires the two counterparts to exchange fixed rate for floating rate or vice versa. In particular, the fixed rate in a swap contract is known as the swap rate. This question is to ask you to determine the swap rate for an interest rate swap. Suppose that you are going to enter with the other party a 2-year interest rate swap by which you promise to pay a fixed rate in exchange for a floating rate defined by (6 month LIBOR rate + 0.5%) on a principal of 1 million dollars. The payments will be made every half of a year. Determine the swap rate (i.e., how much you need to pay). For your information, you observe the following term structure of LIBOR rates in the market today. All the rates given in the table are annualized. Time (months) 6 12 18 24 LIBOR rates (%) 5.00 6.00 7.00 8.00 (Hint: Recall that the forward price is determined such that the contract value is 0 when it is entered. Since the interest rate swap can be regarded as a bundle of forward contracts. The swap rate is the rate that makes the contract value zero.) Recall the interest rate swap requires the two counterparts to exchange fixed rate for floating rate or vice versa. In particular, the fixed rate in a swap contract is known as the swap rate. This question is to ask you to determine the swap rate for an interest rate swap. Suppose that you are going to enter with the other party a 2-year interest rate swap by which you promise to pay a fixed rate in exchange for a floating rate defined by (6 month LIBOR rate + 0.5%) on a principal of 1 million dollars. The payments will be made every half of a year. Determine the swap rate (i.e., how much you need to pay). For your information, you observe the following term structure of LIBOR rates in the market today. All the rates given in the table are annualized. Time (months) 6 12 18 24 LIBOR rates (%) 5.00 6.00 7.00 8.00 (Hint: Recall that the forward price is determined such that the contract value is 0 when it is entered. Since the interest rate swap can be regarded as a bundle of forward contracts. The swap rate is the rate that makes the contract value zero.)