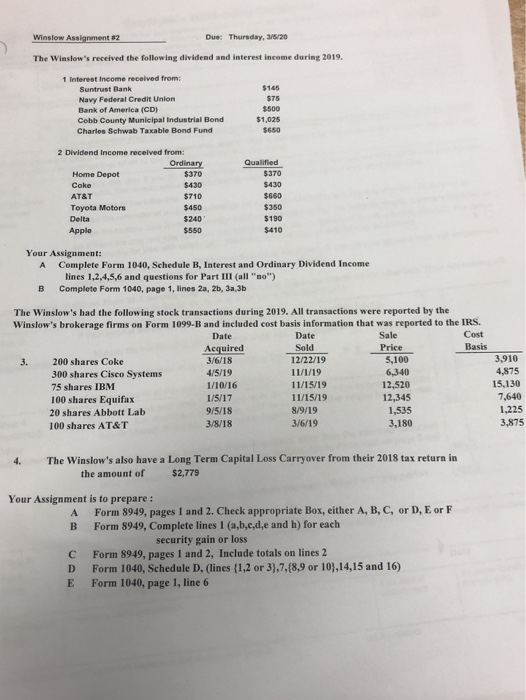

Winslow Assignment 82 Due: Thursday, 3/5/20 The Winslow's received the following dividend and interest income during 2019, $145 1 Interest Income received from: Suntruet Bank Navy Federal Credit Union Bank of America (CD) Cobb County Municipal Industrial Bond Charles Schwab Taxable Bond Fund $500 $1,025 Qualified $370 2 Dividend income received from: Ordinary Home Depot Coke Toyota Motors $450 Delta $240 Apple $550 5370 5430 5710 5.430 S60 $190 $410 Your Assignment: A Complete Form 1040, Schedule B, Interest and Ordinary Dividend Income lines 1,2,4,5,6 and questions for Part III (all "no") B Complete Form 1040, page 1, lines 2a, 2b, 3a, 3b The Winslow's had the following stock transactions during 2019. All transactions were reported by the Winslow's brokerage firms on Form 1099-B and included cost basis information that was reported to the IRS. Date Date Sale Cost Acquired Sold Price Basis 3. 200 shares Coke 3/6/18 12/22/19 5,100 3,910 300 shares Cisco Systems 4/5/19 11/1/19 6,340 4,875 75 shares IBM 1/10/16 11/15/19 12,520 15,130 100 shares Equifax 1/5/17 11/15/19 12,345 7,640 20 shares Abbott Lab 9/5/18 8/9/19 1,535 1,225 100 shares AT&T 3/8/18 3/6/19 3,180 3.875 4. The Winslow's also have a Long Term Capital Loss Carryover from their 2018 tax return in the amount of $2,779 Your Assignment is to prepare : A Form 8949, pages 1 and 2. Check appropriate Box, either A, B, C, or D, E or F B Form 8949, Complete lines 1 (a,b,d,e and h) for each security gain or loss C Form 8949, pages 1 and 2, Include totals on lines 2 D Form 1040, Schedule D. (lines {1,2 or 3},7,(8,9 or 103,14,15 and 16) E Form 1040, page 1, line 6 Winslow Assignment 82 Due: Thursday, 3/5/20 The Winslow's received the following dividend and interest income during 2019, $145 1 Interest Income received from: Suntruet Bank Navy Federal Credit Union Bank of America (CD) Cobb County Municipal Industrial Bond Charles Schwab Taxable Bond Fund $500 $1,025 Qualified $370 2 Dividend income received from: Ordinary Home Depot Coke Toyota Motors $450 Delta $240 Apple $550 5370 5430 5710 5.430 S60 $190 $410 Your Assignment: A Complete Form 1040, Schedule B, Interest and Ordinary Dividend Income lines 1,2,4,5,6 and questions for Part III (all "no") B Complete Form 1040, page 1, lines 2a, 2b, 3a, 3b The Winslow's had the following stock transactions during 2019. All transactions were reported by the Winslow's brokerage firms on Form 1099-B and included cost basis information that was reported to the IRS. Date Date Sale Cost Acquired Sold Price Basis 3. 200 shares Coke 3/6/18 12/22/19 5,100 3,910 300 shares Cisco Systems 4/5/19 11/1/19 6,340 4,875 75 shares IBM 1/10/16 11/15/19 12,520 15,130 100 shares Equifax 1/5/17 11/15/19 12,345 7,640 20 shares Abbott Lab 9/5/18 8/9/19 1,535 1,225 100 shares AT&T 3/8/18 3/6/19 3,180 3.875 4. The Winslow's also have a Long Term Capital Loss Carryover from their 2018 tax return in the amount of $2,779 Your Assignment is to prepare : A Form 8949, pages 1 and 2. Check appropriate Box, either A, B, C, or D, E or F B Form 8949, Complete lines 1 (a,b,d,e and h) for each security gain or loss C Form 8949, pages 1 and 2, Include totals on lines 2 D Form 1040, Schedule D. (lines {1,2 or 3},7,(8,9 or 103,14,15 and 16) E Form 1040, page 1, line 6