Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Windsor Company issued its 9%,25-year morteage bonds in the principal amount of $2,770,000 on January 2,2011 , at a discount of $137,000, which it proceeded

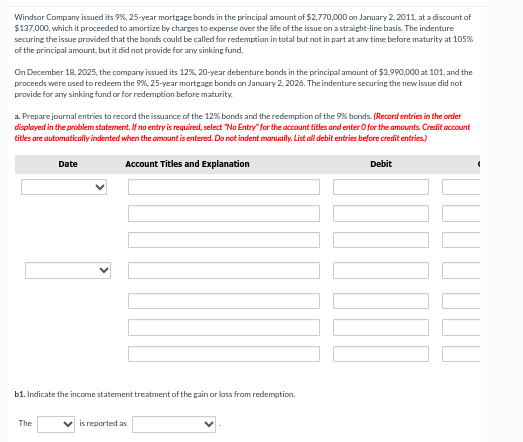

Windsor Company issued its 9%,25-year morteage bonds in the principal amount of $2,770,000 on January 2,2011 , at a discount of $137,000, which it proceeded to amortize by charges to expense over the life of the issue on a straight-line basis. The indenture securine the issue prowided that the bonds could be called for redemption in total but not in part at any time before maturity at 105% of the principal amount, but it did not provide for any sinking fund. On December 18, 2025, the compary issued its 12\%, 20-year debenture bonds in the principal amount of $3,990,000 at 101 , and the proceeds were used to redeem the 9%,25-year morteage bonds on January 2, 2026. The indenture securing the new issue did not provide for arry sinking fund or for redemption before maturity. a. Prepare journal entries to record the issuance of the 12% bonds and the redemption of the 9% bonds. (Record entries in the order disployed in the problem statement. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Credit occount titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) b1. Indicate the income statement treatment of the gain or lass from redemption

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started