Answered step by step

Verified Expert Solution

Question

1 Approved Answer

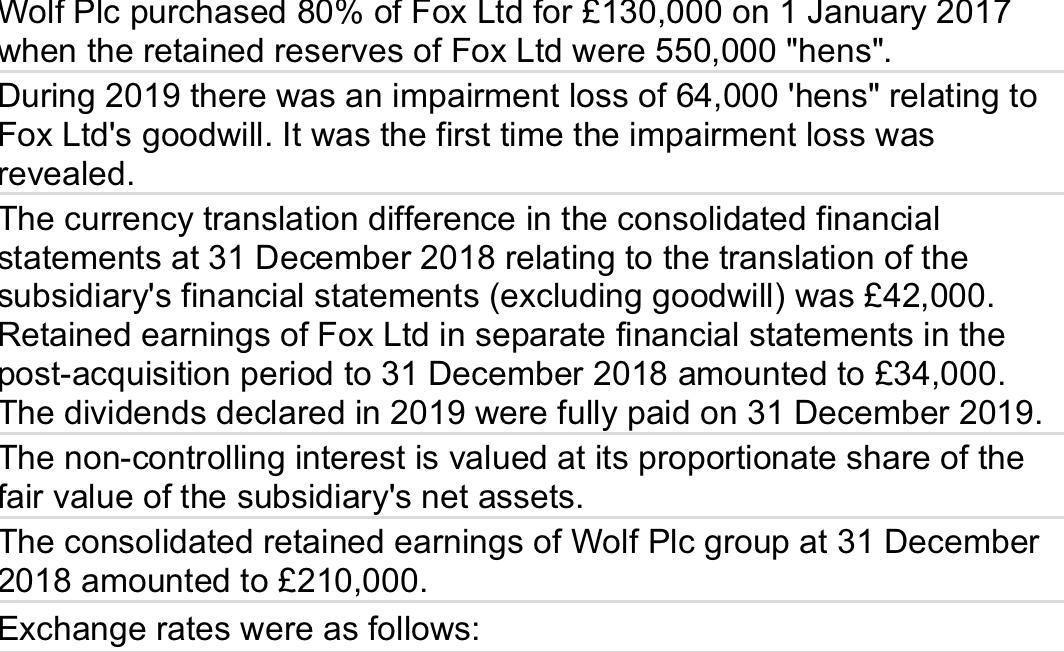

Wolf Plc purchased 80% of Fox Ltd for 130,000 on 1 January 2017 when the retained reserves of Fox Ltd were 550,000 hens. During

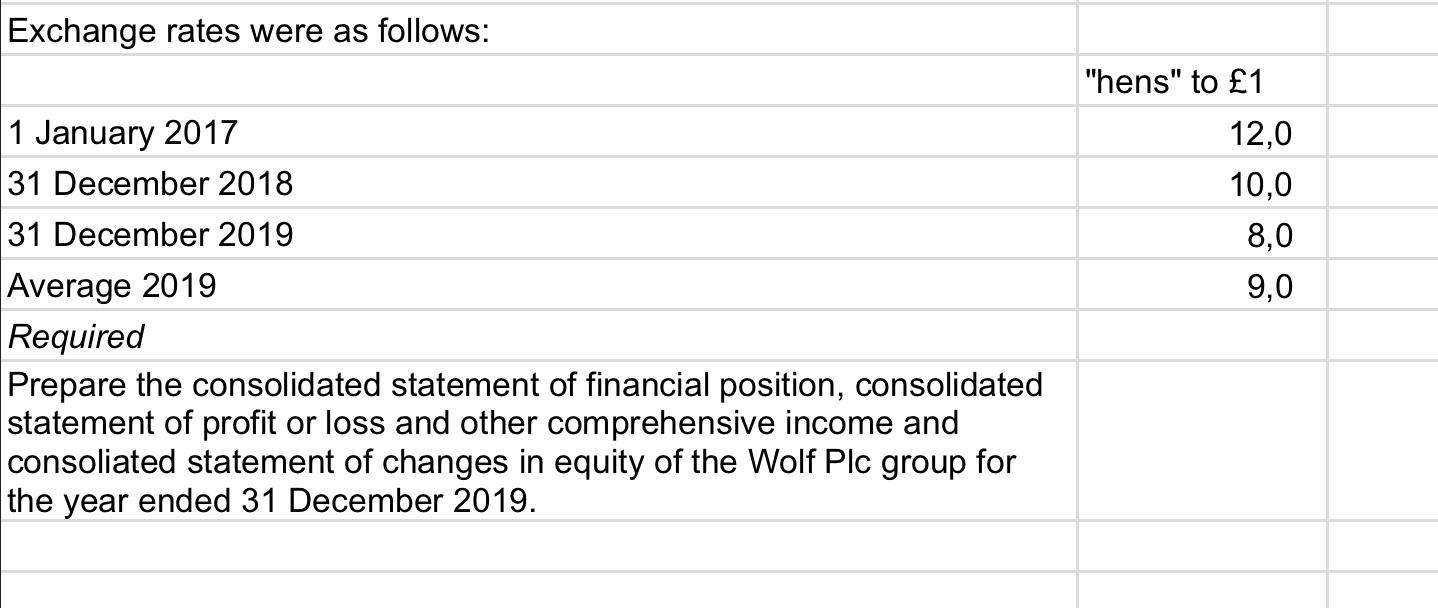

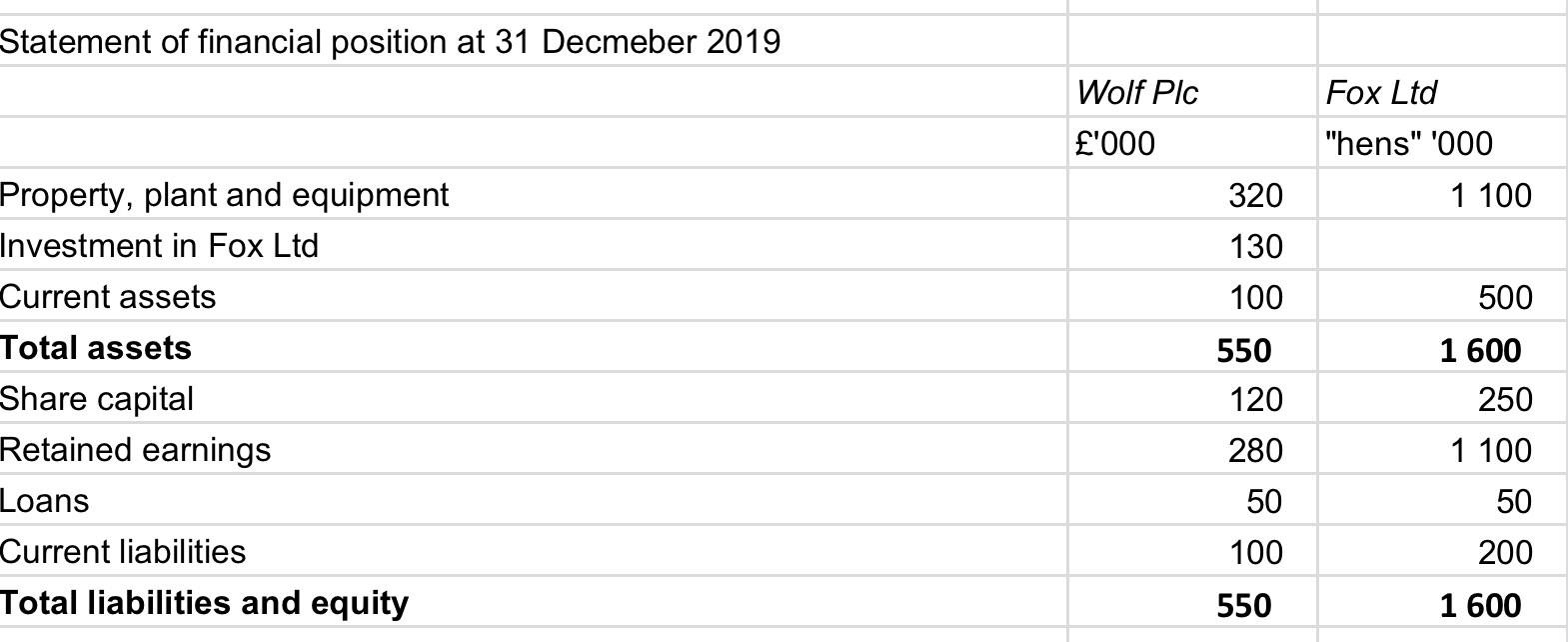

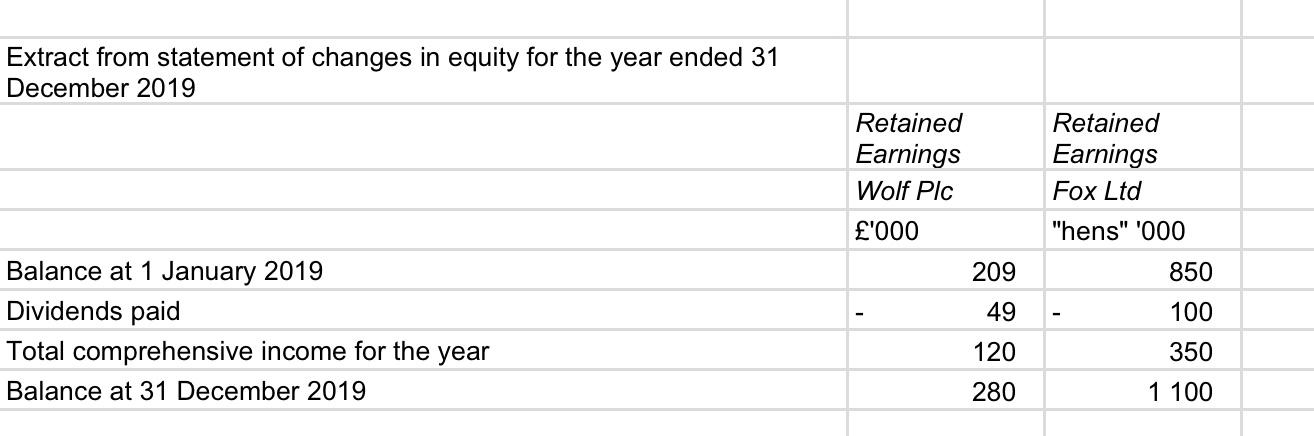

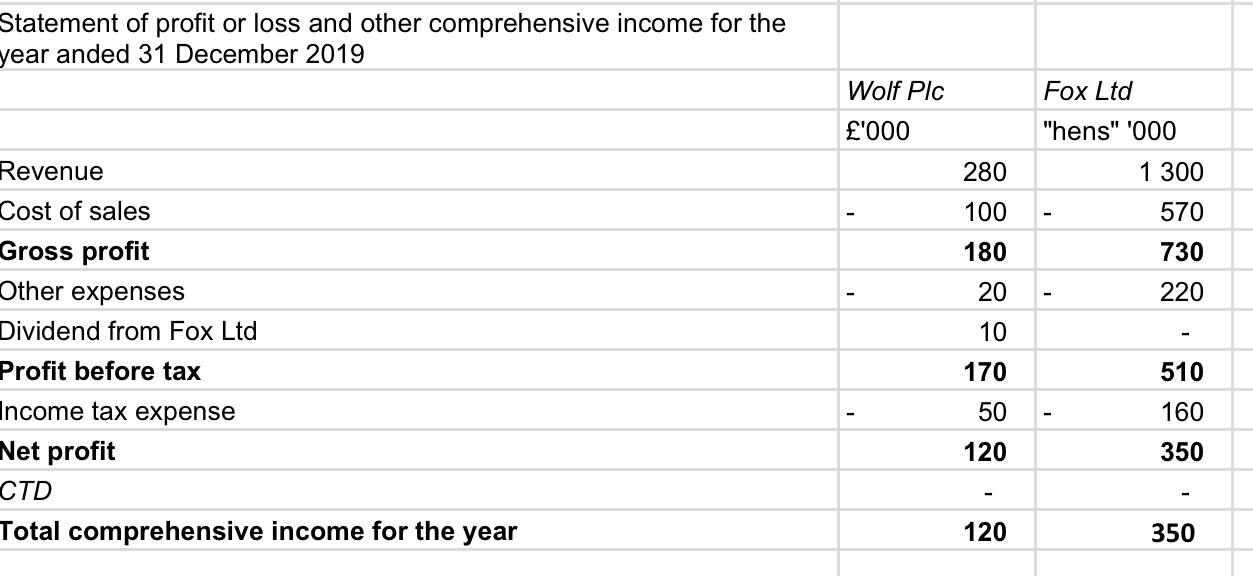

Wolf Plc purchased 80% of Fox Ltd for 130,000 on 1 January 2017 when the retained reserves of Fox Ltd were 550,000 "hens". During 2019 there was an impairment loss of 64,000 'hens" relating to Fox Ltd's goodwill. It was the first time the impairment loss was revealed. The currency translation difference in the consolidated financial statements at 31 December 2018 relating to the translation of the subsidiary's financial statements (excluding goodwill) was 42,000. Retained earnings of Fox Ltd in separate financial statements in the post-acquisition period to 31 December 2018 amounted to 34,000. The dividends declared in 2019 were fully paid on 31 December 2019. The non-controlling interest is valued at its proportionate share of the fair value of the subsidiary's net assets. The consolidated retained earnings of Wolf Plc group at 31 December 2018 amounted to 210,000. Exchange rates were as follows: Exchange rates were as follows: "hens" to 1 1 January 2017 31 December 2018 12,0 10,0 31 December 2019 8,0 Average 2019 Required Prepare the consolidated statement of financial position, consolidated statement of profit or loss and other comprehensive income and consoliated statement of changes in equity of the Wolf Plc group for the year ended 31 December 2019. 9,0 Statement of financial position at 31 Decmeber 2019 Wolf Plc Fox Ltd '000 "hens" '000 Property, plant and equipment 320 1 100 Investment in Fox Ltd 130 Current assets 100 500 Total assets 550 1 600 Share capital 120 250 Retained earnings 280 1 100 Loans 50 50 Current liabilities 100 200 Total liabilities and equity 550 1 600 Extract from statement of changes in equity for the year ended 31 December 2019 Retained Retained Earnings Earnings Fox Ltd Wolf Plc '000 "hens" '000 Balance at 1 January 2019 209 850 Dividends paid 49 100 Total comprehensive income for the year 120 350 Balance at 31 December 2019 280 1 100 Statement of profit or loss and other comprehensive income for the year anded 31 December 2019 Wolf Plc Fox Ltd '000 "hens" '000 Revenue 280 1 300 Cost of sales 100 570 Gross profit 180 730 Other expenses 20 220 Dividend from Fox Ltd 10 Profit before tax 170 510 Income tax expense 50 160 Net profit 120 350 CTD Total comprehensive income for the year 120 350

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Statement of Consolidated Profit and Loss for the year ended 31 December 2019 Income Expenses Wolf Plc Euro Fox Ltd Hens Fox Ltd Euro fx rate a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started