Answered step by step

Verified Expert Solution

Question

1 Approved Answer

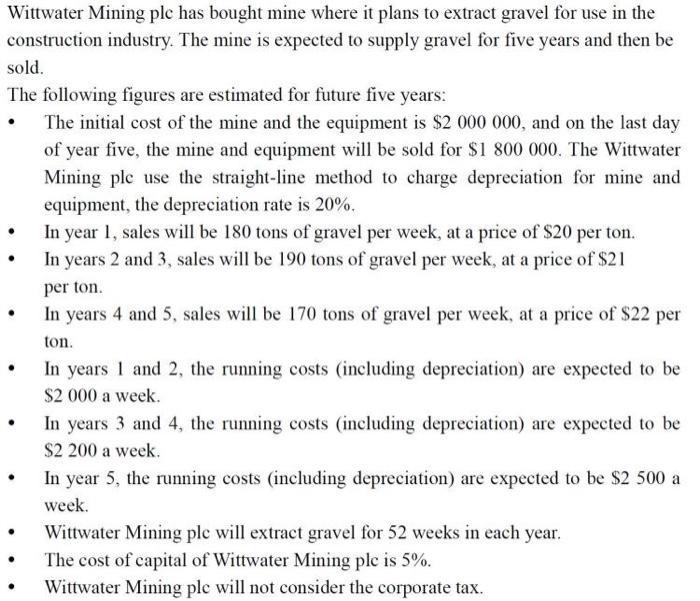

Wittwater Mining ple has bought mine where it plans to extract gravel for use in the construction industry. The mine is expected to supply

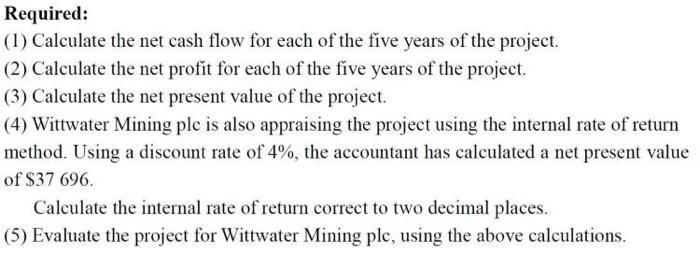

Wittwater Mining ple has bought mine where it plans to extract gravel for use in the construction industry. The mine is expected to supply gravel for five years and then be sold. The following figures are estimated for future five years: . The initial cost of the mine and the equipment is $2 000 000, and on the last day of year five, the mine and equipment will be sold for $1 800 000. The Wittwater Mining ple use the straight-line method to charge depreciation for mine and equipment, the depreciation rate is 20%. In year 1, sales will be 180 tons of gravel per week, at a price of $20 per ton. In years 2 and 3, sales will be 190 tons of gravel per week, at a price of $21 per ton. In years 4 and 5, sales will be 170 tons of gravel per week, at a price of $22 per ton. In years 1 and 2, the running costs (including depreciation) are expected to be $2 000 a week. In years 3 and 4, the running costs (including depreciation) are expected to be $2 200 a week. In year 5, the running costs (including depreciation) are expected to be $2 500 a week. Wittwater Mining ple will extract gravel for 52 weeks in each year. The cost of capital of Wittwater Mining plc is 5%. Wittwater Mining ple will not consider the corporate tax. Required: (1) Calculate the net cash flow for each of the five years of the project. (2) Calculate the net profit for each of the five years of the project. (3) Calculate the net present value of the project. (4) Wittwater Mining ple is also appraising the project using the internal rate of return method. Using a discount rate of 4%, the accountant has calculated a net present value of $37 696. Calculate the internal rate of return correct to two decimal places. (5) Evaluate the project for Wittwater Mining plc, using the above calculations.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Net Cash Flow for Year 1 Re venue 180 x 20 36 00 Less Operating Cost 2 000 Dep reciation 2 000 000 x 20 400 000 52 weeks 7 692 Net Cash Flow 36 00 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started