Answered step by step

Verified Expert Solution

Question

1 Approved Answer

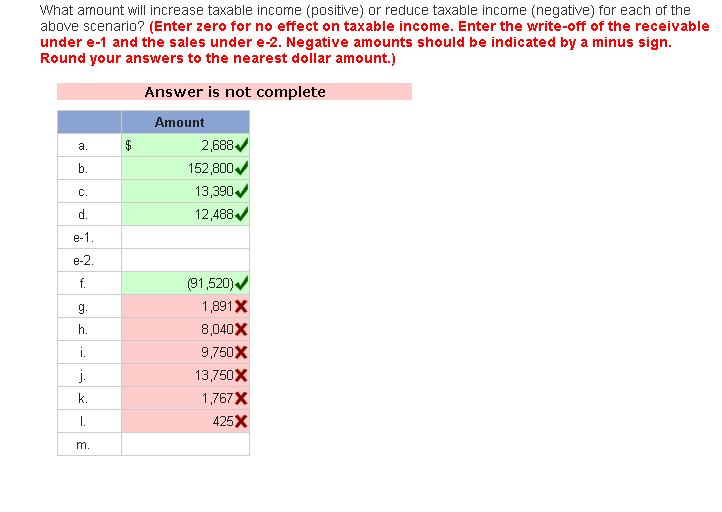

*Will you please help me figure out the ones in red that I got wrong as well as the other two blank spots, m. and

*Will you please help me figure out the ones in red that I got wrong as well as the other two blank spots, m. and e-1, and e-2? Please show calculations so I can learn as well, not just the answer* Thank you!

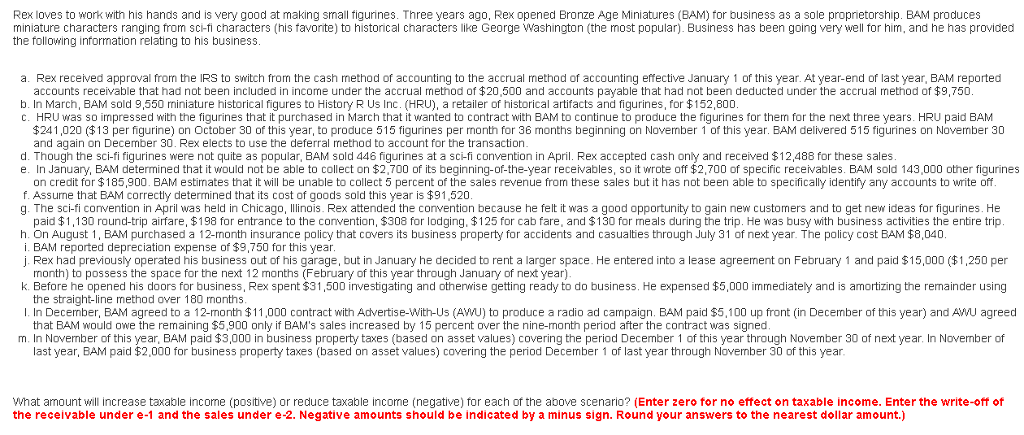

ex loves to work with his hands and s ery good at making small figurines. Three years ago, Rex opened Bronze Age Miniature (BAM) for business as a sole proprietorship BAM produces characters (his favorite) to historic miniature characters ranging from scifi rs like Georg e Washington (the most popula Business has been going very well for h m, and he has provide hara cte the following information relating to his business a. R ex received approval from the IRS to switch from the cash method of accounting to the accrual method of accounting effective January 1 of this year. At year-end of last year, BAM reporte cluded in income under the accrual method of 00 and accounts payable that had not been deducted under the accrual method of $9,750 accounts receivable that had not been RU), a retailer of historical artifacts and figurines, for $152,800 March BAM sold 9,550 miniature historical figures to History R Us Inc. (H HRU was so impressed with the figurines that it purchased in March tha wanted to contra ct with BAM to continue to produc the figurines for them for the next three years HRU paid BAM $241,020 ($13 per figurin e) on October 30 of this yea o produce 515 gurines per month for 36 months beginning on Novembe of this year. BAM delivered 515 figurines on November 30 and again on December 30. ex elects to use the deferral method to account for the transaction n April. Rex accepted cash only and received 488 for the sales d. Though the sci gurines were not quite as popular, BAM sold 446 figurines at a sci fi convention $2,700 of its beginning-o eceivables, so it wrote off $2,700 of specific receivables n January, BAM determined that it would not be able to collect on BAM sold 143,000 other figurine e-yea on credit for $185,900 nt of the sales revenue from these sales bu it has not been able to specific any accounts to write off BAM estimates that will be unable to collect 5 perce iden f. Assume that BAM correctly determined that its cost of goods sold this year is $91,520 g. The sc n in Ap was held in Chicago, Illinois. Rex attended the convention b he felt it was a good opportunity to gain new customers and to get new ideas for figurines. He onventio paid 0 round-trip airfare, $198 for entrance to the convention, $308 for lodging, $12 or cab fare, and $130 for meals during the trip. He was busy with busine he entire activities accidents and casualties through July 31 of next year. The policy cost BAM $8,040 h. On Augu BAM purchased a 2-month insurance policy that covers its business property for $9,750 for this yea i. BAM reported depreciation expense of larger space. He entered into a lease a 1 and paid $15,000 ($1,250 per j. Rex had previously operated his business out of his garage, but i n January he decided to rent a greement on Februa month) to possess the space for th e next 12 months February of this year through January of next yea ness, Rex spent $31,500 investigating and otherwise getting ready to do business. H e expensed $5,000 immediate k. Before e opened his doors for b ly and is zing the remainder using usl the straig ne method ove r 180 months December, BAM agreed to a with (AMU) to produce a radio ad campaign. BAM paid $5.10 up front (in December of this year and 0 12-month $11,000 contract Advertise-With-Us AWU agreed he remaining $5,900 only if BAM that BAM would owe s sales increased by 15 percent over the nine-month period after the contrac was signed his year, BAM paid $3,000 in business property taxes (based on asset values) covering the period December 1 of m, In November of his year hrough November 30 of next year. n November of last year, BAM paid $2,000 for business property taxes (based on asset values) ering the period December 1 of last year through November 30 of this year. hat amount crease taxable in come (positive) or reduce taxable income (negative) each the above for of scenario? (Enter zero for no effect on taxable income. Enter the write-off of the receivable under e and the sales under e-2. Negative amounts should be indicated by a minus sign. Round your answers to the nearest dollar amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started