Answered step by step

Verified Expert Solution

Question

1 Approved Answer

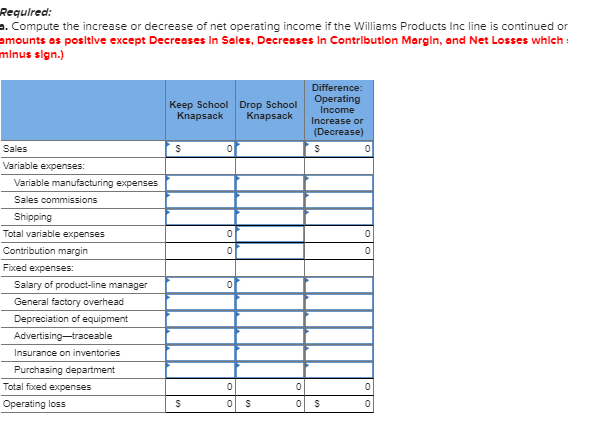

Williams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time,

Williams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time, as shown by the contribution format income statement below:

| WILLIAMS PRODUCTS INC. | ||||||

| Income StatementSchool Knapsacks | ||||||

| For the Quarter Ended June 30 | ||||||

| Sales | $ | 200,000 | ||||

| Variable expenses: | ||||||

| Variable manufacturing expenses | $ | 56,000 | ||||

| Sales commissions | 22,000 | |||||

| Shipping | 6,000 | |||||

| Total variable expenses | 84,000 | |||||

| Contribution margin | 116,000 | |||||

| Fixed expenses: | ||||||

| Salary of product-line manager | 7,000 | |||||

| General factory overhead | 40,000 | * | ||||

| Depreciation of equipment (no resale value) | 13,000 | |||||

| Advertisingtraceable | 48,000 | |||||

| Insurance on inventories | 3,100 | |||||

| Purchasing department | 25,480 | |||||

| Total fixed expenses | 136,580 | |||||

| Operating loss | $ | (20,580 | ) | |||

*Allocated on the basis of machine-hours. Allocated on the basis of sales dollars. Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the companys total general factory overhead or total purchasing department expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started