Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wilson Morgan purchased a new heavy-duty equipment for his business purpose on July 1, 2015. Following is the given information regarding the equipment: a) $40,000

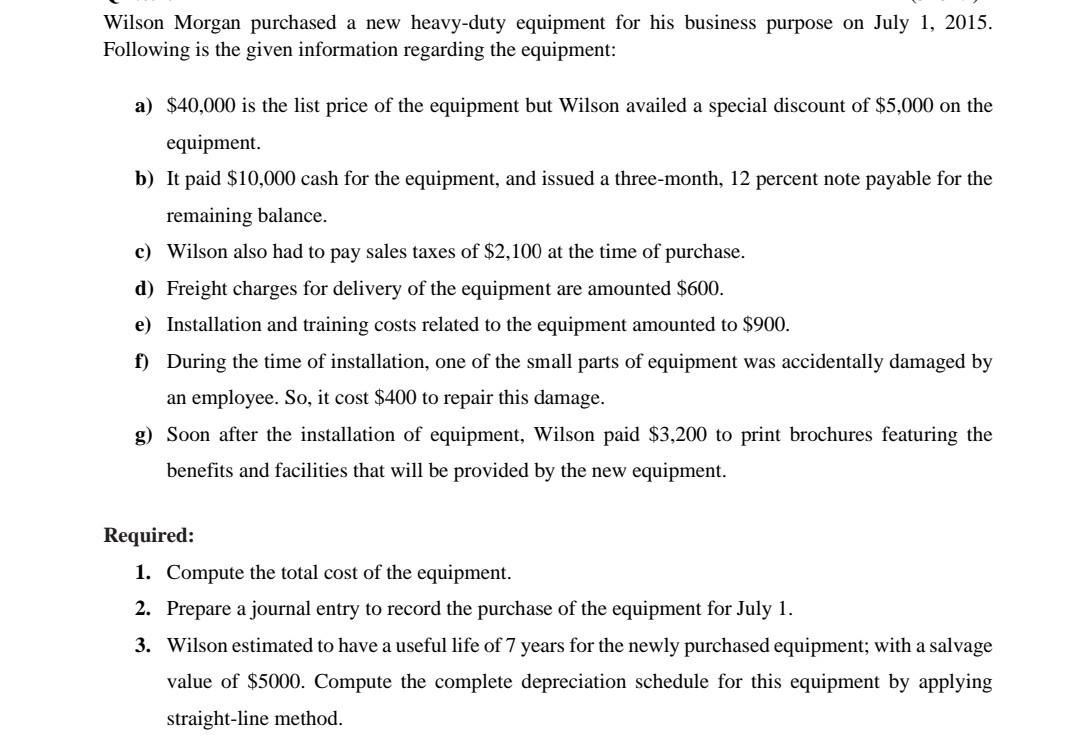

Wilson Morgan purchased a new heavy-duty equipment for his business purpose on July 1, 2015. Following is the given information regarding the equipment: a) $40,000 is the list price of the equipment but Wilson availed a special discount of $5,000 on the equipment. b) It paid $10,000 cash for the equipment, and issued a three-month, 12 percent note payable for the remaining balance. c) Wilson also had to pay sales taxes of $2,100 at the time of purchase. d) Freight charges for delivery of the equipment are amounted $600. e) Installation and training costs related to the equipment amounted to $900. f) During the time of installation, one of the small parts of equipment was accidentally damaged by an employee. So, it cost $400 to repair this damage. g) Soon after the installation of equipment, Wilson paid $3,200 to print brochures featuring the benefits and facilities that will be provided by the new equipment. Required: 1. Compute the total cost of the equipment. 2. Prepare a journal entry to record the purchase of the equipment for July 1. 3. Wilson estimated to have a useful life of 7 years for the newly purchased equipment; with a salvage value of $5000. Compute the complete depreciation schedule for this equipment by applying straight-line method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started