Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with formula 1. Y plc has the following history of dividend payouts (paid on 31st December): (a) It is now 1st January 2018 and you

with formula

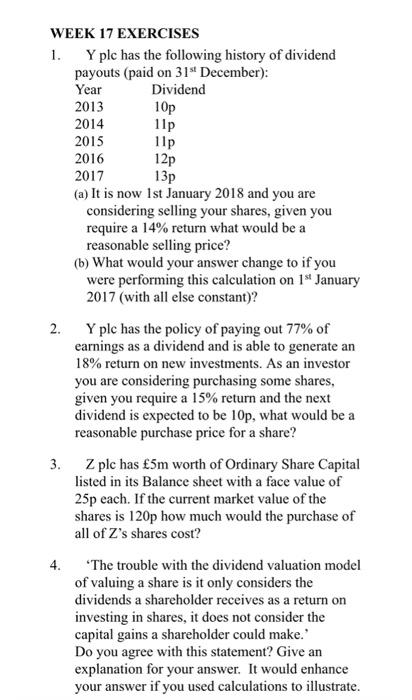

1. Y plc has the following history of dividend payouts (paid on 31st December): (a) It is now 1st January 2018 and you are considering selling your shares, given you require a 14% return what would be a reasonable selling price? (b) What would your answer change to if you were performing this calculation on 1st January 2017 (with all else constant)? 2. Y plc has the policy of paying out 77% of earnings as a dividend and is able to generate an 18% return on new investments. As an investor you are considering purchasing some shares, given you require a 15% return and the next dividend is expected to be 10p, what would be a reasonable purchase price for a share? 3. Z plc has 5m worth of Ordinary Share Capital listed in its Balance sheet with a face value of 25p each. If the current market value of the shares is 120p how much would the purchase of all of Z's shares cost? 4. 'The trouble with the dividend valuation model of valuing a share is it only considers the dividends a shareholder receives as a return on investing in shares, it does not consider the capital gains a shareholder could make.' Do you agree with this statement? Give an explanation for your answer. It would enhance your answer if you used calculations to illustrate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started