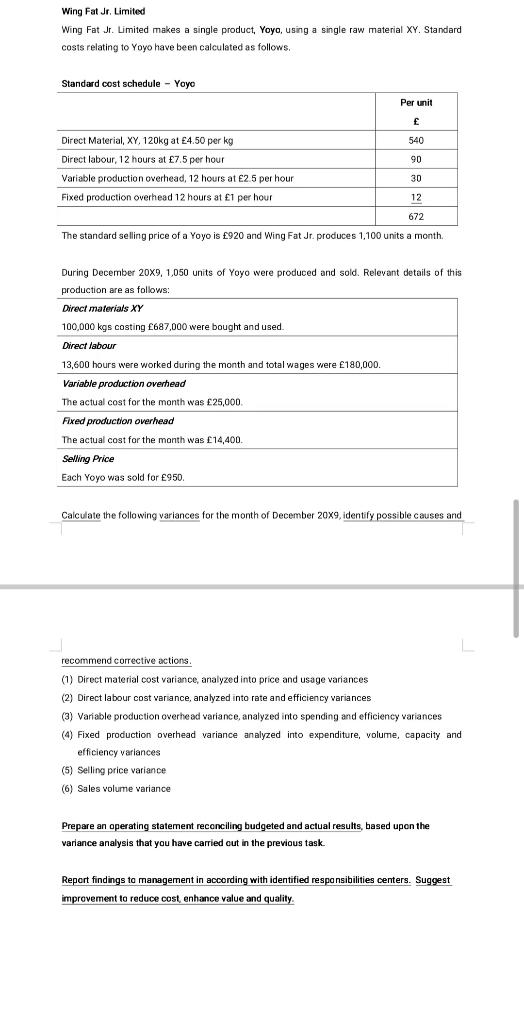

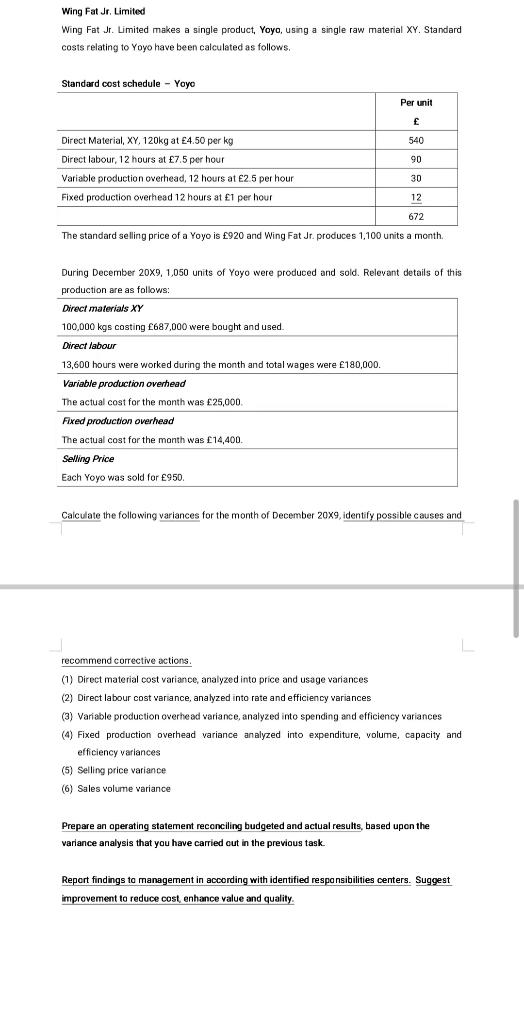

Wing Fat Jr. Limited

Wing Fat Jr. Limited makes a single product, Yoyo, using a single raw material XY. Standard costs relating to Yoyo have been calculated as follows.

Standard cost schedule Yoyo

| | Per unit

|

| Direct Material, XY, 120kg at 4.50 per kg | 540 |

| Direct labour, 12 hours at 7.5 per hour | 90 |

| Variable production overhead, 12 hours at 2.5 per hour | 30 |

| Fixed production overhead 12 hours at 1 per hour | 12 |

| | 672 |

The standard selling price of a Yoyo is 920 and Wing Fat Jr. produces 1,100 units a month.

During December 20X9, 1,050 units of Yoyo were produced and sold. Relevant details of this production are as follows:

| Direct materials XY 100,000 kgs costing 687,000 were bought and used. |

| Direct labour 13,600 hours were worked during the month and total wages were 180,000. |

| Variable production overhead The actual cost for the month was 25,000. |

| Fixed production overhead The actual cost for the month was 14,400. |

| Selling Price Each Yoyo was sold for 950. |

Calculate the following variances for the month of December 20X9, identify possible causes and recommend corrective actions.

- Direct material cost variance, analyzed into price and usage variances

- Direct labour cost variance, analyzed into rate and efficiency variances

- Variable production overhead variance, analyzed into spending and efficiency variances

- Fixed production overhead variance analyzed into expenditure, volume, capacity and efficiency variances

- Selling price variance

- Sales volume variance

Prepare an operating statement reconciling budgeted and actual results, based upon the variance analysis that you have carried out in the previous task.

Report findings to management in according with identified responsibilities centers. Suggest improvement to reduce cost, enhance value and quality.

Wing Fat Jr. Limited Wing Fat Jr. Limited makes a single product, Yoyo, using a single raw material XY. Standard costs relating to Yoyo have been calculated as follows. Standard cost schedule - Yoyo Per unit 540 90 30 12 672 The standard selling price of a Yoyo is 920 and Wing Fat Jr. produces 1,100 units a month.. Direct Material, XY, 120kg at 4.50 per kg Direct labour, 12 hours at 7.5 per hour Variable production overhead, 12 hours at 2.5 per hour Fixed production overhead 12 hours at 1 per hour During December 20X9, 1,050 units of Yoyo were produced and sold. Relevant details of this production are as follows: Direct materials XY 100,000 kgs costing 687,000 were bought and used. Direct labour 13,600 hours were worked during the month and total wages were 180,000. Variable production overhead The actual cost for the month was 25,000. Fixed production overhead The actual cost for the month was 14,400. Selling Price Each Yoyo was sold for 950. Calculate the following variances for the month of December 20X9, identify possible causes and recommend corrective actions. (1) Direct material cost variance, analyzed into price and usage variances. (2) Direct labour cost variance, analyzed into rate and efficiency variances (3) Variable production overhead variance, analyzed into spending and efficiency variances. (4) Fixed production overhead variance analyzed into expenditure, volume, capacity and efficiency variances (5) Selling price variance (6) Sales volume variance Prepare an operating statement reconciling budgeted and actual results, based upon the variance analysis that you have carried out in the previous task. Report findings to management in according with identified responsibilities centers. Suggest improvement to reduce cost, enhance value and quality. Wing Fat Jr. Limited Wing Fat Jr. Limited makes a single product, Yoyo, using a single raw material XY. Standard costs relating to Yoyo have been calculated as follows. Standard cost schedule - Yoyo Per unit 540 90 30 12 672 The standard selling price of a Yoyo is 920 and Wing Fat Jr. produces 1,100 units a month.. Direct Material, XY, 120kg at 4.50 per kg Direct labour, 12 hours at 7.5 per hour Variable production overhead, 12 hours at 2.5 per hour Fixed production overhead 12 hours at 1 per hour During December 20X9, 1,050 units of Yoyo were produced and sold. Relevant details of this production are as follows: Direct materials XY 100,000 kgs costing 687,000 were bought and used. Direct labour 13,600 hours were worked during the month and total wages were 180,000. Variable production overhead The actual cost for the month was 25,000. Fixed production overhead The actual cost for the month was 14,400. Selling Price Each Yoyo was sold for 950. Calculate the following variances for the month of December 20X9, identify possible causes and recommend corrective actions. (1) Direct material cost variance, analyzed into price and usage variances. (2) Direct labour cost variance, analyzed into rate and efficiency variances (3) Variable production overhead variance, analyzed into spending and efficiency variances. (4) Fixed production overhead variance analyzed into expenditure, volume, capacity and efficiency variances (5) Selling price variance (6) Sales volume variance Prepare an operating statement reconciling budgeted and actual results, based upon the variance analysis that you have carried out in the previous task. Report findings to management in according with identified responsibilities centers. Suggest improvement to reduce cost, enhance value and quality