Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with formula 1. An irredeemable bond has a face value of 100 and a coupon rate of 8%, if the market rate of interest is

with formula

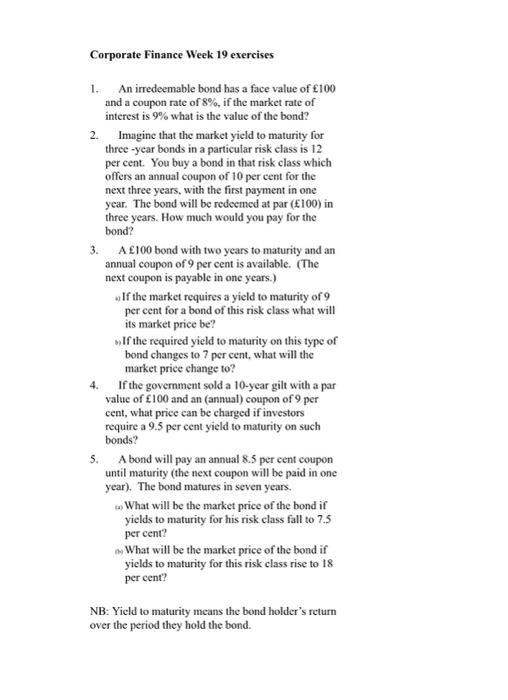

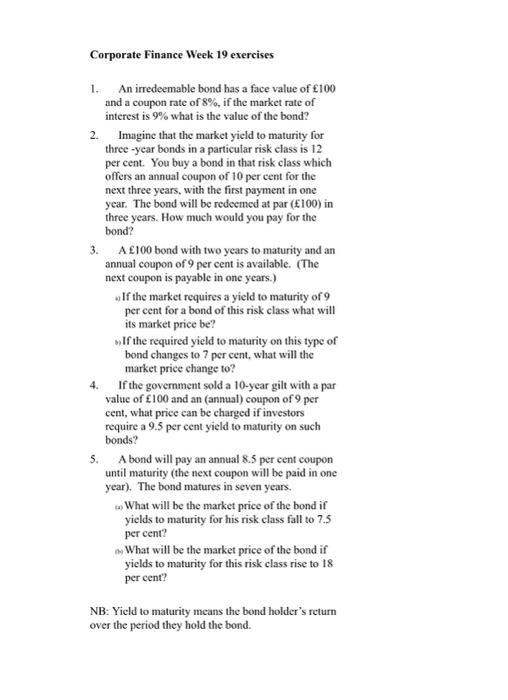

1. An irredeemable bond has a face value of 100 and a coupon rate of 8%, if the market rate of interest is 9% what is the value of the bond? 2. Imagine that the market yield to maturity for three -year bonds in a particular risk class is 12 per cent. You buy a bond in that risk class which offers an annual coupon of 10 per cent for the next three years, with the first payment in one year. The bond will be redeemed at par (E100) in three years. How much would you pay for the bond? 3. A 100 bond with two years to maturity and an annual coupon of 9 per cent is available. (The next coupon is payable in one years.) w If the market requires a yield to maturity of 9 per cent for a bond of this risk class what will its market price be? wIf the required yield to maturity on this type of bond changes to 7 per cent, what will the market price change to? 4. If the government sold a 10-year gilt with a par value of 100 and an (annual) coupon of 9 per cent, what price can be charged if investors require a 9.5 per cent yield to maturity on such bonds? 5. A bond will pay an annual 8.5 per cent coupon until maturity (the next coupon will be paid in one year). The bond matures in seven years. what will be the market price of the bond if yields to maturity for his risk class fall to 7.5 per eent? n. What will be the market price of the bond if yields to maturity for this risk class rise to 18 per cent? NB: Yicld to maturity means the bond holder's return over the period they hold the bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started