Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Words:0 QUESTIONS Mutaraz Limited's cost of equity is 21.97%. The company has 14 million shares in issue with a market value of $10 per share,

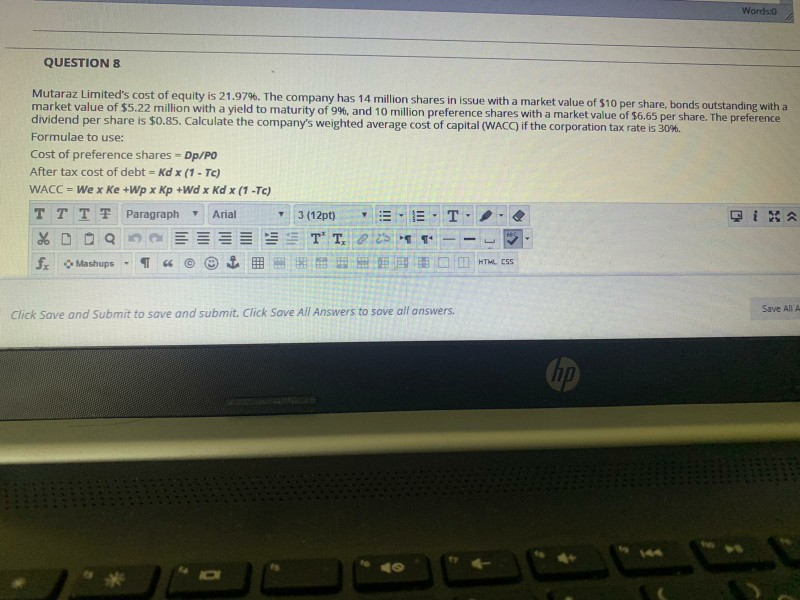

Words:0 QUESTIONS Mutaraz Limited's cost of equity is 21.97%. The company has 14 million shares in issue with a market value of $10 per share, bonds outstanding with a market value of $5.22 million with a yield to maturity of 9%, and 10 million preference shares with a market value of $6.65 per share. The preference dividend per share is $0.85. Calculate the company's weighted average cost of capital (WACC) if the corporation tax rate is 30%. Formulae to use: Cost of preference shares - Dp/PO After tax cost of debt - Kd x (1 - TC) WACC = We x Ke +Wp x Kp +Wd x Kd x (1 -TC) TT TT Paragraph Arial 3 (12pt) T % DO T T25 fx Mashups 66 @ MINI HTML CS5 Save All A Click Save and Submit to save and submit. Click Save All Answers to sove all answers. ho

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started