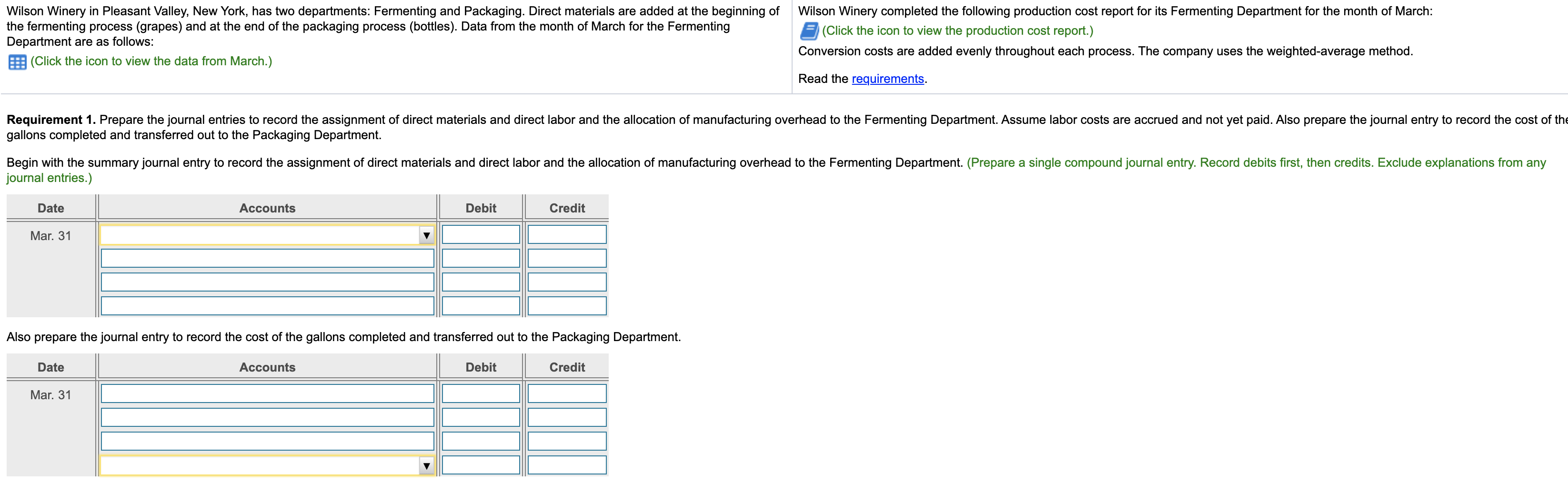

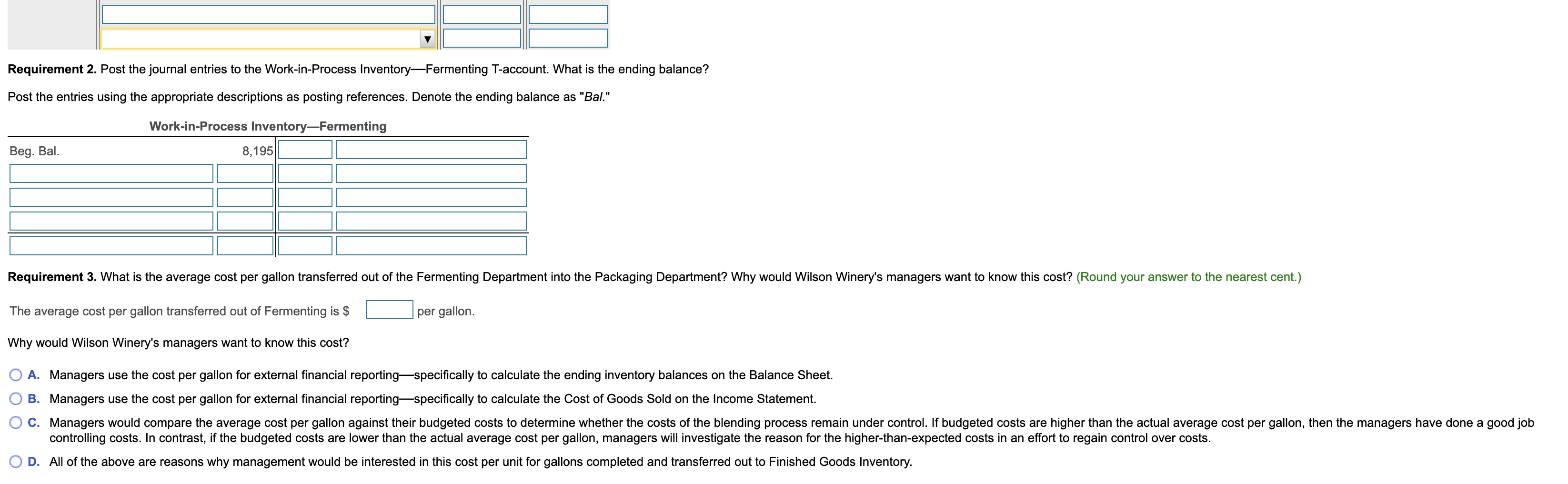

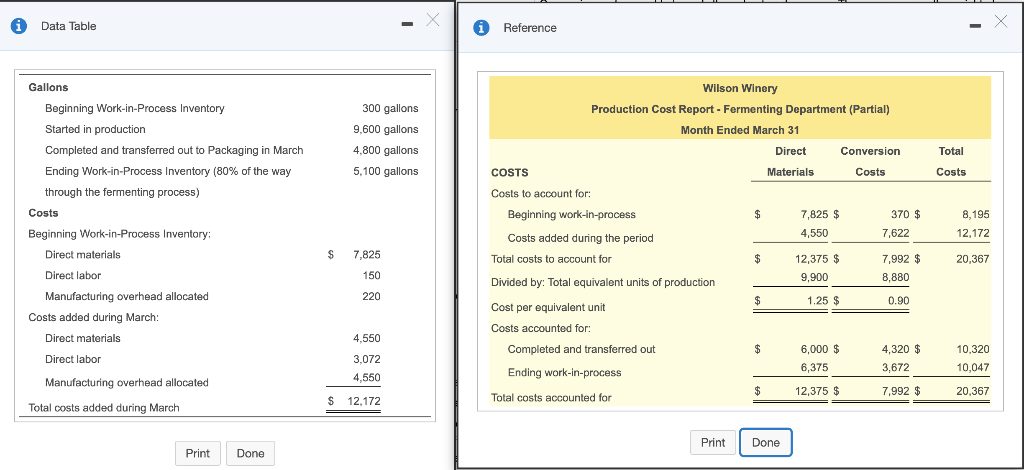

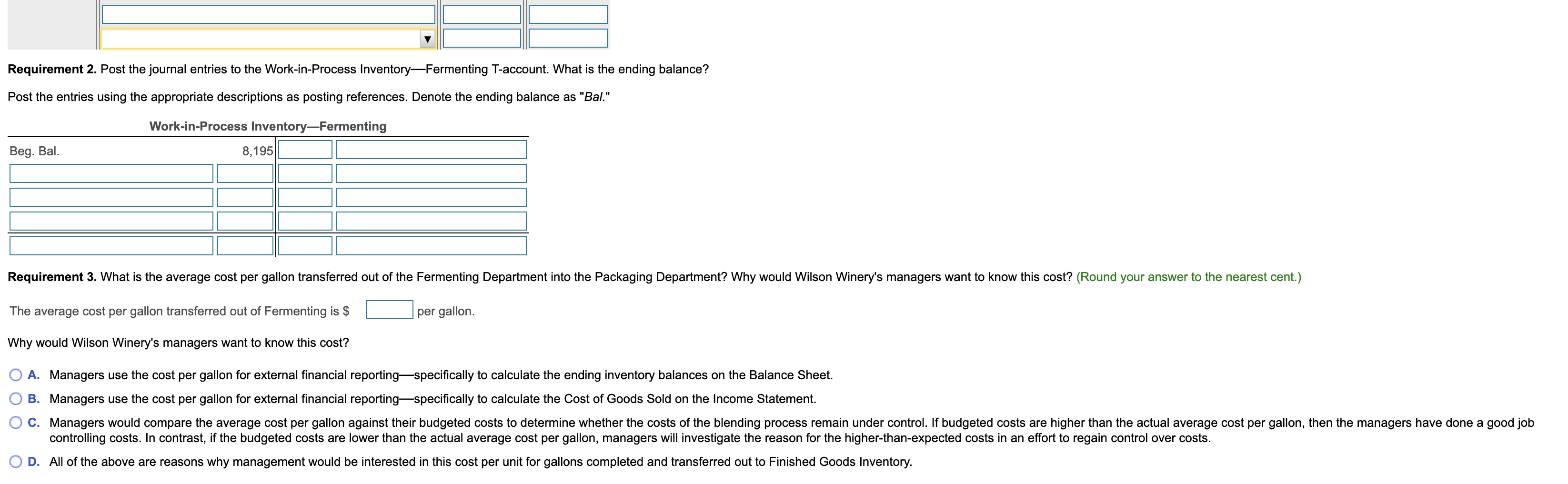

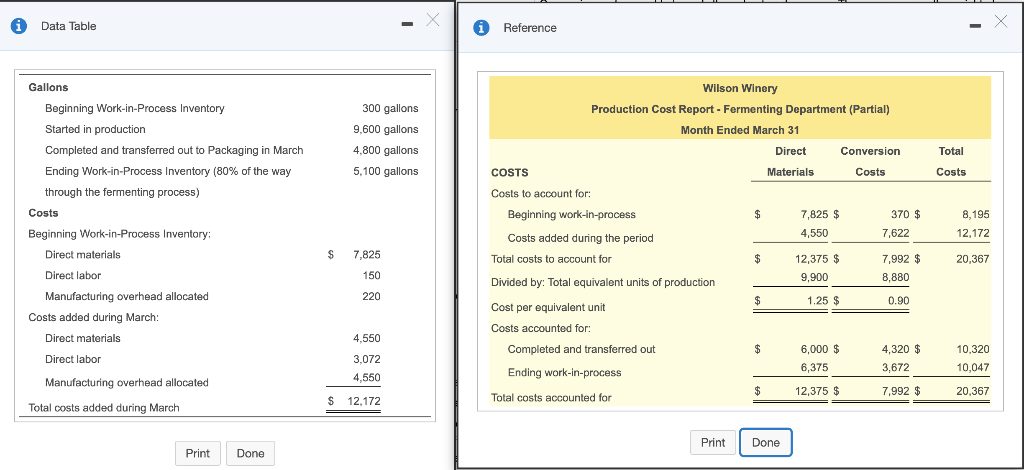

Wilson Winery in Pleasant Valley, New York, has two departments: Fermenting and Packaging. Direct materials are added at the beginning of the fermenting process (grapes) and at the end of the packaging process (bottles). Data from the month of March for the Fermenting Department are as follows: (Click the icon to view the data from March.) Wilson Winery completed the following production cost report for its Fermenting Department for the month of March: (Click the icon to view the production cost report.) Conversion costs are added evenly throughout each process. The company uses the weighted-average method. Read the requirements. Requirement 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. Assume labor costs are accrued and not yet paid. Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department. Begin with the summary journal entry to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. (Prepare a single compound journal entry. Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Mar. 31 Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department. Date Accounts Debit Credit Mar. 31 Requirement 2. Post the journal entries to the Work-in-Process InventoryFermenting T-account. What is the ending balance? Post the entries using the appropriate descriptions as posting references. Denote the ending balance as "Bal." Work-in-Process Inventory-Fermenting Beg. Bal. 8,195 Requirement 3. What is the average cost per gallon transferred out of the Fermenting Department into the Packaging Department? Why would Wilson Winery's managers want to know this cost? (Round your answer to the nearest cent.) The average cost per gallon transferred out of Fermenting is $ per gallon. Why would Wilson Winery's managers want to know this cost? A. Managers use the cost per gallon for external financial reporting specifically to calculate the ending inventory balances on the Balance Sheet. B. Managers use the cost per gallon for external financial reporting-specifically to calculate the cost of Goods Sold on the Income Statement. C. Managers would compare the average cost per gallon against their budgeted costs to determine whether the costs of the blending process remain under control. If budgeted costs are higher than the actual average cost per gallon, then the managers have done a good job controlling costs. In contrast, if the budgeted costs are lower than the actual average cost per gallon, managers will investigate the reason for the higher-than-expected costs in an effort to regain control over costs. D. All of the above are reasons why management would be interested in this cost per unit for gallons completed and transferred out to Finished Goods Inventory. Data Table Reference Gallons 300 gallons 9,600 gallons 4.800 gallons 5,100 gallons Wilson Winery Production Cost Report - Fermenting Department (Partial) Month Ended March 31 Direct Conversion Materials Costs Total COSTS Costs Beginning Work-in-Process Inventory Started in production Completed and transferred out to Packaging in March Ending Work-in-Process Inventory (80% of the way through the fermenting process) Costs Beginning Work-in-Process Inventory: Direct materials Costs to account for: $ 370 $ 8,195 Beginning work-in-process Costs added during the period Total costs to account for 7,825 $ 4,550 7,622 12,172 $ 7,825 $ 7,992 $ 20,367 12,375 $ 9,900 Direct labor 150 Divided by: Total equivalent units of production 8,880 220 $ 1.25 $ 0.90 Manufacturing overhead allocated Costs added during March: Direct materials Cost per equivalent unit Costs accounted for: Completed and transferred out 4,550 $ Direct labor 3,072 4,550 6,000 $ 6,375 4,320 $ 3,672 10,320 10,047 Ending work-in-process Manufacturing overhead allocated $ 12,375 $ 7,992 $ 20,367 S 12.172 Total costs accounted for Total costs added during March Print Done Print Done