Answered step by step

Verified Expert Solution

Question

1 Approved Answer

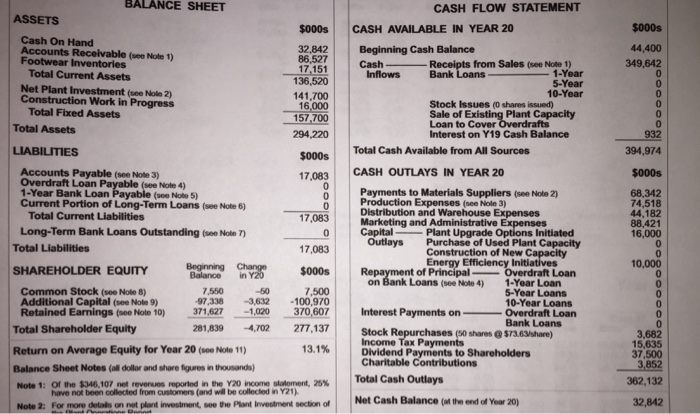

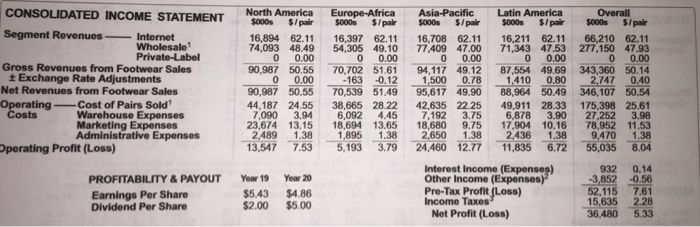

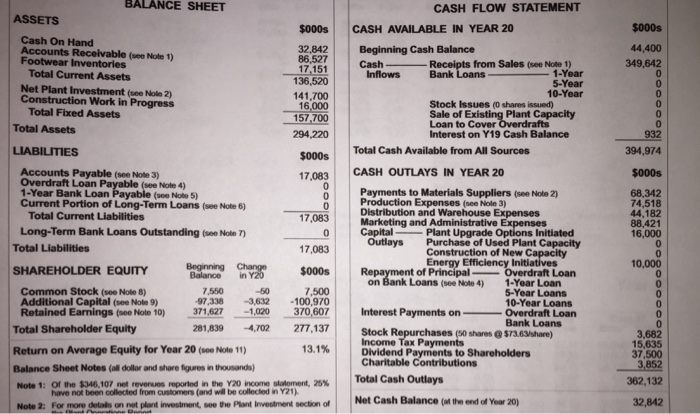

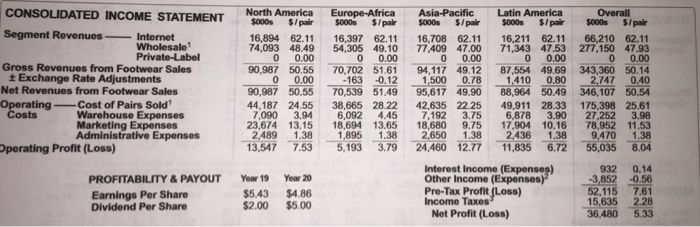

With the information provided what are the ratios? 1- Return on shareholders Equity? 2- Debt /EBITDA? BALANCE SHEET CASH FLOW STATEMENT $000s CASH AVAILABLE IN

With the information provided what are the ratios?

BALANCE SHEET CASH FLOW STATEMENT $000s CASH AVAILABLE IN YEAR 20 Cash On Hand Accounts Receivable (see Note 1) 32.842 Beginning Cash Balance 44,400 Cash Receipts from Sales (see Nole 1) Net Plant Investment (see Nole 2) Construction Work in Progress 136,520 141.700 157,700 Stock Issues (0 shares issued) Sale of Existing Plant Capacity Loan to Cover Interest on Y19 Cash Balance Total Assets Total Cash Available from All Sources 394,974 $000s 17,083 CASH OUTLAYS IN YEAR 20 Accounts Payable (see Note 3) Overdraft Loan Payable (see Note 4) Payments to Materials Suppliers (see Note 2) Production Expenses (see Nole 3) Distribution and Warehouse Expenses 68,342 74,518 44.182 Current Portion of Long-Term Loans (see Note 6) Total Current Liabilities Long-Term Bank Loans Outstanding (see Note T) 17,083 Capital Plant Upgrade Options Initiated Purchase of Used Plant Capacity 16,000 Outlays Total Liabilities 17,083 ficlen SHAREHOLDER EQUITY Anong nan? $000s Rena ment of Principal Overdraft Loan Loans (see Note 4) Common Stock (see Nole 8) Additional Capital (see Note 9) Retained Earnings (see Note 10) 97,338-3,632 100,970 371,6271,020370,607 1-Year Loan 5-Year Loans 10-Year Loans Interest Payments on-Overdraft Loan Total Shareholder Equity 281,839 2 277,37 Stock 15,635 Return on Average Equity for Year 20 (see Nole 11) 13.1%| | DivorneTax Pa Dividend Payments to Shareholders Balance Sheet Notes (all dollor and share figures in thousands) Note 1: or the S346.107 net revers?mportodn the Y20 roorne stakmert, 25% Total Cash Outlays 362,132 have not been collected from customers (and will be collected in Y21) Net Cash Balance (at the end of Year 20) Note 2: For more detals on not plant investment, see the Pant Iement section of 1- Return on shareholders Equity?

2- Debt /EBITDA?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started