Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Woodland plc, which is based in Singapore, owns Ubin Island which is located off the coast of Singapore. On Ubin Island, Woodland plc operates

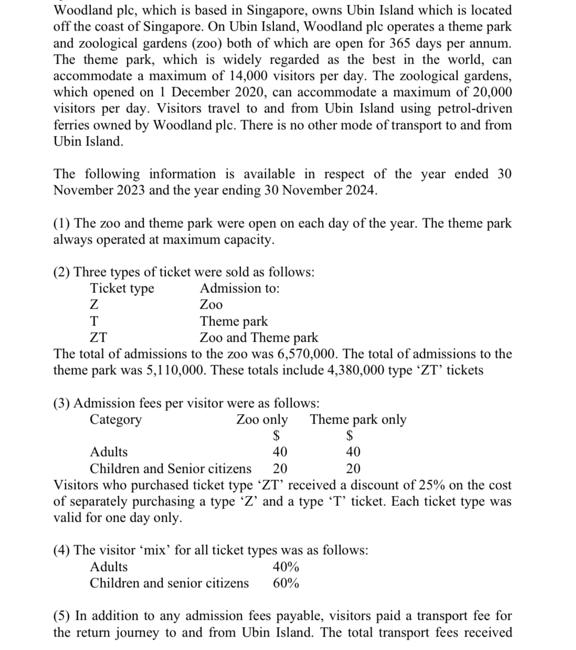

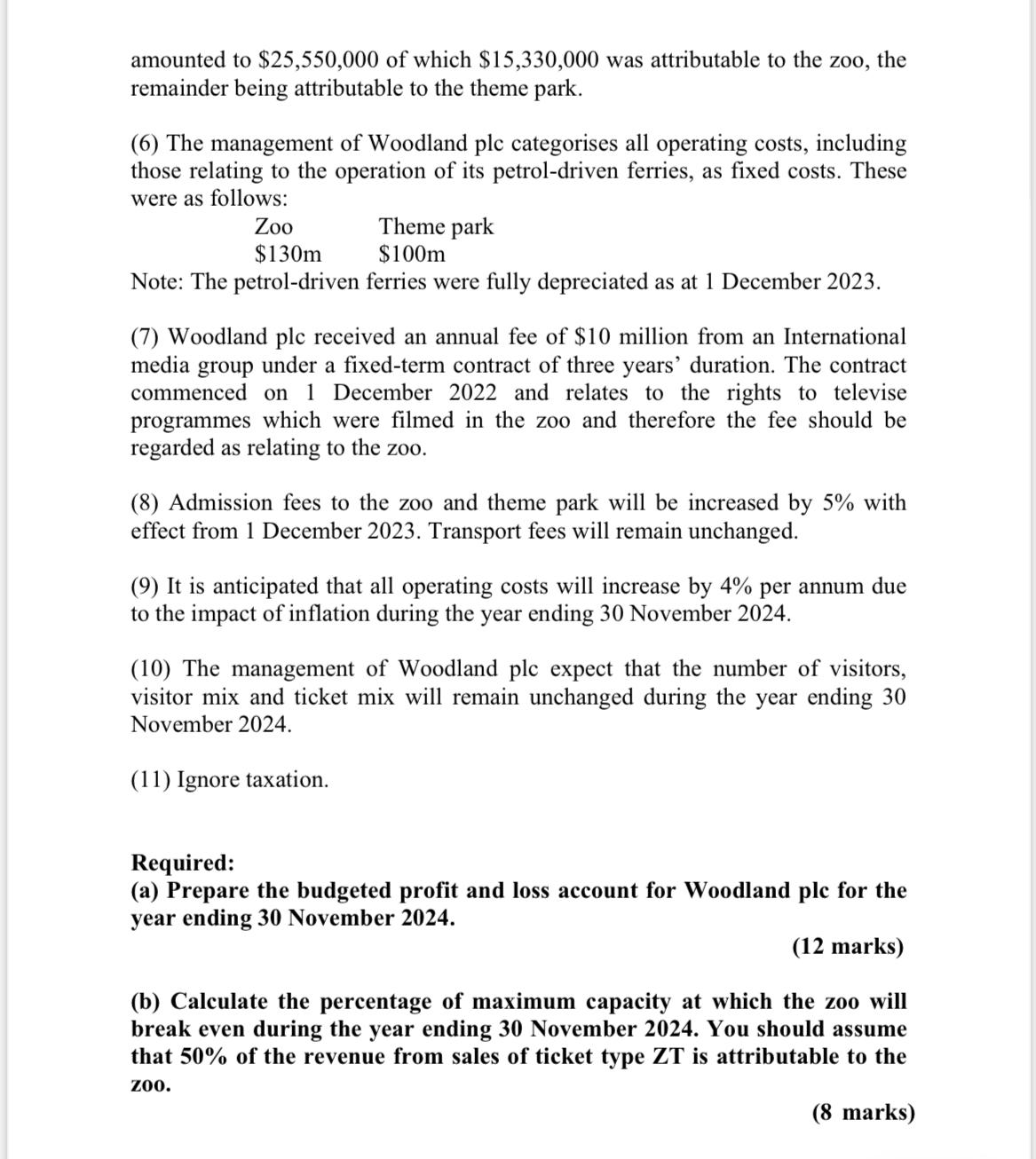

Woodland plc, which is based in Singapore, owns Ubin Island which is located off the coast of Singapore. On Ubin Island, Woodland plc operates a theme park and zoological gardens (zoo) both of which are open for 365 days per annum. The theme park, which is widely regarded as the best in the world, can accommodate a maximum of 14,000 visitors per day. The zoological gardens, which opened on 1 December 2020, can accommodate a maximum of 20,000 visitors per day. Visitors travel to and from Ubin Island using petrol-driven ferries owned by Woodland ple. There is no other mode of transport to and from Ubin Island. The following information is available in respect of the year ended 30 November 2023 and the year ending 30 November 2024. (1) The zoo and theme park were open on each day of the year. The theme park always operated at maximum capacity. (2) Three types of ticket were sold as follows: Admission to: Ticket type Z Zoo T Theme park ZT Zoo and Theme park The total of admissions to the zoo was 6,570,000. The total of admissions to the theme park was 5,110,000. These totals include 4,380,000 type ZT' tickets (3) Admission fees per visitor were as follows: Category Zoo only Theme park only $ 40 $ 40 20 Adults Children and Senior citizens 20 Visitors who purchased ticket type 'ZT' received a discount of 25% on the cost of separately purchasing a type 'Z' and a type 'T' ticket. Each ticket type was valid for one day only. (4) The visitor 'mix' for all ticket types was as follows: Adults 40% Children and senior citizens 60% (5) In addition to any admission fees payable, visitors paid a transport fee for the return journey to and from Ubin Island. The total transport fees received amounted to $25,550,000 of which $15,330,000 was attributable to the zoo, the remainder being attributable to the theme park. (6) The management of Woodland plc categorises all operating costs, including those relating to the operation of its petrol-driven ferries, as fixed costs. These were as follows: Theme park $100m Zoo $130m Note: The petrol-driven ferries were fully depreciated as at 1 December 2023. (7) Woodland plc received an annual fee of $10 million from an International media group under a fixed-term contract of three years' duration. The contract commenced on 1 December 2022 and relates to the rights to televise programmes which were filmed in the zoo and therefore the fee should be regarded as relating to the zoo. (8) Admission fees to the zoo and theme park will be increased by 5% with effect from 1 December 2023. Transport fees will remain unchanged. (9) It is anticipated that all operating costs will increase by 4% per annum due to the impact of inflation during the year ending 30 November 2024. (10) The management of Woodland plc expect that the number of visitors, visitor mix and ticket mix will remain unchanged during the year ending 30 November 2024. (11) Ignore taxation. Required: (a) Prepare the budgeted profit and loss account for Woodland plc for the year ending 30 November 2024. (12 marks) (b) Calculate the percentage of maximum capacity at which the zoo will break even during the year ending 30 November 2024. You should assume that 50% of the revenue from sales of ticket type ZT is attributable to the ZOO. (8 marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Budgeted Profit and Loss Account for Woodland plc for the year ending 30 November 2024 Desc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started