Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wodonga Off-road manufactures 4wd nudge bars. As part of the production process, the Steel Fabrication Department supplies steel to the Assembly Department. The Assembly

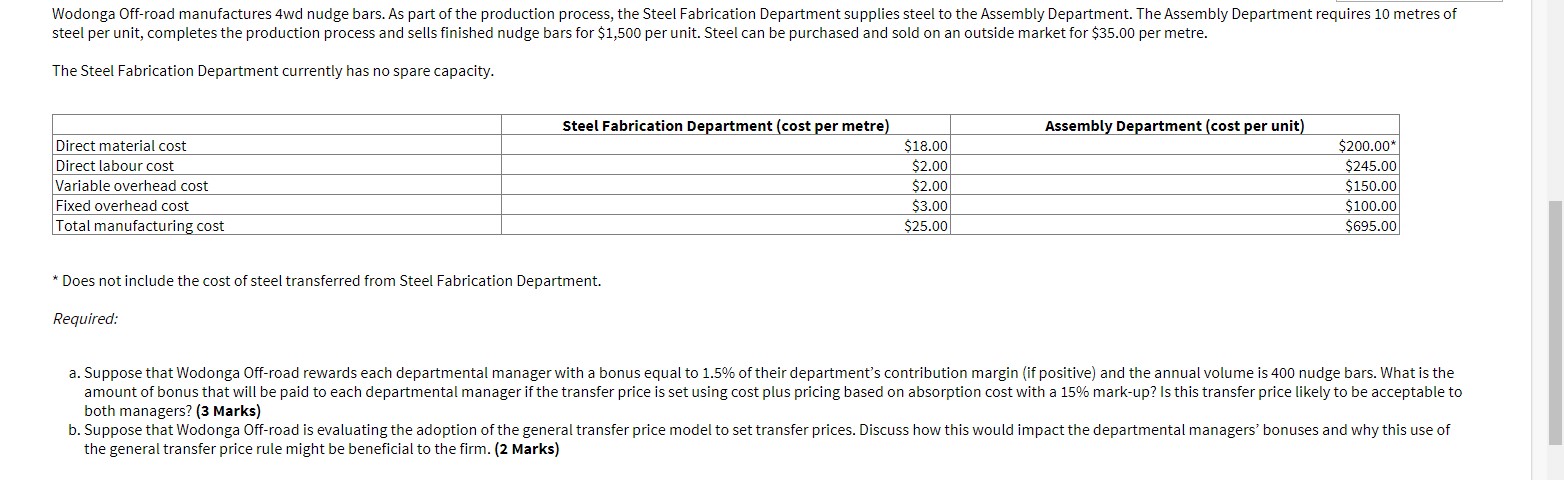

Wodonga Off-road manufactures 4wd nudge bars. As part of the production process, the Steel Fabrication Department supplies steel to the Assembly Department. The Assembly Department requires 10 metres of steel per unit, completes the production process and sells finished nudge bars for $1,500 per unit. Steel can be purchased and sold on an outside market for $35.00 per metre. The Steel Fabrication Department currently has no spare capacity. Direct material cost Direct labour cost Variable overhead cost Fixed overhead cost Total manufacturing cost Steel Fabrication Department (cost per metre) Assembly Department (cost per unit) $18.00 $2.00 $200.00* $245.00 $2.00 $150.00 $3.00 $25.00 $100.00 $695.00 * Does not include the cost of steel transferred from Steel Fabrication Department. Required: a. Suppose that Wodonga Off-road rewards each departmental manager with a bonus equal to 1.5% of their department's contribution margin (if positive) and the annual volume is 400 nudge bars. What is the amount of bonus that will be paid to each departmental manager if the transfer price is set using cost plus pricing based on absorption cost with a 15% mark-up? Is this transfer price likely to be acceptable to both managers? (3 Marks) b. Suppose that Wodonga Off-road is evaluating the adoption of the general transfer price model to set transfer prices. Discuss how this would impact the departmental managers' bonuses and why this use of the general transfer price rule might be beneficial to the firm. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculating the departmental bonuses under costplus pricing Steel Fabrication Department Transfer price per metre 1800 1800 015 2070 Total transfer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started