Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Woollyworm, Incorporated, is one of the world's largest manufacturers of construction, mining, and forestry machinery. The following disclosure note is included in the company's 2

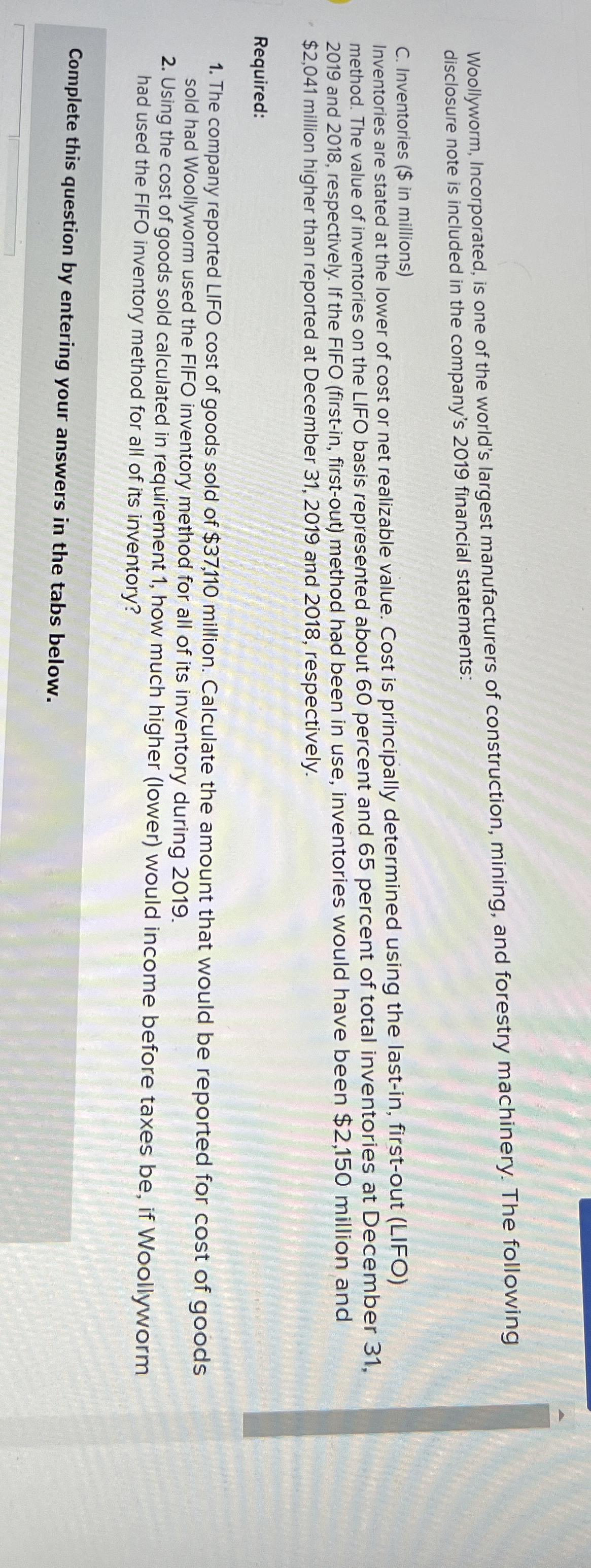

Woollyworm, Incorporated, is one of the world's largest manufacturers of construction, mining, and forestry machinery. The following disclosure note is included in the company's financial statements:

C Inventories $ in millions

Inventories are stated at the lower of cost or net realizable value. Cost is principally determined using the lastin firstout LIFO method. The value of inventories on the LIFO basis represented about percent and percent of total inventories at December and respectively. If the FIFO firstin firstout method had been in use, inventories would have been $ million and $ million higher than reported at December and respectively.

Required:

The company reported LIFO cost of goods sold of $ million. Calculate the amount that would be reported for cost of goods sold had Woollyworm used the FIFO inventory method for all of its inventory during

Using the cost of goods sold calculated in requirement how much higher lower would income before taxes be if Woollyworm had used the FIFO inventory method for all of its inventory?

Complete this question by entering your answers in the tabs below.Woollyworm, Incorporated, is one of the world's largest manufacturers of construction, mining, and forestry machinery. The following disclosure note is included in the company's financial statements:

C Inventories $ in millions

Inventories are stated at the lower of cost or net realizable value. Cost is principally determined using the lastin firstout LIFO method. The value of inventories on the LIFO basis represented about percent and percent of total inventories at December and respectively. If the FIFO firstin firstout method had been in use, inventories would have been $ million and $ million higher than reported at December and respectively.

Required:

The company reported LIFO cost of goods sold of $ million. Calculate the amount that would be reported for cost of goods sold had Woollyworm used the FIFO inventory method for all of its inventory during

Using the cost of goods sold calculated in requirement how much higher lower would income before taxes be if Woollyworm had used the FIFO inventory method for all of its inventory?

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started