Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wilmington Company fas two manufacturing departments - Assembly and Fabrication. All of its manufacturing overhead costs are fixed costs. The first set of data shown

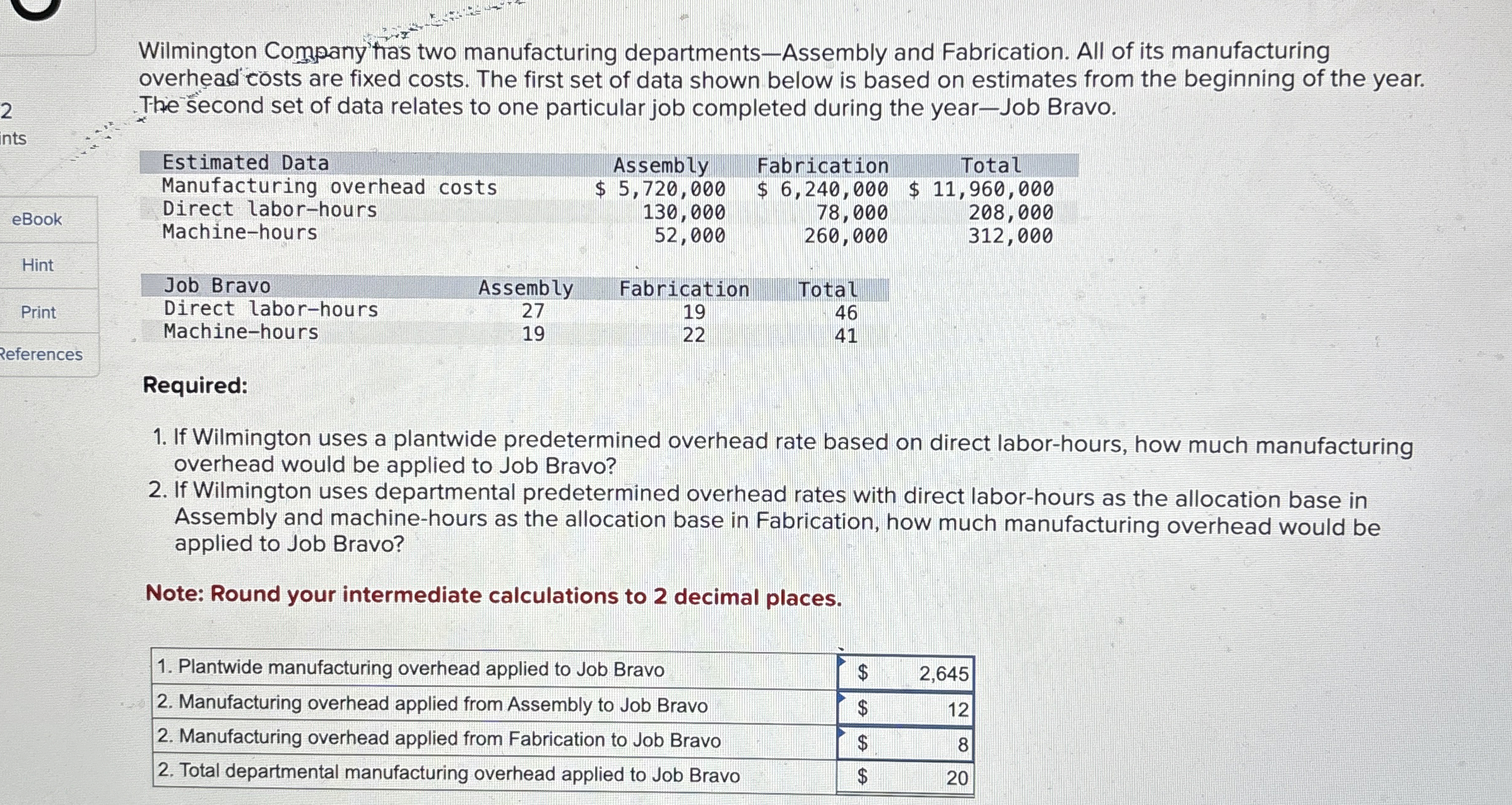

Wilmington Company fas two manufacturing departmentsAssembly and Fabrication. All of its manufacturing overhead costs are fixed costs. The first set of data shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the yearJob Bravo.

tableEstimated Data,Assembly,Fabrication,Total,Manufacturing overhead costs,$$$Direct laborhours,Machinehours,Job Bravo,Assembly,Fabrication,Total,Direct laborhours,Machinehours,Required:

If Wilmington uses a plantwide predetermined overhead rate based on direct laborhours, how much manufacturing overhead would be applied to Job Bravo?

If Wilmington uses departmental predetermined overhead rates with direct laborhours as the allocation base in Assembly and machinehours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo?

Note: Round your intermediate calculations to decimal places.

table Plantwide manufacturing overhead applied to Job Bravo,$ Manufacturing overhead applied from Assembly to Job Bravo,$ Manufacturing overhead applied from Fabrication to Job Bravo,$ Total departmental manufacturing overhead applied to Job Bravo,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started