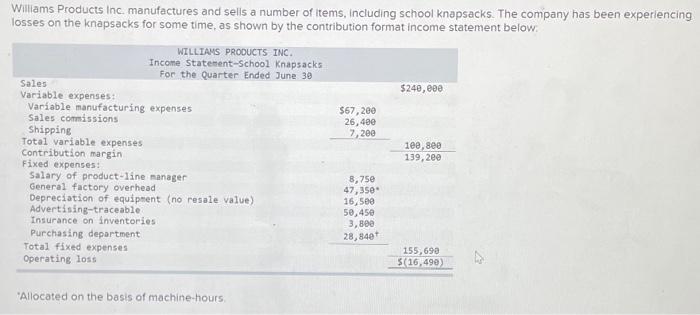

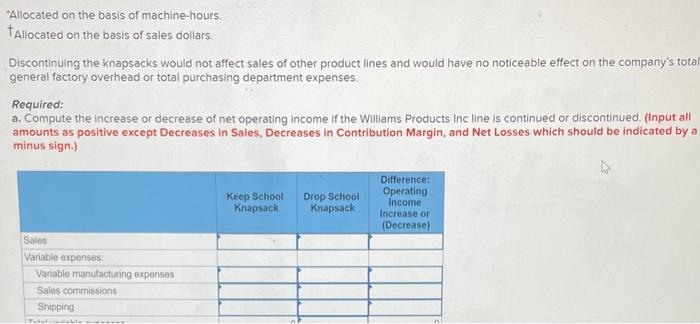

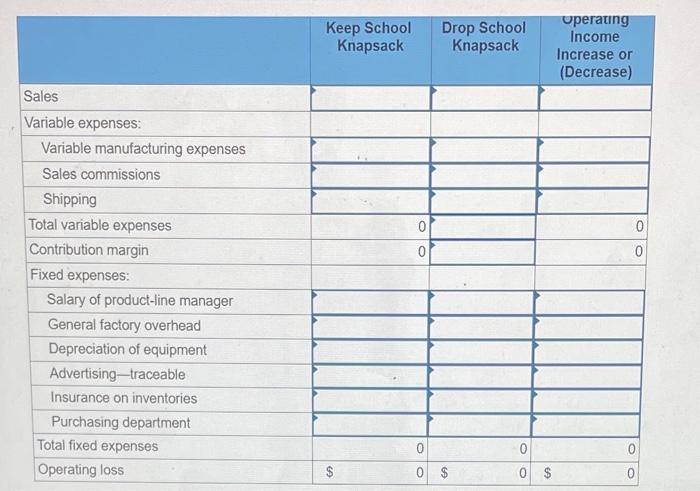

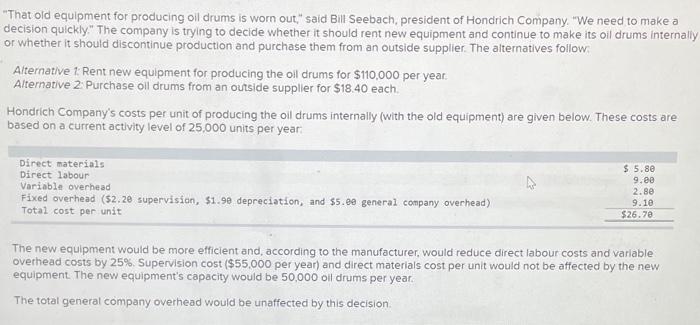

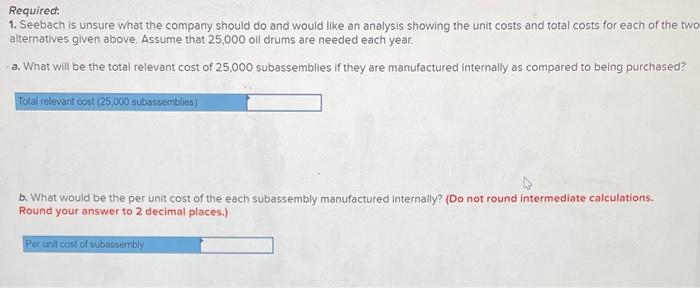

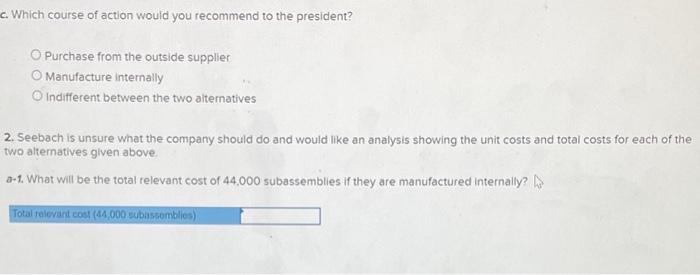

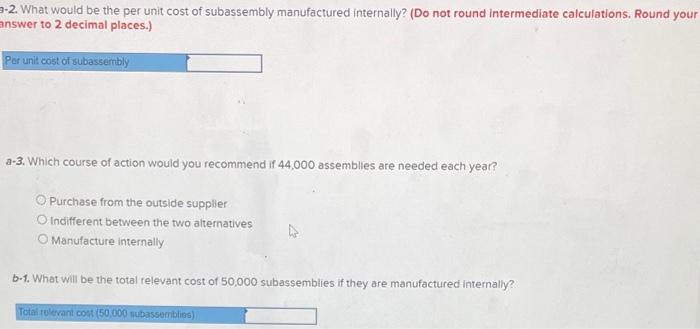

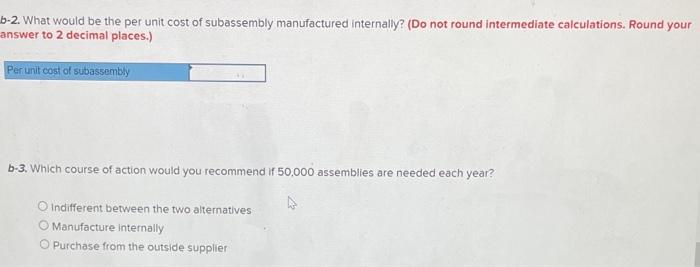

Willams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time, as shown by the contribution format income statement below: Allocated on the basis of machine-hours "Allocated on the basis of machine-hours. tAllocated on the basis of sales dollars. Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the company's tota generai factory overhead or total purchasing department expenses. Required: a. Compute the increase or decrease of net operating income if the Williams Products Inc line is continued or discontinued. (Input all amounts as positive except Decreases in Sales, Decreases in Contribution Margin, and Net Losses which should be indicated by a minus sign.) \begin{tabular}{|l|l|l|l|} \hline & KeepSchoolKnapsack & DropSchoolKnapsack & uperatingIncomeIncreaseor(Decrease) \\ \hline Sales & & & \\ \hline Variable expenses: & & & \\ \hline Variable manufacturing expenses & & & \\ \hline Sales commissions & & & \\ \hline Shipping & & & \\ \hline Total variable expenses & & & \\ \hline Contribution margin & & & \\ \hline Fixed expenses: & & & \\ \hline Salary of product-line manager & & & \\ \hline General factory overhead & & & \\ \hline Depreciation of equipment & & & \\ \hline Advertising-traceable & & & \\ \hline Insurance on inventories & & & \\ \hline Purchasing department & & & \\ \hline Total fixed expenses & & & \\ \hline Operating loss & & & \\ \hline \end{tabular} b. Would you recommend that the Williams Products Inc line be discontinued? Yes No "That old equipment for producing oil drums is worn out," said Bill Seebach, president of Hondrich Company. "We need to make a decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow: Aiternative 1 : Rent new equipment for producing the oll drums for $110,000 per year. Alternative 2: Purchase oll drums from an outside supplier for $18.40 each. Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are based on a current activity level of 25,000 units per year: The new equipment would be more efficient and, according to the manufacturer, would reduce direct labour costs and variable overhead costs by 25%. Supervision cost ( $55.000 per year) and direct materials cost per unit would not be affected by the new equipment. The new equipment's capacity would be 50,000 oll drums per year. The total general company overhead would be unaffected by this decision. Required: 1. Seebach is unsure what the company should do and would like an analysis showing the unit costs and total costs for each of the tw aiternatives given above. Assume that 25,000 oil drums are needed each year. a. What will be the total relevant cost of 25,000 subassemblies if they are manufactured internally as compared to being purchased? b. What would be the per unit cost of the each subassembly manufactured internally? (Do not round intermediate calculations. Round your answer to 2 decimal places.) E. Which course of action would you recommend to the president? Purchase from the outside supplier Manufacture internally Indifferent between the two alternatives 2. Seebach is unsure what the company should do and would like an analysis showing the unit costs and total costs for each of the two alternatives given above. a-1. What will be the total relevant cost of 44,000 subassemblies if they are manufactured internally? -2. What would be the per unit cost of subassembly manufactured internally? (Do not round intermediate calculations. Round your nswer to 2 decimal places.) a-3. Which course of action would you recommend if 44,000 assemblies are needed each year? Purchase from the outside supplier Indifferent between the two alternatives Manufacture internally b-1. What will be the total relevant cost of 50,000 subassemblies if they are manufactured internally? 2-2. What would be the per unit cost of subassembly manufactured internally? (Do not round intermediate calculations. Round your inswer to 2 decimal places.) b-3. Which course of action would you recommend if 50,000 assemblies are needed each year? Indifferent between the two alternatives Manufacture internally Purchase from the outside supplier