with the following information if you could please help with the question at the bottom

questions

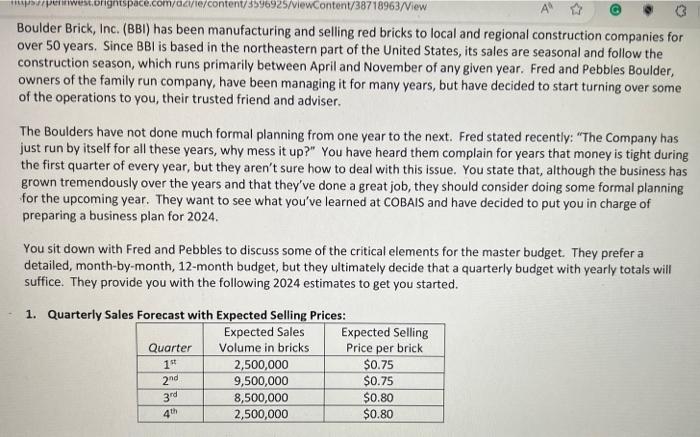

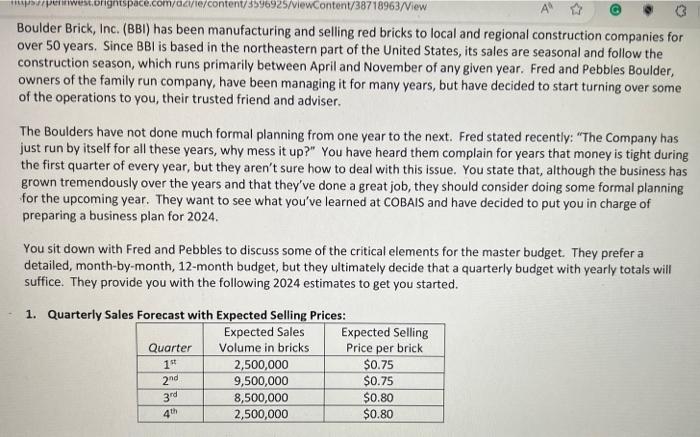

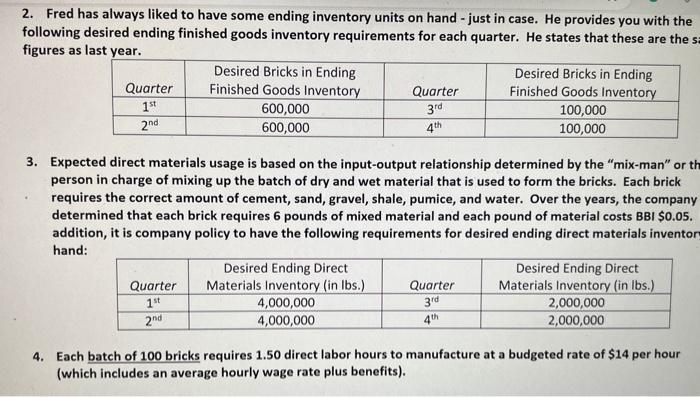

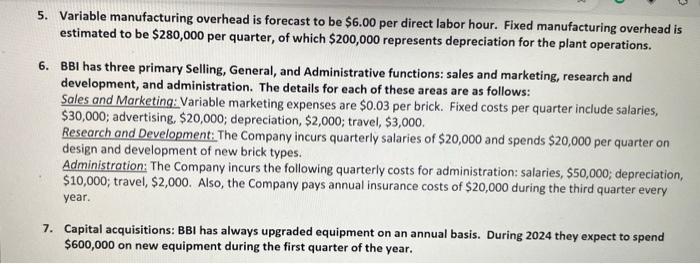

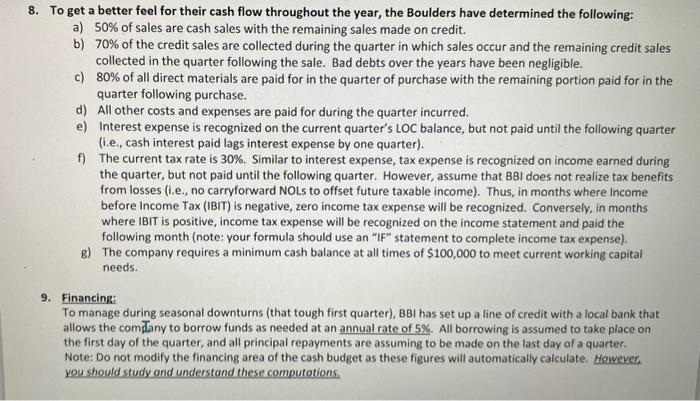

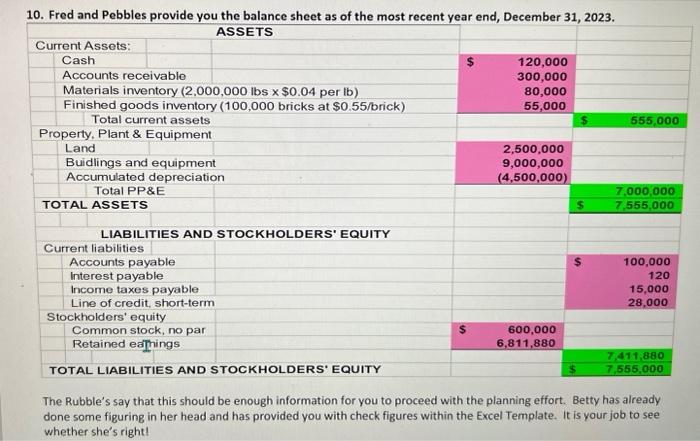

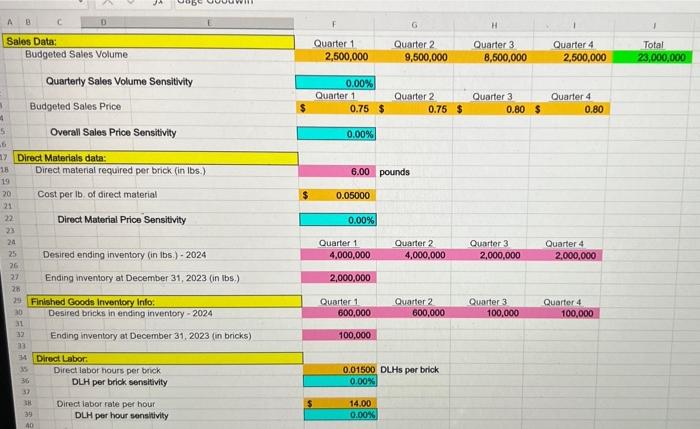

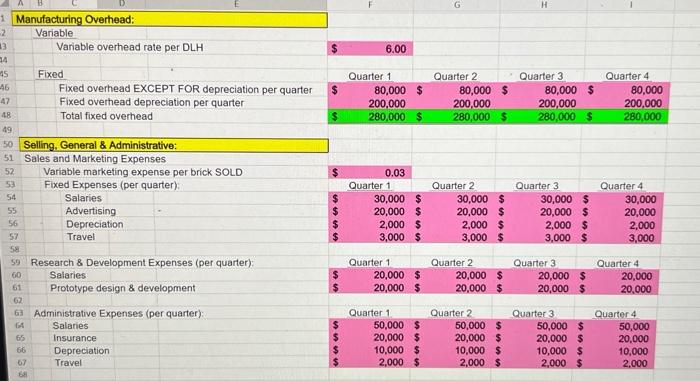

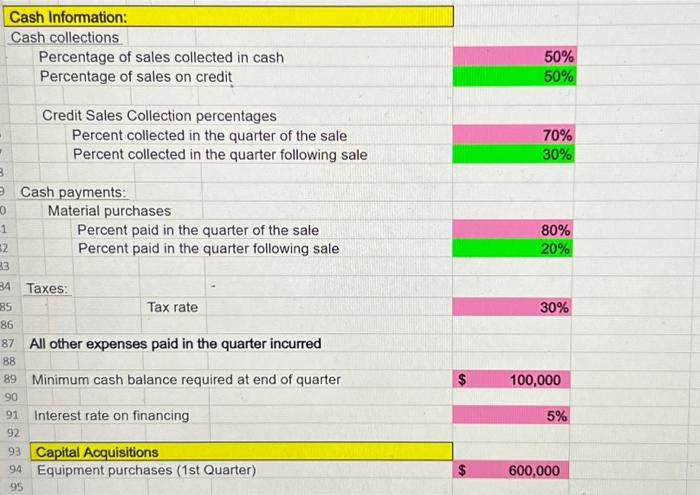

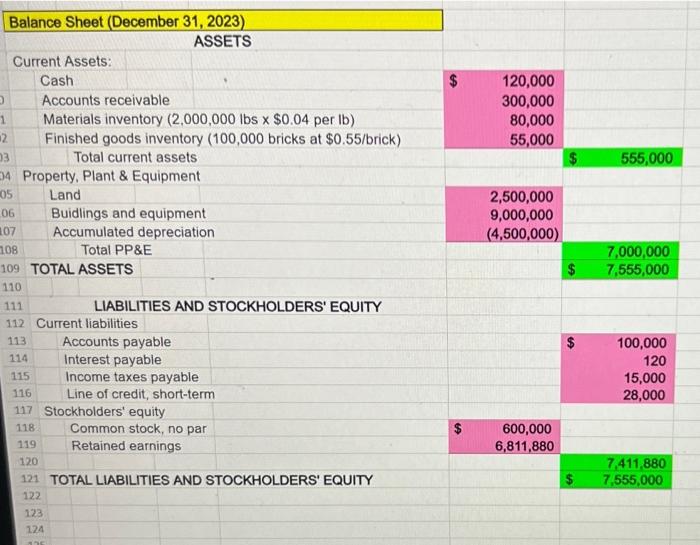

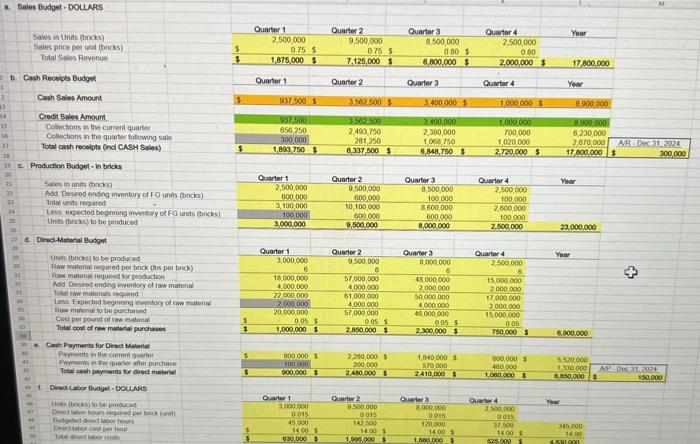

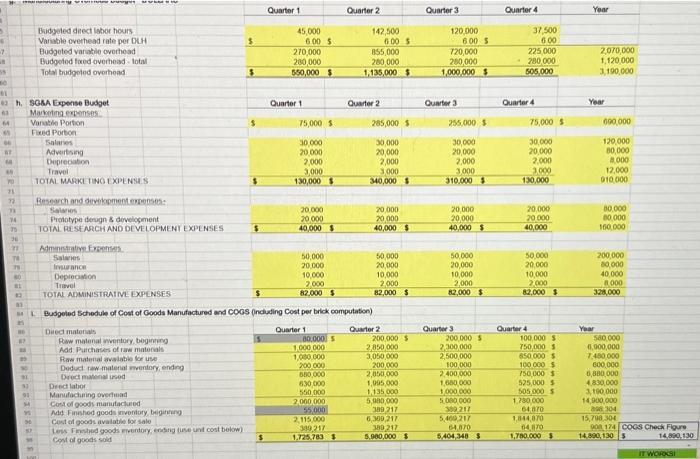

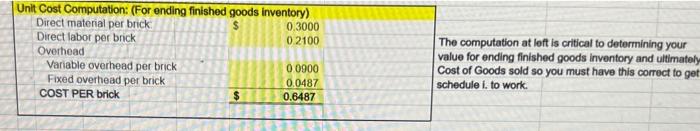

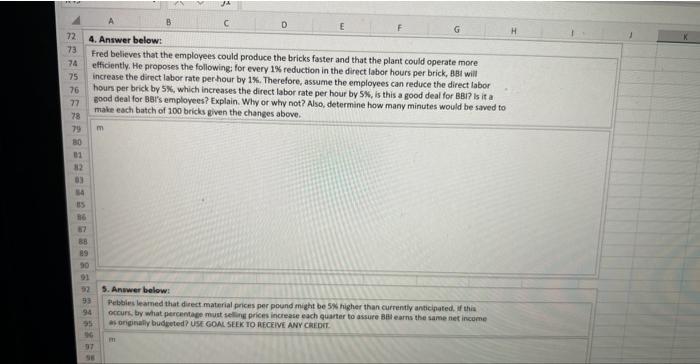

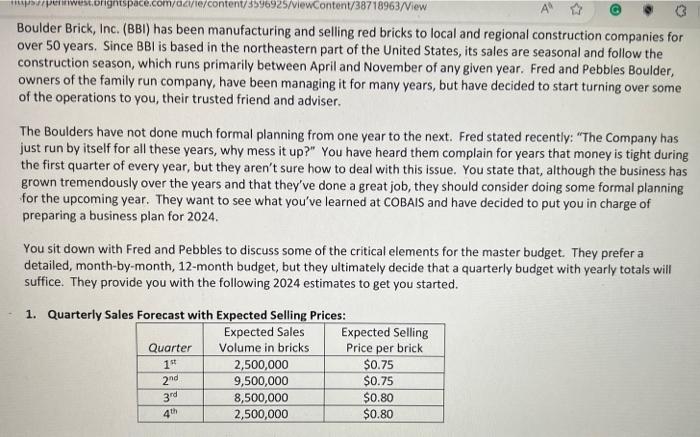

5. Variable manufacturing overhead is forecast to be $6.00 per direct labor hour. Fixed manufacturing overhead is estimated to be $280,000 per quarter, of which $200,000 represents depreciation for the plant operations. 6. BBI has three primary Selling, General, and Administrative functions: sales and marketing, research and development, and administration. The details for each of these areas are as follows: Sales and Marketing: Variable marketing expenses are $0.03 per brick. Fixed costs per quarter include salaries, $30,000; advertising, $20,000; depreciation, $2,000; travel, $3,000. Research and Development: The Company incurs quarterly salaries of $20,000 and spends $20,000 per quarter on design and development of new brick types. Administration: The Company incurs the following quarterly costs for administration: salaries, $50,000; depreciation, $10,000; travel, $2,000. Also, the Company pays annual insurance costs of $20,000 during the third quarter every year. 7. Capital acquisitions: BBI has always upgraded equipment on an annual basis. During 2024 they expect to spend $600,000 on new equipment during the first quarter of the year. 8. To get a better feel for their cash flow throughout the year, the Boulders have determined the following: a) 50% of sales are cash sales with the remaining sales made on credit. b) 70% of the credit sales are collected during the quarter in which sales occur and the remaining credit sales collected in the quarter following the sale. Bad debts over the years have been negligible. c) 80% of all direct materials are paid for in the quarter of purchase with the remaining portion paid for in the quarter following purchase. d) All other costs and expenses are paid for during the quarter incurred. e) Interest expense is recognized on the current quarter's LOC balance, but not paid until the following quarter (i.e., cash interest paid lags interest expense by one quarter). f) The current tax rate is 30%. Similar to interest expense, tax expense is recognized on income earned during the quarter, but not paid until the following quarter. However, assume that BBI does not realize tax benefits from losses (i.e., no carryforward NOLs to offset future taxable income). Thus, in months where Income before Income Tax (IBIT) is negative, zero income tax expense will be recognized. Conversely, in months where IBIT is positive, income tax expense will be recognized on the income statement and paid the following month (note: your formula should use an "IF" statement to complete income tax expense). g) The company requires a minimum cash balance at all times of $100,000 to meet current working capital needs. 9. Financins: To manage during seasonal downturns (that tough first quarter), BBI has set up a line of credit with a local bank that allows the comjany to borrow funds as needed at an annual rate of 5%. All borrowing is assumed to take place on the first day of the quarter, and all principal repayments are assuming to be made on the last day of a quarter. Note: Do not modify the financing area of the cash budget as these figures will automatically calculate. However. you should study and understand these computations. aone some riguring in ner nead and nas pruviutu you win cueck ugures wiun ule cxcer iemprate is is your job to see whether she's right! 2. Fred has always liked to have some ending inventory units on hand - just in case. He provides you with the following desired ending finished goods inventory requirements for each quarter. He states that these are the s figures as last year. 3. Expected direct materials usage is based on the input-output relationship determined by the "mix-man" or th person in charge of mixing up the batch of dry and wet material that is used to form the bricks. Each brick requires the correct amount of cement, sand, gravel, shale, pumice, and water. Over the years, the company determined that each brick requires 6 pounds of mixed material and each pound of material costs BBI $0.05. addition, it is company policy to have the following requirements for desired ending direct materials inventor hand: 4. Each batch of 100 bricks requires 1.50 direct labor hours to manufacture at a budgeted rate of $14 per hour (which includes an average hourly wage rate plus benefits). Budgoted Schedule of Cost of Goods Manufactured and Cocs (including Cost per brick computation) a. Sales Budpet-DOLUARS b. d. 4. Answer below: Fred believes that the employees could produce the bricks faster and that the plant could operate more efficiently. He proposes the following: for every 1% reduction in the direct labor hours per brick, BBit will increase the direct labor rate per hour by 1%. Therefore, assume the employees can reduce the direct labor hours per brick by 5%, which increases the direct labor rate per hour by 5%, is this a good deal for BBi? is it a sood deal for Bar's employees? Explain. Why or why not? Also, determine how many minutes would be saved to make each batch of 100 bricks given the changes above. 5. Anwwer below: Febbles leamed that direct material prices per pound might be 5s higher than currently anticipated, if this occurs, by what percentage must sellire prices inciease euch quanter to assure BBi earns the same net incume Boulder Brick, Inc. (BBI) has been manufacturing and selling red bricks to local and regional construction companies for over 50 years. Since BBI is based in the northeastern part of the United States, its sales are seasonal and follow the construction season, which runs primarily between April and November of any given year. Fred and Pebbles Boulder, owners of the family run company, have been managing it for many years, but have decided to start turning over some of the operations to you, their trusted friend and adviser. The Boulders have not done much formal planning from one year to the next. Fred stated recently: "The Company has just run by itself for all these years, why mess it up?" You have heard them complain for years that money is tight during the first quarter of every year, but they aren't sure how to deal with this issue. You state that, although the business has grown tremendously over the years and that they've done a great job, they should consider doing some formal planning for the upcoming year. They want to see what you've learned at COBAIS and have decided to put you in charge of preparing a business plan for 2024 . You sit down with Fred and Pebbles to discuss some of the critical elements for the master budget. They prefer a detailed, month-by-month, 12-month budget, but they ultimately decide that a quarterly budget with yearly totals will suffice. They provide you with the following 2024 estimates to get you started. 1. Quarterly Sales Forecast with Expected Selling Prices