Question

Wilson Manufacturing Company Wilson Manufacturing (the Company), an SEC registrant with a calendar year-end (December 31), is a manufacturer and distributor of fitness equipment. The

Wilson Manufacturing Company Wilson Manufacturing (the Company), an SEC registrant with a calendar year-end (December 31), is a manufacturer and distributor of fitness equipment. The company was created in 1989 and is headquartered in Southern California. The Company has manufacturing operations and numerous sales and administrative locations in the United States. Wilson files a consolidated U.S. federal tax return. (This case will not consider the evaluation of the state jurisdictions; it will only consider the federal jurisdiction.)

As Wilsons auditors, you are now performing the Companys year-end audit for the fiscal year ended December 31, 2018, and have the following information available to you:

The Tax Cuts and Jobs Act (the Act) was enacted in the United States on December 22, 2017, and was accounted for accordingly by Wilson Manufacturing.

The Act changed the rules related to tax loss carryforwards such that tax loss carryforwards arising in years after 2017 have an unlimited carryforward period though they may only be used to offset 80% of taxable income in a given year. Further, the Act removed the carryback period that had previously been allowed.

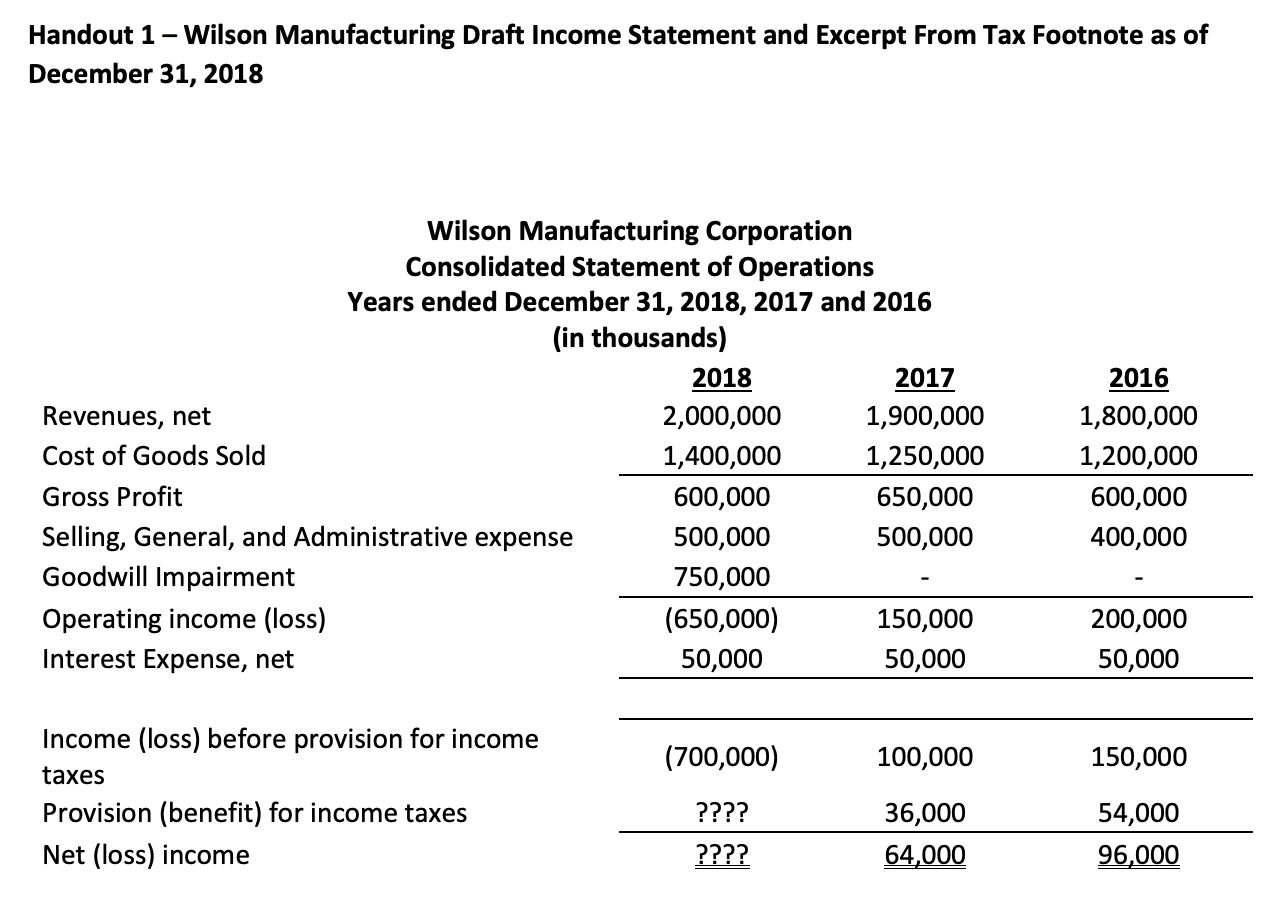

Wilson Manufacturing draft income statement and excerpt from tax footnote as of December 31, 2018 (Handout 1).

The tax loss carryforwards detailed in Handout 1 arose before 2018.

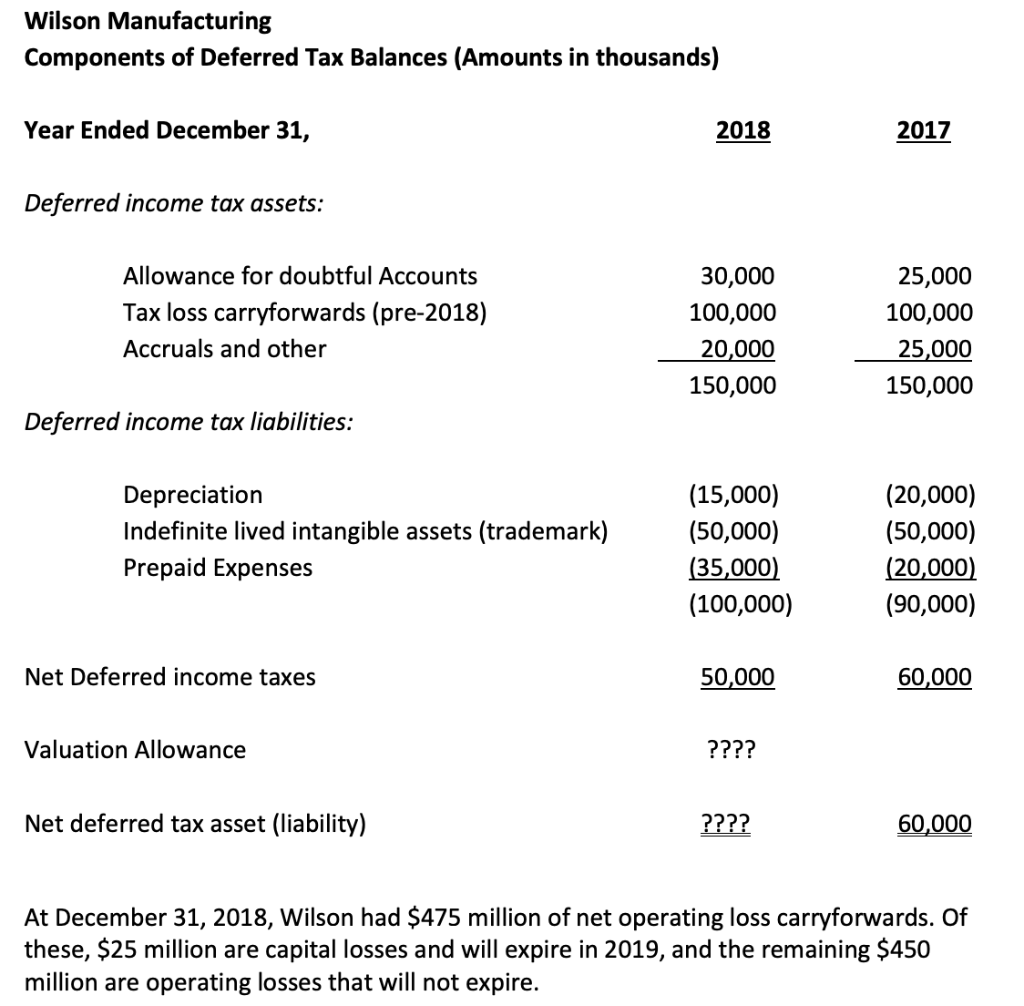

A deferred tax asset realization analysis showing pre-tax book income projections (Handout 2).

Managements pre-tax income forecast considerations (Handouts 2 & 3)

The projected income schedule (realization analysis above) projects organic growth beginning in 2020 after stemming the decrease in pre-tax book income.

The nondeductible goodwill impairment charge is a permanent item.

Wilson does not have the ability to carry back any losses to prior periods.

A significant customer declared bankruptcy in 2018; therefore, the Company wrote off all accounts receivable from this customer. The Company is considering the exclusion of such expense when evaluating whether future income is objectively verifiable.

The Company does not have a history of operating losses or tax credit carryforwards expiring unused.

The Company has identified the following possible tax-planning strategies:

Selling and leasing back manufacturing equipment that would result in a taxable gain of $20 million.

Selling the primary manufacturing facility at a gain to offset existing capital loss carryforwards.

Required

Question 2 How much of the reversing taxable temporary differences may be considered in estimating future taxable income? Assume the net operating losses (NOLs) arose in 2018.

Handout 1 Wilson Manufacturing Draft Income Statement and Excerpt From Tax Footnote as of December 31, 2018 Wilson Manufacturing Corporation Consolidated Statement of Operations Years ended December 31, 2018, 2017 and 2016 (in thousands) 2018 2017 Revenues, net 2,000,000 1,900,000 Cost of Goods Sold 1,400,000 1,250,000 Gross Profit 600,000 650,000 Selling, General, and Administrative expense 500,000 500,000 Goodwill Impairment 750,000 Operating income (loss) (650,000) 150,000 Interest Expense, net 50,000 50,000 2016 1,800,000 1,200,000 600,000 400,000 200,000 50,000 (700,000) 100,000 150,000 Income (loss) before provision for income taxes Provision (benefit) for income taxes Net (loss) income ???? ???? 36,000 64,000 54,000 96,000 Handout 2 - Wilson Manufacturing: Deferred Tax Asset Realization Analysis (Amounts in thousands) The documentation below was provided to the auditors as part of their audit. Year Pre-Tax Book Income (Loss) Goodwill Impairment * Adjusted Pre-Tax Book Income (Loss) Actual Results 2016 150,000 150,000 2017 100,000 100,000 2018 (700,000) (750,000) 50,000 Projections 2019 2020 40,000 2021 80,000 2022 85,000 2023 90,000 2024 95,000 2025 100,000 2026 105,000 2027 110,000 2028 115,000 2029 120,000 * The goodwill impaired is nondeductible. There was no basis in the goodwill for tax purposes; therefore, the impairment had no direct impact on the tax provision. In other words, the impairment of the goodwill for book purposes does not result in a corresponding deduction for tax purposes in any period. The book expense, therefore, does not affect the resulting taxes payable and results in an effective tax rate that differs (unfavorably) from the statutory tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started