Answered step by step

Verified Expert Solution

Question

1 Approved Answer

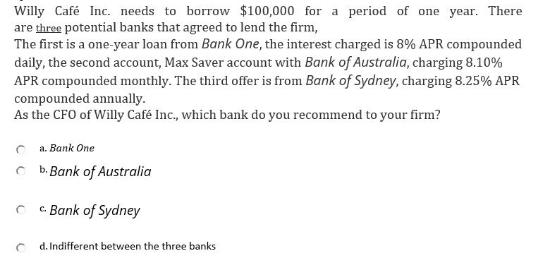

Willy Caf Inc. needs to borrow $100,000 for a period of one year. There are three potential banks that agreed to lend the firm,

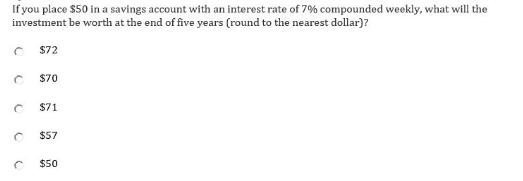

Willy Caf Inc. needs to borrow $100,000 for a period of one year. There are three potential banks that agreed to lend the firm, The first is a one-year loan from Bank One, the interest charged is 8% APR compounded daily, the second account, Max Saver account with Bank of Australia, charging 8.10% APR compounded monthly. The third offer is from Bank of Sydney, charging 8.25% APR compounded annually. As the CFO of Willy Caf Inc., which bank do you recommend to your firm? C C a. Bank One b. Bank of Australia c. Bank of Sydney d. Indifferent between the three banks If you place $50 in a savings account with an interest rate of 7% compounded weekly, what will the investment be worth at the end of five years (round to the nearest dollar)? $72 C C $70 C C C $71 $57 $50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine which bank offer is the mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started