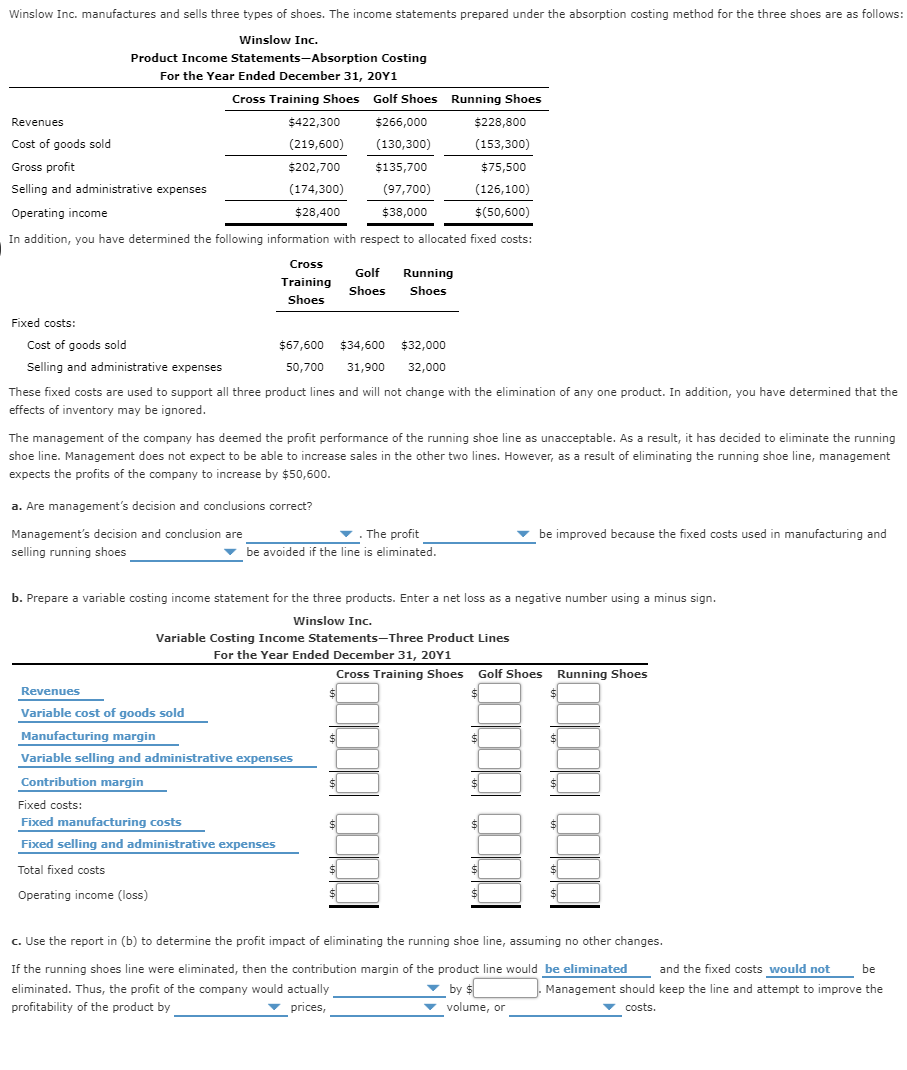

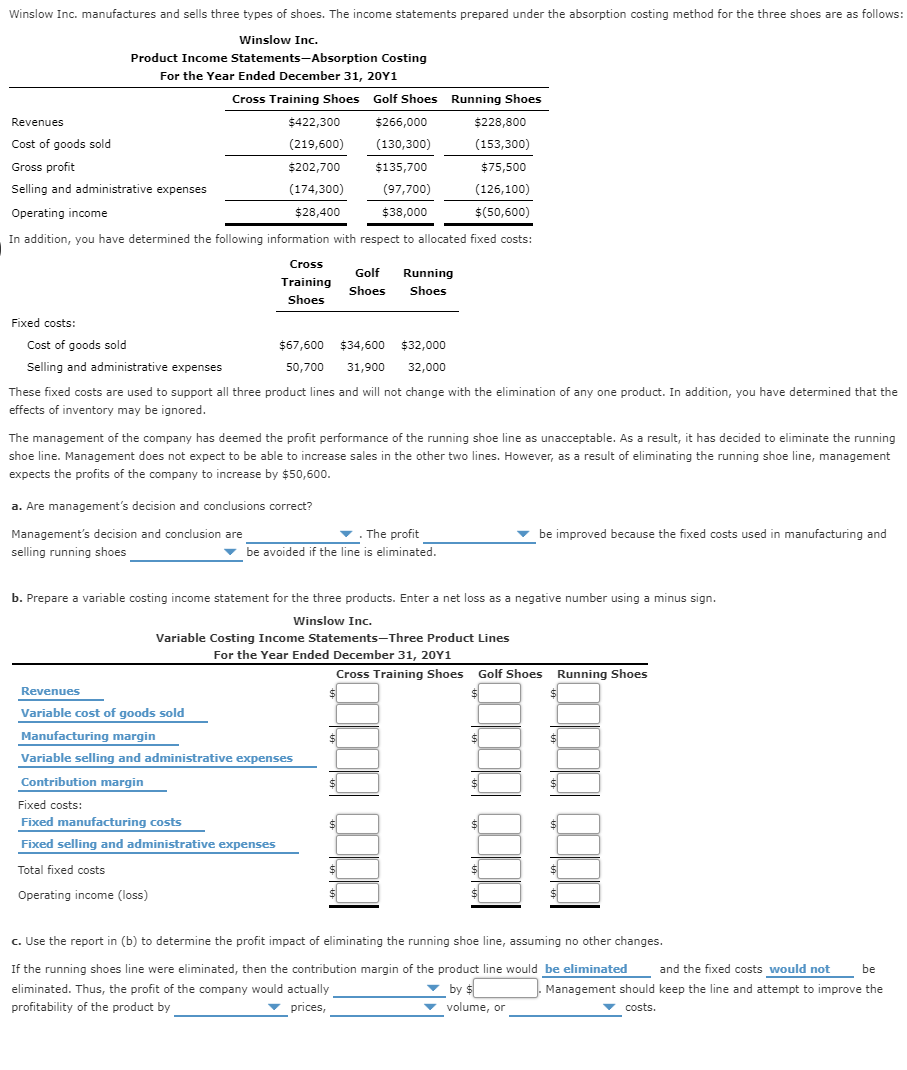

Winslow Inc. manufactures and sells three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31, 20Y1 Cross Training Shoes Golf Shoes Revenues $422,300 $266,000 Cost of goods sold (219,600) (130,300) Gross profit $202,700 $135,700 Selling and administrative expenses (174,300) (97,700) Operating income $28,400 $38,000 Running Shoes $228,800 (153,300) $75,500 (126,100) $(50,600) In addition, you have determined the following information with respect to allocated fixed costs: Cross Training Shoes Golf Shoes Running Shoes Fixed costs: Cost of goods sold $67,600 $34,600 $32,000 Selling and administrative expenses 50,700 31,900 32,000 These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effects of inventory may be ignored. The management of the company has deemed the profit performance of the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by $50,600. a. Are management's decision and conclusions correct? be improved because the fixed costs used in manufacturing and Management's decision and conclusion are . The profit selling running shoes be avoided if the line eliminated. $ b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Winslow Inc. Variable Costing Income Statements-Three Product Lines For the Year Ended December 31, 20Y1 Cross Training Shoes Golf Shoes Running Shoes Revenues Variable cost of goods sold Manufacturing margin $ $ Variable selling and administrative expenses Contribution margin $ Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs $ Operating income (loss) in ito c. Use the report in (b) to determine the profit impact of eliminating the running shoe line, assuming no other changes. If the running shoes line were eliminated, then the contribution margin of the product line would be eliminated and the fixed costs would not be eliminated. Thus, the profit of the company would actually by $ Management should keep the line and attempt to improve the profitability of the product by prices, volume, or costs