Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Win Win Limited is a robot manufacturer to be sold to another tech firm at the end of one year. Win Win expects that

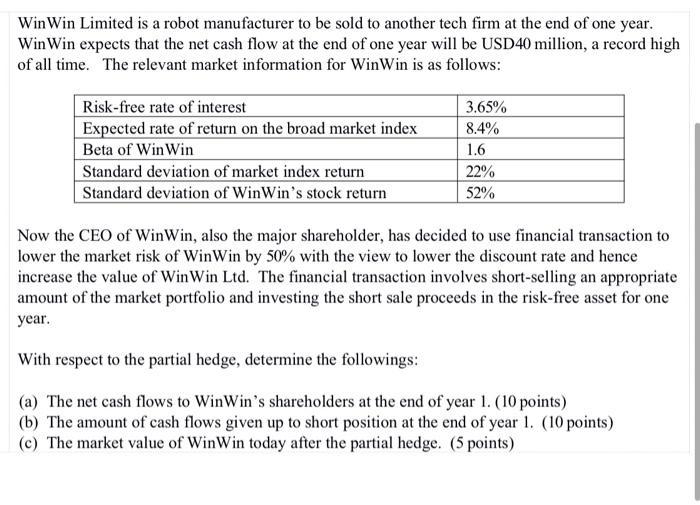

Win Win Limited is a robot manufacturer to be sold to another tech firm at the end of one year. Win Win expects that the net cash flow at the end of one year will be USD40 million, a record high of all time. The relevant market information for WinWin is as follows: Risk-free rate of interest Expected rate of return on the broad market index Beta of Win Win Standard deviation of market index return 3.65% 8.4% 1.6 Standard deviation of WinWin's stock return 22% 52% Now the CEO of WinWin, also the major shareholder, has decided to use financial transaction to lower the market risk of WinWin by 50% with the view to lower the discount rate and hence increase the value of WinWin Ltd. The financial transaction involves short-selling an appropriate amount of the market portfolio and investing the short sale proceeds in the risk-free asset for one year. With respect to the partial hedge, determine the followings: (a) The net cash flows to WinWin's shareholders at the end of year 1. (10 points) (b) The amount of cash flows given up to short position at the end of year 1. (10 points) (c) The market value of WinWin today after the partial hedge. (5 points)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the net cash flows to WinWins shareholders at the end of year 1 the amount of cash flows given up to the short position at the end of yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started