Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wondering if someone could please explain how the final JE is found? Along with common stock, APIC, and RE on the balance sheet? Thanks! (The

Wondering if someone could please explain how the final JE is found? Along with common stock, APIC, and RE on the balance sheet? Thanks! (The answers are given in blue)

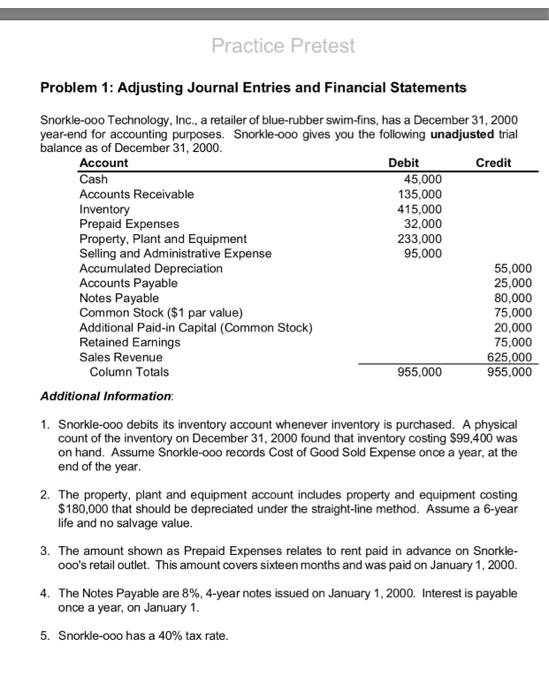

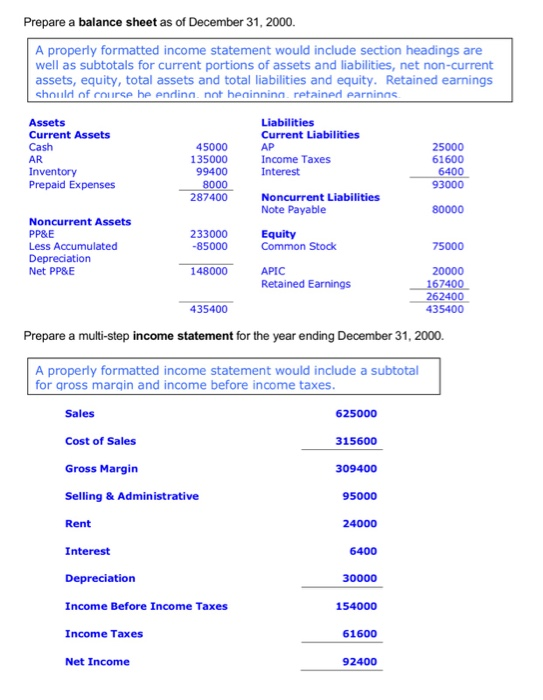

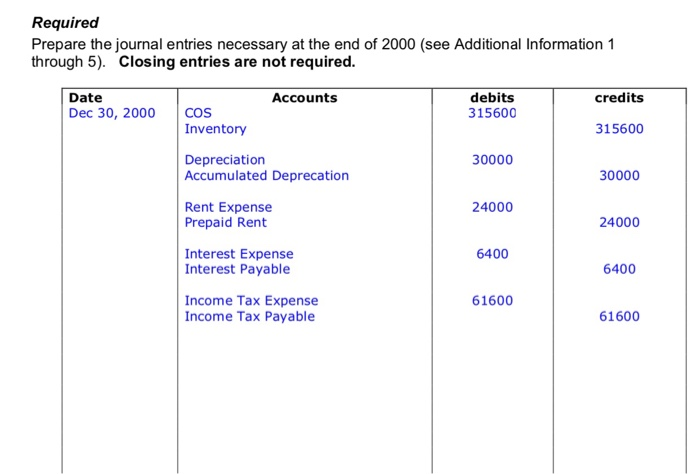

Practice Pretest Problem 1: Adjusting Journal Entries and Financial Statements Snorkle-ooo Technology, Inc., a retailer of blue-rubber swim-fins, has a December 31, 2000 year-end for accounting purposes. Snorkle-ooo gives you the following unadjusted trial balance as of December 31, 2000. Account Debit Credit Cash 45,000 Accounts Receivable 135,000 Inventory 415,000 Prepaid Expenses 32,000 Property, Plant and Equipment 233,000 Selling and Administrative Expense 95,000 Accumulated Depreciation 55,000 Accounts Payable 25,000 Notes Payable 80,000 Common Stock ($1 par value) 75,000 Additional Paid-in Capital (Common Stock) 20,000 Retained Earnings 75,000 Sales Revenue 625,000 Column Totals 955,000 955,000 Additional Information: 1. Snorkle-ooo debits its inventory account whenever inventory is purchased. A physical count of the inventory on December 31, 2000 found that inventory costing $99,400 was on hand. Assume Snorkle-ooo records Cost of Good Sold Expense once a year, at the end of the year. 2. The property, plant and equipment account includes property and equipment costing $180,000 that should be depreciated under the straight-line method. Assume a 6-year life and no salvage value. 3. The amount shown as Prepaid Expenses relates to rent paid in advance on Snorkle- ooo's retail outlet. This amount covers sixteen months and was paid on January 1, 2000. 4. The Notes Payable are 8%, 4-year notes issued on January 1, 2000. Interest is payable once a year, on January 1. 5. Snorkle-ooo has a 40% tax rate. Prepare a balance sheet as of December 31, 2000. A properly formatted income statement would include section headings are well as subtotals for current portions of assets and liabilities, net non-current assets, equity, total assets and total liabilities and equity. Retained earnings should of course he ending not heainning retained earnings Assets Current Assets Cash Liabilities Current Liabilities AP Income Taxes Interest AR 45000 135000 99400 8000 287400 Inventory Prepaid Expenses 25000 61600 6400 93000 Noncurrent Liabilities Note Payable 80000 233000 Noncurrent Assets PPSE Less Accumulated Depreciation Net PP&E -85000 Equity Common Stock 75000 148000 APIC Retained Earnings 20000 167400 262400 435400 435400 Prepare a multi-step income statement for the year ending December 31, 2000, A properly formatted income statement would include a subtotal for gross margin and income before income taxes. Sales 625000 Cost of Sales 315600 Gross Margin 309400 Selling & Administrative 95000 Rent 24000 Interest 6400 Depreciation 30000 Income Before Income Taxes 154000 Income Taxes 61600 Net Income 92400 Required Prepare the journal entries necessary at the end of 2000 (see Additional Information 1 through 5). Closing entries are not required. Date Dec 30, 2000 Accounts debits 315600 credits COS Inventory 315600 30000 Depreciation Accumulated Deprecation 30000 24000 Rent Expense Prepaid Rent 24000 6400 Interest Expense Interest Payable 6400 61600 Income Tax Expense Income Tax Payable 61600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started