with MACRS table method for the corporate tax return where I did wrong.

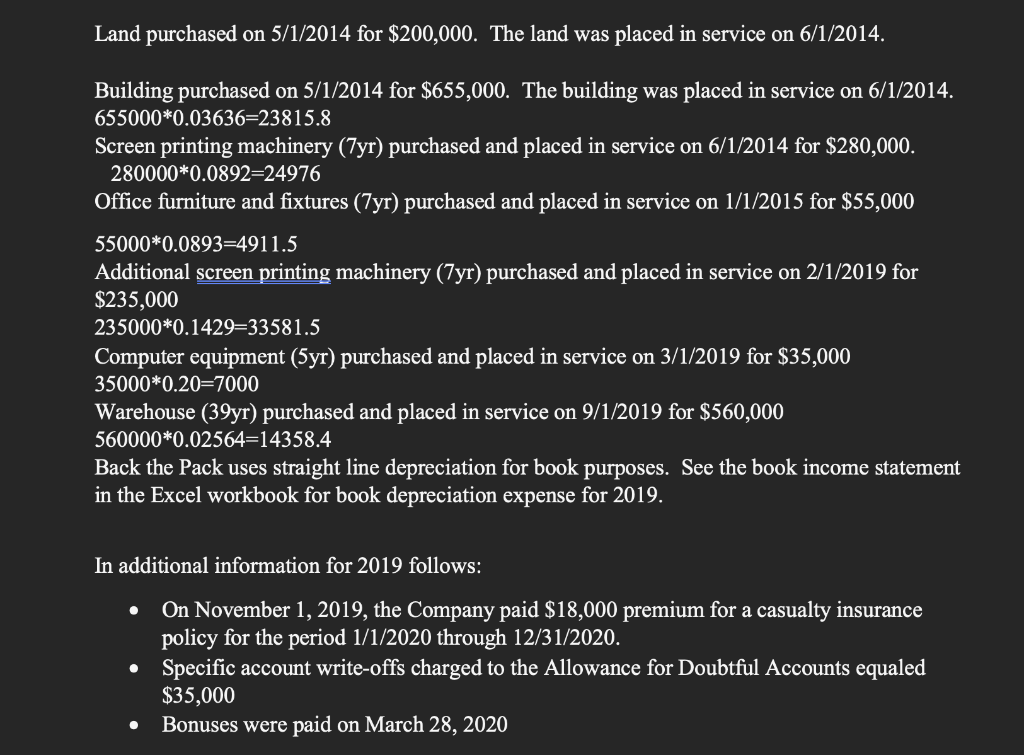

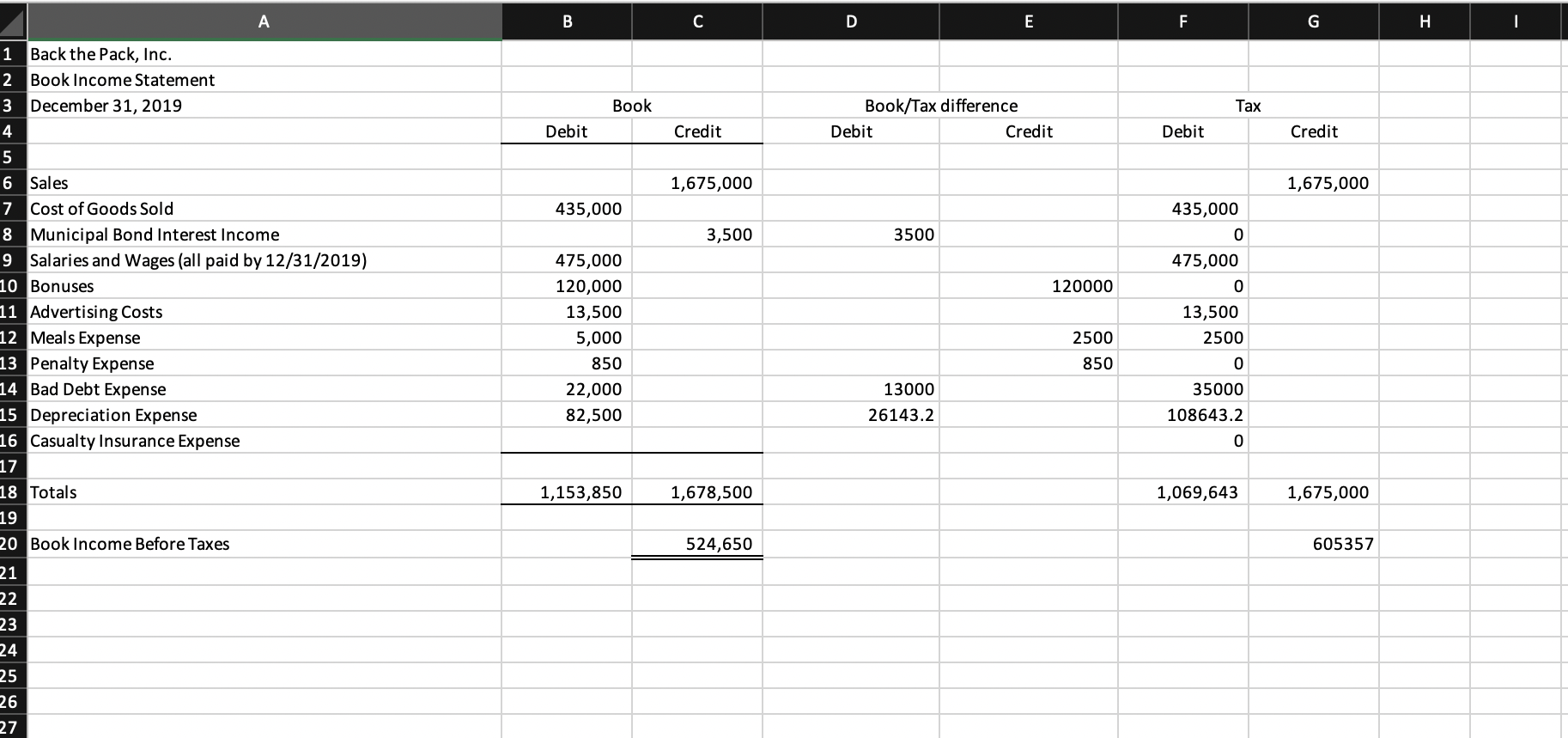

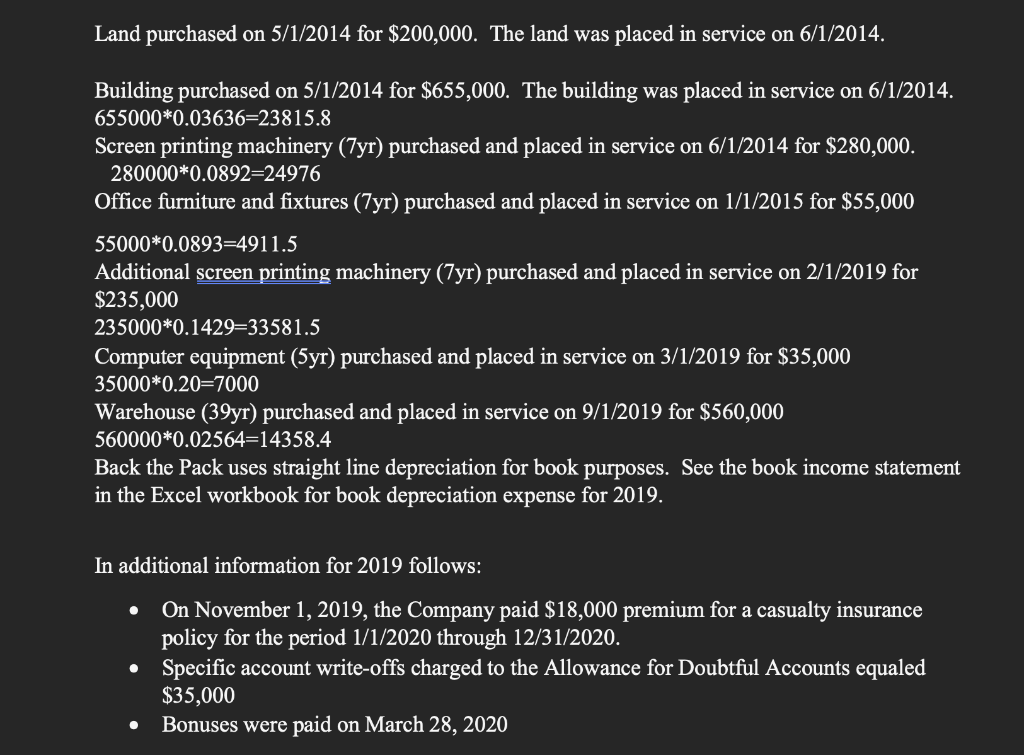

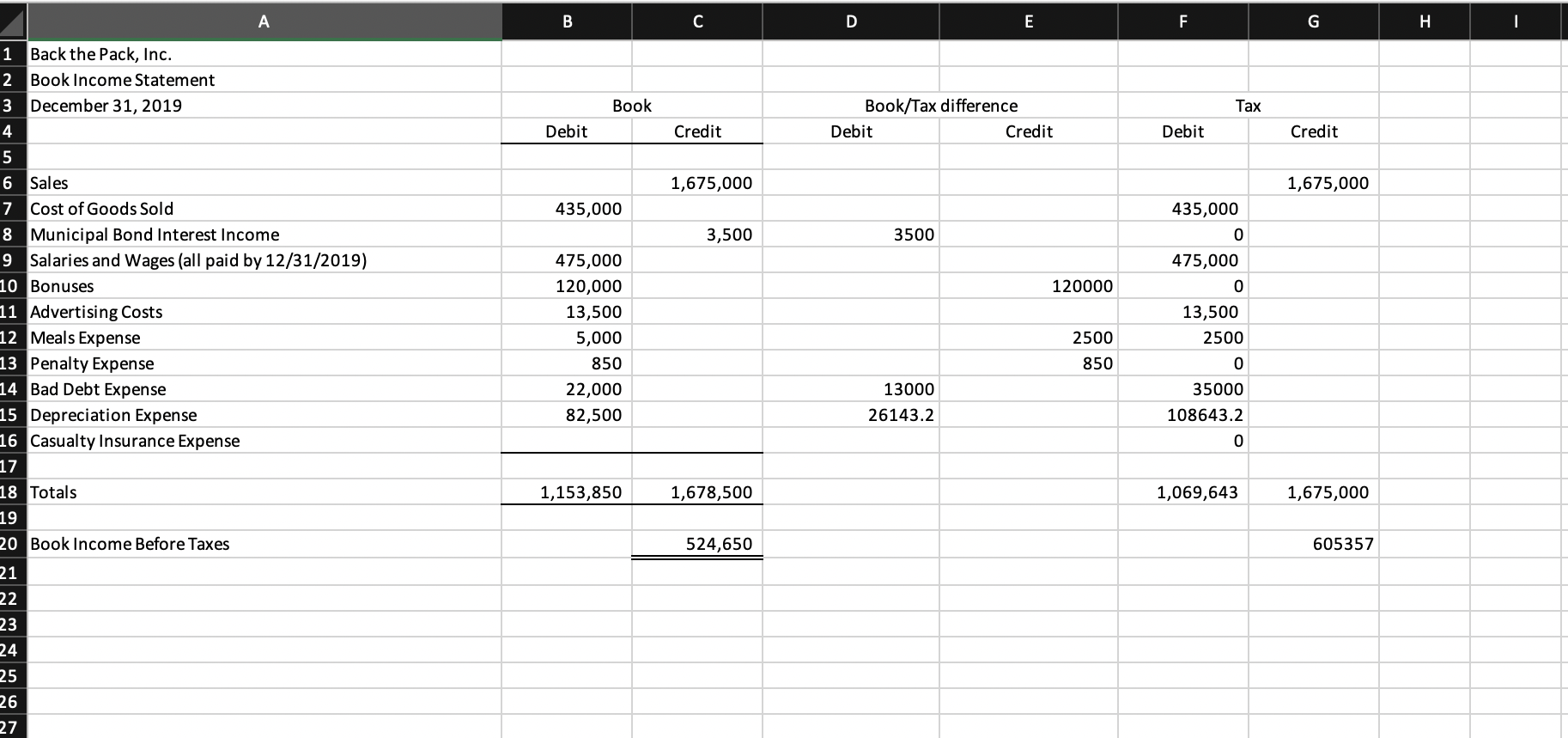

Land purchased on 5/1/2014 for $200,000. The land was placed in service on 6/1/2014. Building purchased on 5/1/2014 for $655,000. The building was placed in service on 6/1/2014. 655000*0.03636=23815.8 Screen printing machinery (7yr) purchased and placed in service on 6/1/2014 for $280,000. 280000*0.0892=24976 Office furniture and fixtures (Tyr) purchased and placed in service on 1/1/2015 for $55,000 55000*0.0893=4911.5 Additional screen printing machinery (7yr) purchased and placed in service on 2/1/2019 for $235,000 235000*0.1429=33581.5 Computer equipment (5yr) purchased and placed in service on 3/1/2019 for $35,000 35000*0.20=7000 Warehouse (39yr) purchased and placed in service on 9/1/2019 for $560,000 560000*0.02564=14358.4 Back the Pack uses straight line depreciation for book purposes. See the book income statement in the Excel workbook for book depreciation expense for 2019. In additional information for 2019 follows: On November 1, 2019, the Company paid $18,000 premium for a casualty insurance policy for the period 1/1/2020 through 12/31/2020. Specific account write-offs charged to the Allowance for Doubtful Accounts equaled $35,000 Bonuses were paid on March 28, 2020 . B E F H Book Tax Book/Tax difference Debit Credit Debit Credit Debit Credit 1,675,000 1,675,000 435,000 3,500 3500 1 Back the Pack, Inc. 2 Book Income Statement 3 December 31, 2019 4 5 6 Sales 7 Cost of Goods Sold 8 Municipal Bond Interest Income 9 Salaries and Wages (all paid by 12/31/2019) 10 Bonuses 11 Advertising Costs 12 Meals Expense 13 Penalty Expense 14 Bad Debt Expense 15 Depreciation Expense 16 Casualty Insurance Expense 17 18 Totals 19 20 Book Income Before Taxes 120000 435,000 0 475,000 0 13,500 2500 475,000 120,000 13,500 5,000 850 22,000 82,500 2500 850 0 13000 26143.2 35000 108643.2 0 1,153,850 1,678,500 1,069,643 1,675,000 524,650 605357 21 22 23 24 25 26 27 Land purchased on 5/1/2014 for $200,000. The land was placed in service on 6/1/2014. Building purchased on 5/1/2014 for $655,000. The building was placed in service on 6/1/2014. 655000*0.03636=23815.8 Screen printing machinery (7yr) purchased and placed in service on 6/1/2014 for $280,000. 280000*0.0892=24976 Office furniture and fixtures (Tyr) purchased and placed in service on 1/1/2015 for $55,000 55000*0.0893=4911.5 Additional screen printing machinery (7yr) purchased and placed in service on 2/1/2019 for $235,000 235000*0.1429=33581.5 Computer equipment (5yr) purchased and placed in service on 3/1/2019 for $35,000 35000*0.20=7000 Warehouse (39yr) purchased and placed in service on 9/1/2019 for $560,000 560000*0.02564=14358.4 Back the Pack uses straight line depreciation for book purposes. See the book income statement in the Excel workbook for book depreciation expense for 2019. In additional information for 2019 follows: On November 1, 2019, the Company paid $18,000 premium for a casualty insurance policy for the period 1/1/2020 through 12/31/2020. Specific account write-offs charged to the Allowance for Doubtful Accounts equaled $35,000 Bonuses were paid on March 28, 2020 . B E F H Book Tax Book/Tax difference Debit Credit Debit Credit Debit Credit 1,675,000 1,675,000 435,000 3,500 3500 1 Back the Pack, Inc. 2 Book Income Statement 3 December 31, 2019 4 5 6 Sales 7 Cost of Goods Sold 8 Municipal Bond Interest Income 9 Salaries and Wages (all paid by 12/31/2019) 10 Bonuses 11 Advertising Costs 12 Meals Expense 13 Penalty Expense 14 Bad Debt Expense 15 Depreciation Expense 16 Casualty Insurance Expense 17 18 Totals 19 20 Book Income Before Taxes 120000 435,000 0 475,000 0 13,500 2500 475,000 120,000 13,500 5,000 850 22,000 82,500 2500 850 0 13000 26143.2 35000 108643.2 0 1,153,850 1,678,500 1,069,643 1,675,000 524,650 605357 21 22 23 24 25 26 27