Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wooster Tool Co. is a supplier that assembles purchased parts into components for three distinct Type of components-Components A, Components B, and Components C.

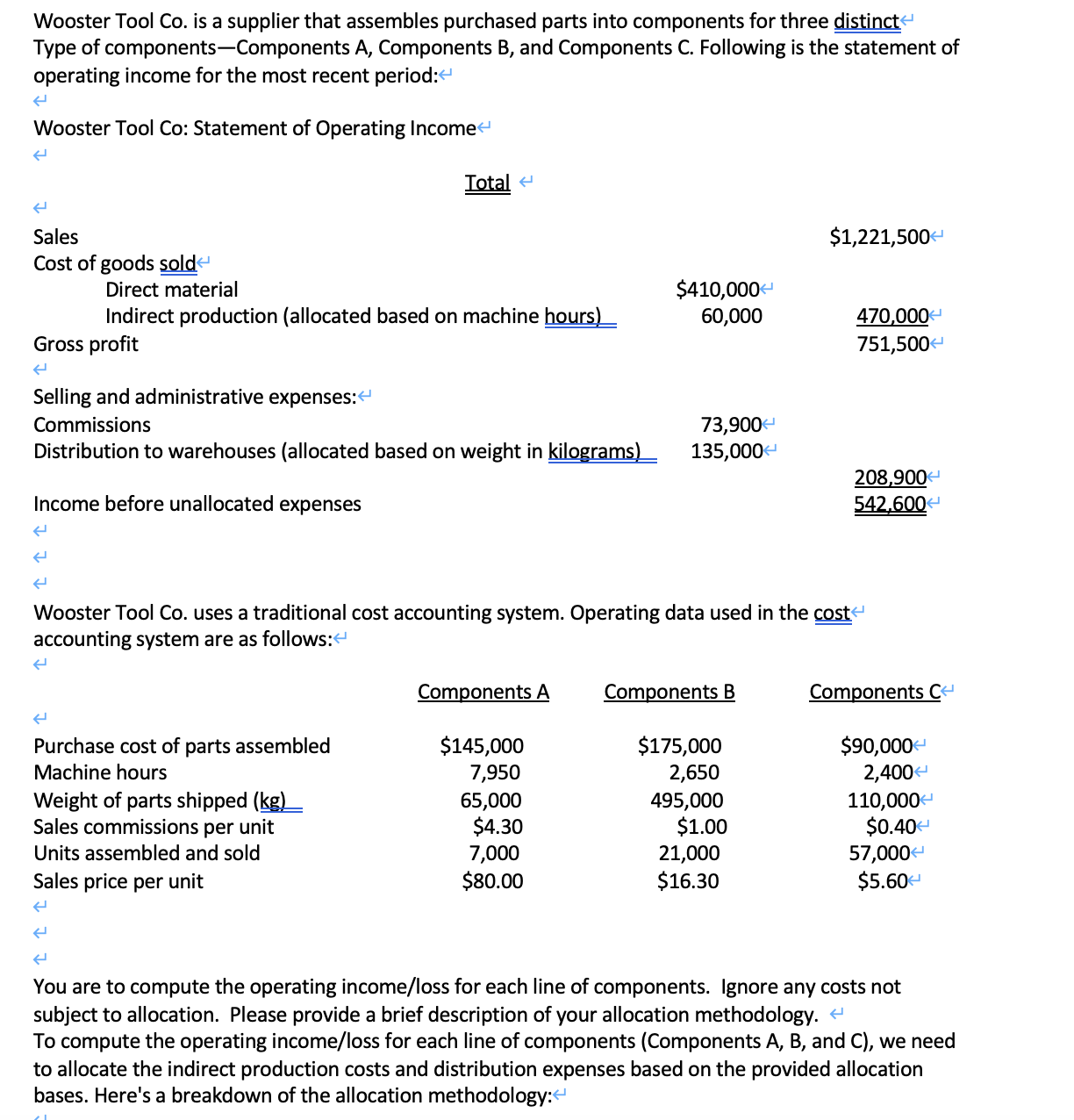

Wooster Tool Co. is a supplier that assembles purchased parts into components for three distinct Type of components-Components A, Components B, and Components C. Following is the statement of operating income for the most recent period: < Wooster Tool Co: Statement of Operating Income H e Sales Cost of goods sold Gross profit H Selling and administrative expenses: < Commissions Distribution to warehouses (allocated based on weight in kilograms) Income before unallocated expenses H ( Direct material Indirect production (allocated based on machine hours) ( Total e Purchase cost of parts assembled Machine hours Wooster Tool Co. uses a traditional cost accounting system. Operating data used in the cost accounting system are as follows: < $410,000+ 60,000 Components A $145,000 7,950 65,000 $4.30 7,000 $80.00 73,900* 135,000* Components B $175,000 2,650 495,000 $1.00 $1,221,500 21,000 $16.30 470,000 < 751,500 208,900 542.600 Components C $90,000 2,400 < 110,000+ $0.40 57,000+ $5.60 Weight of parts shipped (kg)_ Sales commissions per unit Units assembled and sold Sales price per unit ( H ( You are to compute the operating income/loss for each line of components. Ignore any costs not subject to allocation. Please provide a brief description of your allocation methodology. < To compute the operating income/loss for each line of components (Components A, B, and C), we need to allocate the indirect production costs and distribution expenses based on the provided allocation bases. Here's a breakdown of the allocation methodology:

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To allocate the indirect production costs and distribution expenses we will use the allocation bases provided in the operating data 1 Indirect Production Costs Allocation The indirect productio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started