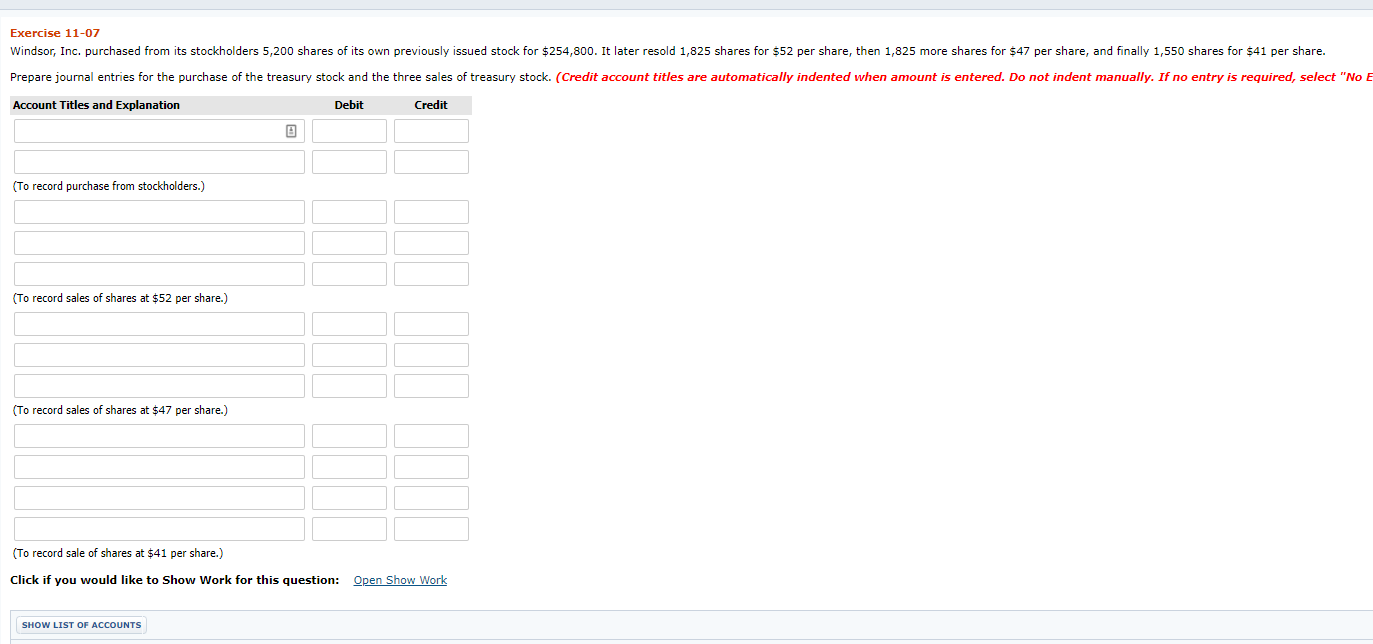

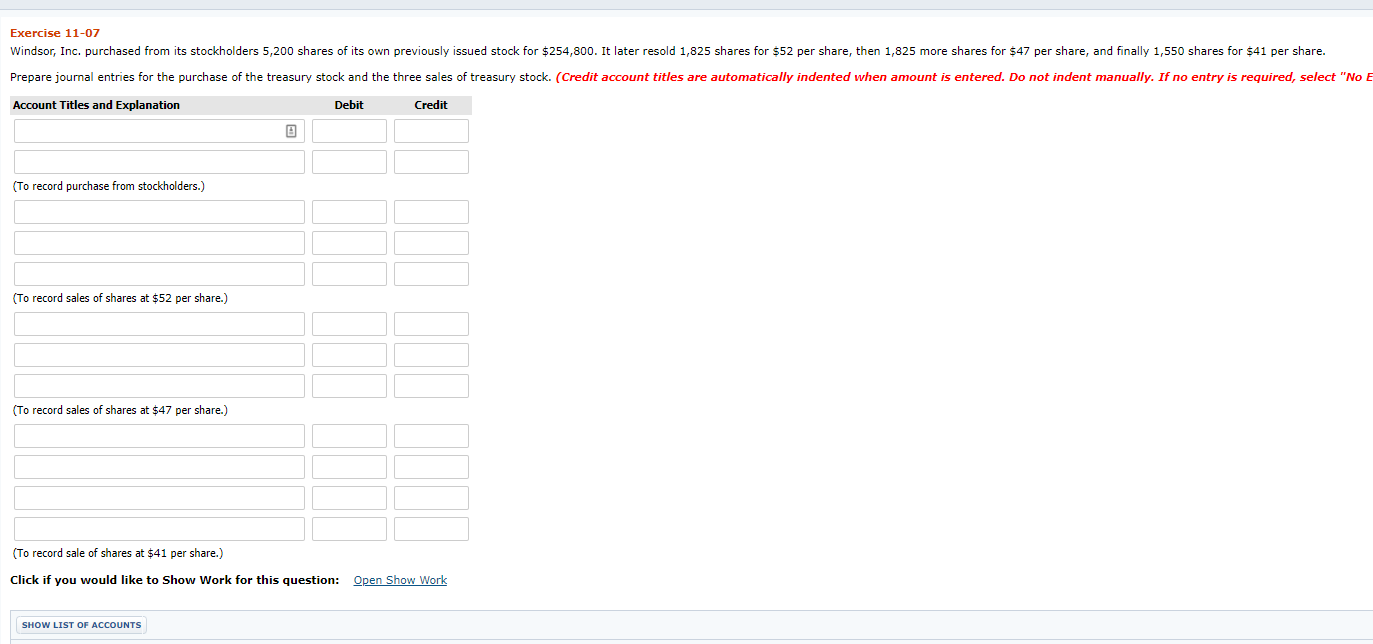

Windsor, Inc. purchased from its stockholders 5,200 shares of its own previously issued stock for $254,800. It later resold 1,825 shares for $52 per share, then 1,825 more shares for $47 per share, and finally 1,550 shares for $41 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock.

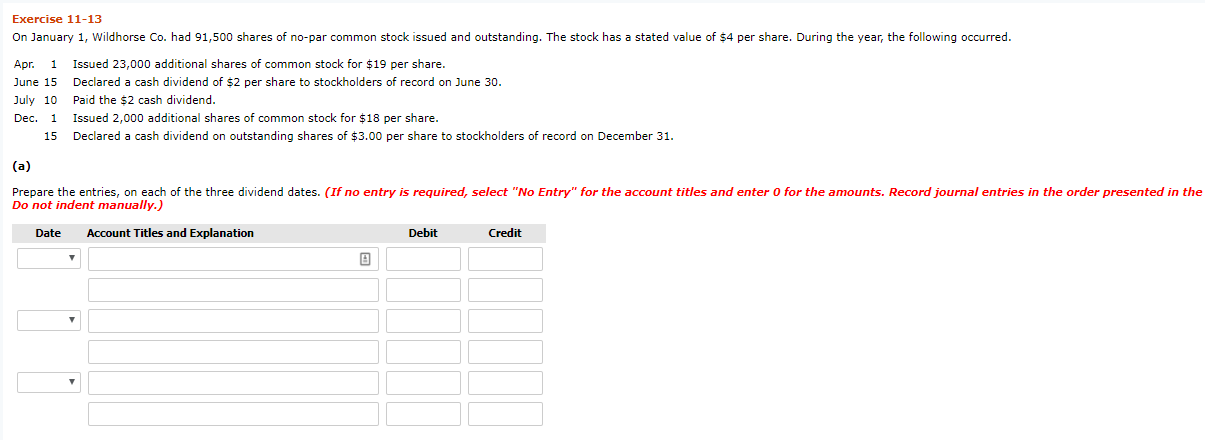

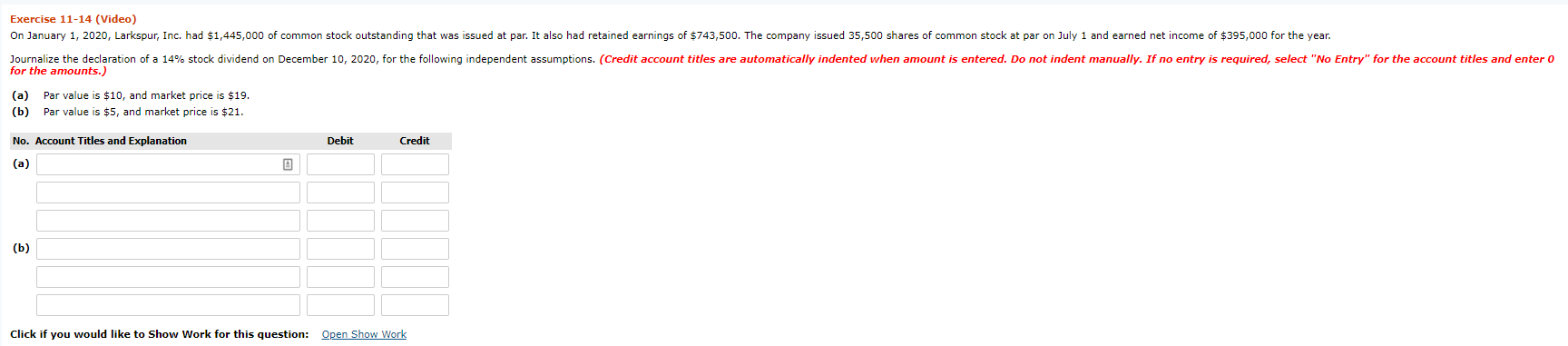

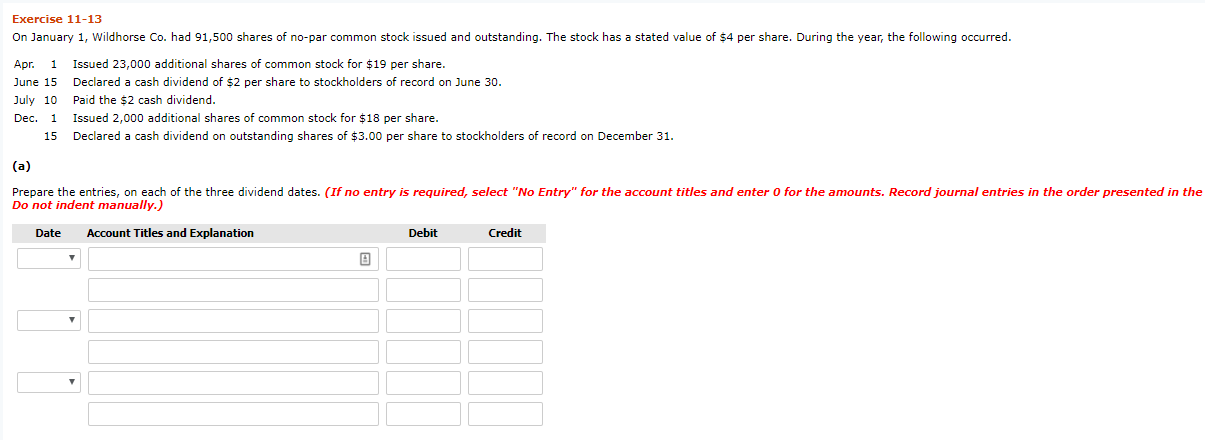

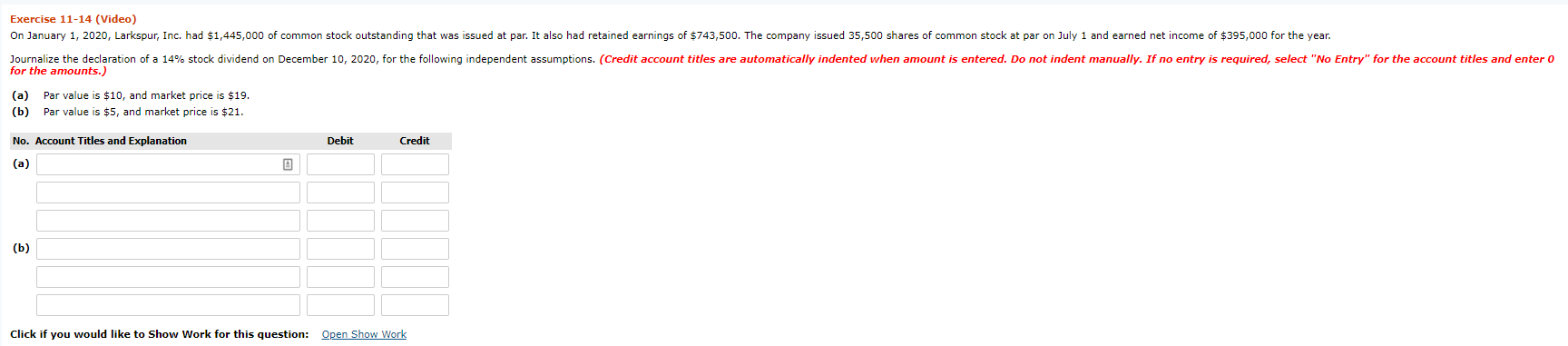

Exercise 11-07 Windsor, Inc. purchased from its stockholders 5,200 shares of its own previously issued stock for $254,800. It later resold 1,825 shares for $52 per share, then 1,825 more shares for $47 per share, and finally 1,550 shares for $41 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No E Account Titles and Explanation Debit Credit (To record purchase from stockholders.) (To record sales of shares at $52 per share.) (To record sales of shares at $47 per share.) (To record sale of shares at $41 per share.) Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS Exercise 11-13 On January 1, Wildhorse Co. had 91,500 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following occurred. Apr. 1 June 15 July 10 Dec. 1 15 Issued 23,000 additional shares of common stock for $19 per share. Declared a cash dividend of $2 per share to stockholders of record on June 30. Paid the $2 cash dividend. Issued 2,000 additional shares of common stock for $18 per share. Declared a cash dividend on outstanding shares of $3.00 per share to stockholders of record on December 31. (a) Prepare the entries, on each of the three dividend dates. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the Do not indent manually.) Date Account Titles and Explanation Debit Credit Exercise 11-14 (Video) On January 1, 2020, Larkspur, Inc. had $1,445,000 of common stock outstanding that was issued at par. It also had retained earnings of $743,500. The company issued 35,500 shares of common stock at par on July 1 and earned net income of $395,000 for the year. Journalize the declaration of a 14% stock dividend on December 10, 2020, for the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) (b) Par value is $10, and market price is $19. Par value is $5, and market price is $21. No. Account Titles and Explanation Debit Credit Click if you would like to Show Work for this question: Open Show Work