Answered step by step

Verified Expert Solution

Question

1 Approved Answer

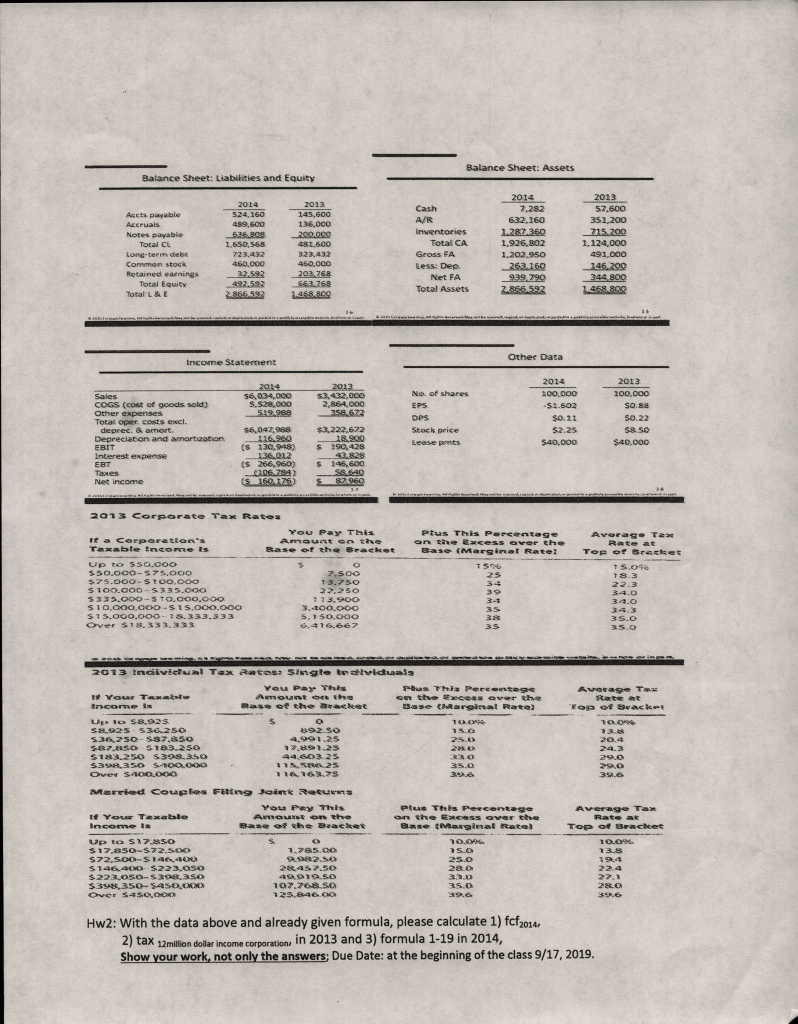

With the data above and already given formula, please calculate 1). fcf 2014 2) tax 12 million dollar income corporation in 2013 and 3). formula

With the data above and already given formula, please calculate

1). fcf 2014

2) tax 12 million dollar income corporation in 2013 and

3). formula 1-19 in 2014

Balance Sheet: Assets Balance Sheet: Liabilities and Equity 2013 Acets payable Accruals Notes payable Total CE Long-term debe Common stock Retained earnings Total Equity Total L&E 2014 5.24.250 489,600 535 909 1.650,568 723 432 460,000 32,592 492.592 2.856.592 145.600 236.000 200.000 50.600 323,232 450,000 203 268 563.268 1.498.800 Cash A/R Inventories Total CA Gross. EA Less: Dep Net FA Total Assets 2014 7.282 632,160 1.287.350 1.926,802 1.202.950 263.160 999 290 2.866.592 2013 57.600 352,200 715.200 1,124.000 491,000 146,200 344.800 1.468.800 Other Data Income Statement 2014 $6,034.000 S.528.000 519.988 2013 $3.432.000 2.864.000 358.672 2013 100.000 SO 88 Sales COGS (cost of goods sold) Other expenses Total Oper costs excl. deprec. & aliort. Depreciation and amortization EBIT Interest expense No. of shares EPS OPS Stock price Lease prints 2014 100,000 -$1.602 $0.21 $2.25 $40,000 S0.22 3.222.622 18.900 190.428 SR 50 $40,000 $ $6,042,988 126.96 ($ 130,948) 136.012 S 266.960) 02.06.294) $ 145.600 SBLAD Taxes Net income Pous This Percentage an the COSS Over the Base (Marginat Rate? Average Tan Retet TopoGrasset 2013 Corporate Tax Rates You Pay This a Corporation's Amount on the Tabte tncome is Base of the Bracket Up to 550.000 $50. 00 979,00D 2.500 $.$.DOOSTOO.000 13.750 $100.000-5335.000 22,250 S335. OO-STO,000,000 773,900 Si0,000,000-$15.000.000 3.200.000 $15.000.000 - 18.333.333 5, 50.000 Over $18.333.33 6,416,667 19.09 22.3 34.0 Average op Back 2013 individual Tax Rates Single Belviduals You Paye This phus The Percentage YOL Table Aguant the Core I S et the tracket Base Caronat Rate Up to $8.925 S.92556250 536, 250 ,850 4. 9125 25 $87.5o 5183.250 12.891. $183.250 $309,350 44. 03.25 . S35, 350 S-ODOO Over $100.OOO 306 100 20.4 24.3 290 0,0 Married couples Fering Point Reus You Pay This If You Tatable Anot a tho Income ta Plus This percentage on the ERGOss over the Base Marginal Rate) Average Tan Rate as TOP ot racket 10.0 so Up to $17.850 $17.850-$72.SONO $72. SOCS ON) S146. 5223. 00 $223.050-52083SO $398,350-$450.COM Over 550, 2.765.00 25 28457.50 49,99.5.0 102,268.SO 129. 00 100 13.8 19 22.4 22.3 3.2.02 391.6 Hw2: With the data above and already given formula, please calculate 1) fcf2014, 2) tax 12 million dollar Income corporation, in 2013 and 3) formula 1-19 in 2014, Show your work, not only the answers: Due Date: at the beginning of the class 9/17, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started