Answered step by step

Verified Expert Solution

Question

1 Approved Answer

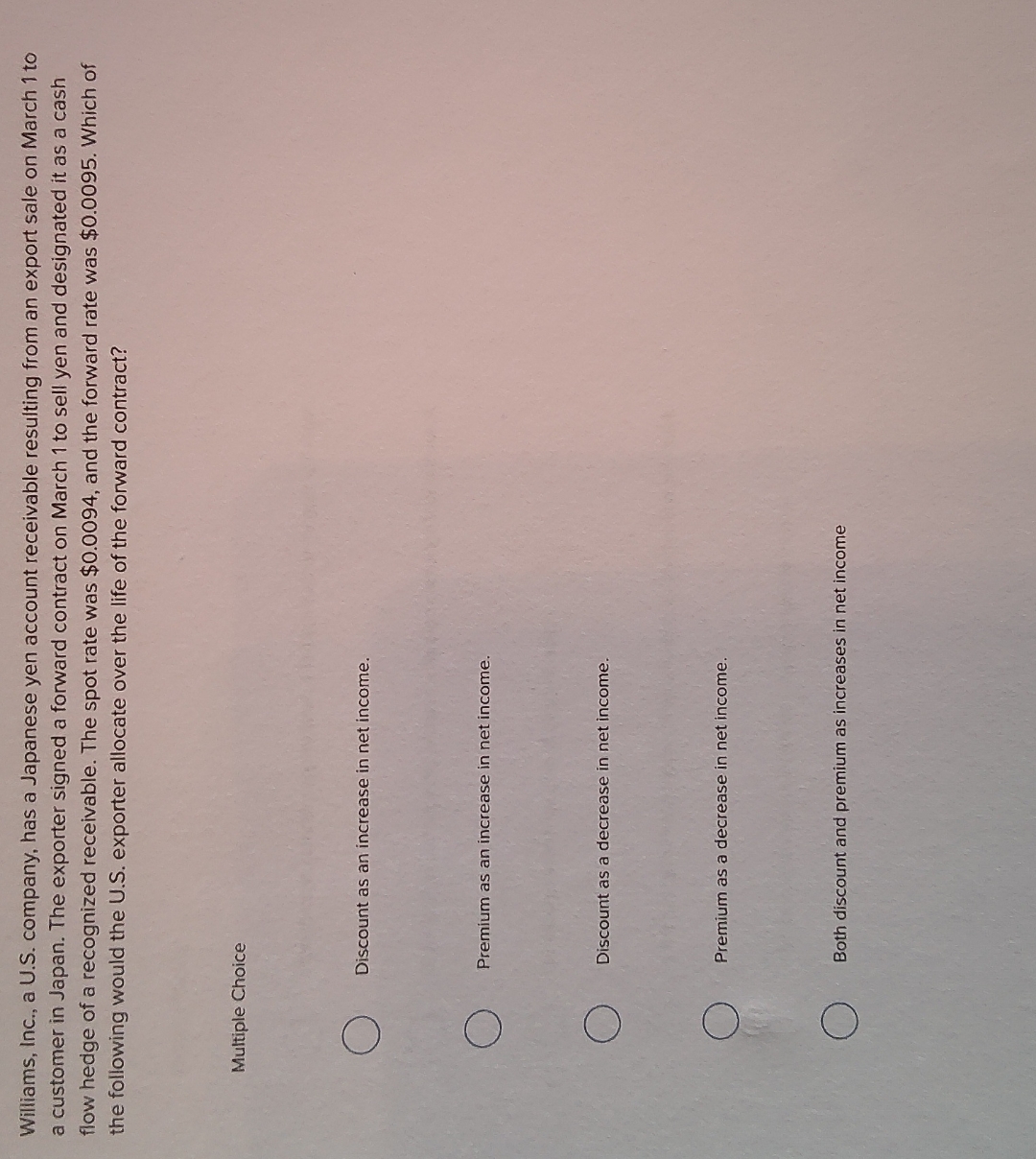

Williams, Inc., a U . S . company, has a Japanese yen account receivable resulting from an export sale on March 1 to a customer

Williams, Inc., a US company, has a Japanese yen account receivable resulting from an export sale on March to

a customer in Japan. The exporter signed a forward contract on March to sell yen and designated it as a cash

flow hedge of a recognized receivable. The spot rate was $ and the forward rate was $ Which of

the following would the US exporter allocate over the life of the forward contract?

Multiple Choice

Discount as an increase in net income.

Premium as an increase in net income.

Discount as a decrease in net income.

Premium as a decrease in net income.

Both discount and premium as increases in net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started