Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WIN Ltd. has entered into a three year lease arrangement with Tanya sports club in respect of Fitness Equipments costing 16,99,999.50. The annual lease

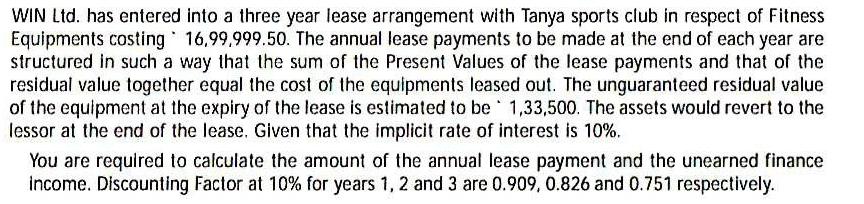

WIN Ltd. has entered into a three year lease arrangement with Tanya sports club in respect of Fitness Equipments costing 16,99,999.50. The annual lease payments to be made at the end of each year are structured in such a way that the sum of the Present Values of the lease payments and that of the residual value together equal the cost of the equipments leased out. The unguaranteed residual value of the equipment at the expiry of the lease is estimated to be 1,33,500. The assets would revert to the lessor at the end of the lease. Given that the implicit rate of interest is 10%. You are required to calculate the amount of the annual lease payment and the unearned finance income. Discounting Factor at 10% for years 1, 2 and 3 are 0.909, 0.826 and 0.751 respectively.

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Aswer Leatt assame Tease ay be Aunual Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started