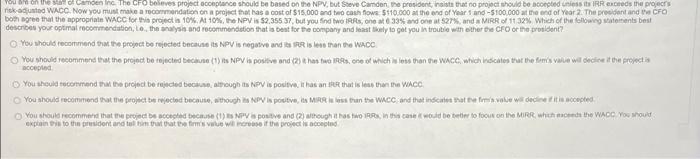

womentos Camden In The CFO beleves project contare should be based on the NPV, but Steve Camden the presidents that no project should be compless IRR exceeds the projects nekaunted WACO Now you must make a recommendation on project that has a cost of $15,000 and to cash flows $110.000 at the end of Year 1 ano -5100.000 at the end of Year 2. The procent and CFO both agree that the appropriate WACC for this project in 10% 10%, the NPV is $2,355 37, but you find two Rs, one at 33% and one at $27% and MIRR/11 32% Which of the following statements best describe your optimal recommendation, to the ways and recommendation that is best for the company and fast icely to get you in trouble with other the CFO or the procent? You should recommend the project be rejected because its NPV is negative and it is less than the WACO You should recommend that the project be tejected because (1) is NPV in positive and (2) has tud 1988, one of which is less than the wace, which indicates that the fom's valen wir decise it the project is You should recommend the project berjedted becas, oughts NPV is positive. It has an enthat is less than the WACC You should recommend that the project bejected because, though a PV in positive, I MIRE than the WACC and that internet e voe we dadine iti scompte You should recommend that the project be copied because (1) Vis positive and (2) though it has two, In this would be better to foot on IN MIRR which the WACC You would pinto the president and to imate is the project is accepted womentos Camden In The CFO beleves project contare should be based on the NPV, but Steve Camden the presidents that no project should be compless IRR exceeds the projects nekaunted WACO Now you must make a recommendation on project that has a cost of $15,000 and to cash flows $110.000 at the end of Year 1 ano -5100.000 at the end of Year 2. The procent and CFO both agree that the appropriate WACC for this project in 10% 10%, the NPV is $2,355 37, but you find two Rs, one at 33% and one at $27% and MIRR/11 32% Which of the following statements best describe your optimal recommendation, to the ways and recommendation that is best for the company and fast icely to get you in trouble with other the CFO or the procent? You should recommend the project be rejected because its NPV is negative and it is less than the WACO You should recommend that the project be tejected because (1) is NPV in positive and (2) has tud 1988, one of which is less than the wace, which indicates that the fom's valen wir decise it the project is You should recommend the project berjedted becas, oughts NPV is positive. It has an enthat is less than the WACC You should recommend that the project bejected because, though a PV in positive, I MIRE than the WACC and that internet e voe we dadine iti scompte You should recommend that the project be copied because (1) Vis positive and (2) though it has two, In this would be better to foot on IN MIRR which the WACC You would pinto the president and to imate is the project is accepted