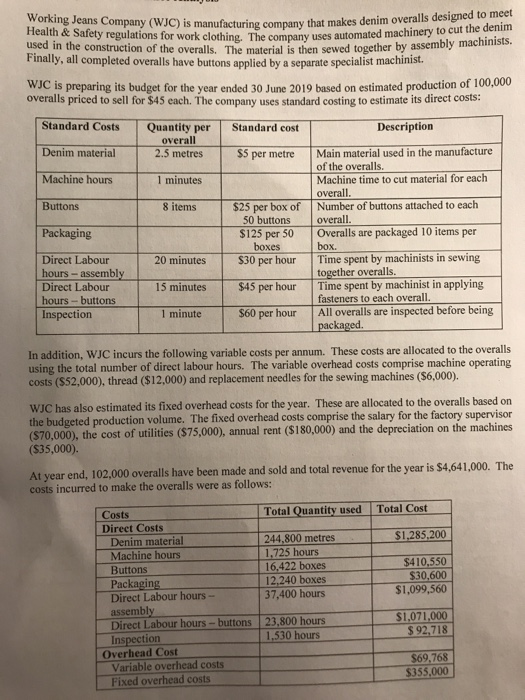

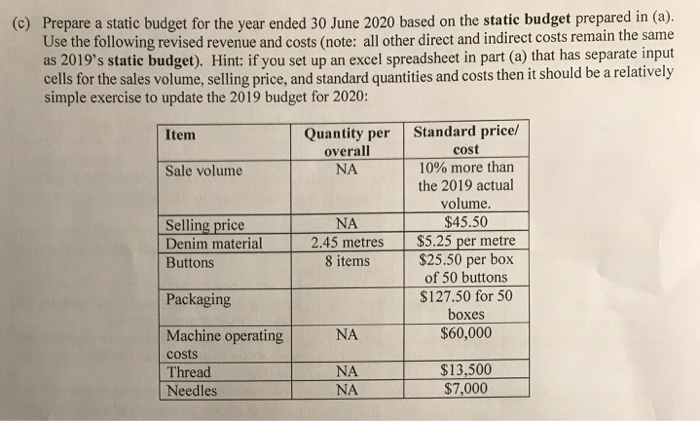

Working Jeans Company (WJC) is manufacturing company that makes denim overalls designed to meet Health & Safety regulations for work clothing. The company uses automated machinery to cut the denim used in the construction of the overalls. The material is then sewed together by assembly machinists. Finally, all completed overalls have buttons applied by a separate specialist machinist. WJC is preparing its budget for the year ended 30 June 2019 based on estimated production of 100,000 overalls priced to sell for $45 each. The company uses standard costing to estimate its direct costs: Description Standard Costs Quantity per overall Standard cost Main material used in the manufacture Denim material 2.5 metres $5 per metre of the overalls. Machine hours 1 minutes Machine time to cut material for each overall. 8 items Number of buttons attached to each overall. Overalls are Buttons $25 per box of 50 buttons Packaging packaged 10 items per $125 per 50 boxes box. Direct Labour hours- assembly Direct Labour Time spent by machinists in sewing together overalls. Time spent by machinist in applying fasteners to each overall. All overalls are inspected before being packaged. 20 minutes $30 per hour $45 per hour 15 minutes hours-buttons Inspection 1 minute $60 per hour In addition, WJC incurs the following variable costs per annum. These costs are allocated to the overalls using the total number of direct labour hours. The variable overhead costs comprise machine operating costs ($52,000), thread ($12,000) and replacement needles for the sewing machines ($6,000). WJC has also estimated its fixed overhead costs for the year. These are allocated to the overalls based on the budgeted production volume. The fixed overhead costs comprise the salary for the factory supervisor ($70,000), the cost of utilities ($75,000), annual rent ($180,000) and the depreciation on the machines ($35,000). At year end, 102,000 overalls have been made and sold and total revenue for the year is $4,641,000. The costs incurred to make the overalls were as follows: Total Cost Total Quantity used Costs Direct Costs Denim material Machine hours $1,285,200 244,800 metres 1,725 hours 16,422 boxes 12,240 boxes 37,400 hours $410,550 $30,600 $1,099,560 Buttons Packaging Direct Labour hours- assembly Direct Labour hours- buttons Inspection Overhead Cost Variable overhead costs Fixed overhead costs $1,071,000 $ 92,718 23,800 hours 1,530 hours $69,768 $355,000 (a) Using the data provided, prepare the static budget, the flexed budget, and the actual results for the year ended 30 June 2019. Calculate the static budget variances, sales-volume variances and flexed budget variances (variances should be calculated for each line item). Identify all variables as (c) Prepare a static budget for the year ended 30 June 2020 based on the static budget prepared in (a) Use the following revised revenue and costs (note: all other direct and indirect costs remain the same as 2019's static budget). Hint: if you set up an excel spreadsheet in part (a) that has separate input cells for the sales volume, selling price, and standard quantities and costs then it should be a relatively simple exercise to update the 2019 budget for 2020: Standard price/ cost 10% more than the 2019 actual volume Quantity per overall NA Item Sale volume Selling price Denim material $45.50 NA $5.25 per metre $25.50 per box of 50 buttons $127.50 for 50 boxes $60,000 2.45 metres 8 items Buttons Packaging Machine operating NA costs $13,500 $7,000 NA Thread Needles NA (a) Using the data provided, prepare the static budget, the flexed budget, and the actual results for the year ended 30 June 2019. Calculate the static budget variances, sales-volume variances and flexed budget variances (variances should be calculated for each line item). Identify all variables as F(avourable) or U(nfavourable). Hint: set up an Excel spreadsheet that has separate input cells for the sales volume, selling price, and standard quantities and costs (b) Calculate all level 3 variances and identify each variance as F(avourable) or U(nfavourable). Reconcile these amounts to the level 2 and level 1 variances calculated in part (a). (c) Prepare a static budget for the year ended 30 June 2020 based on the static budget prepared in (a). Use the following revised revenue and costs (note: all other direct and indirect costs remain the same as 2019's static budget). Hint: if you set up an excel spreadsheet in part (a) that has separate input cells for the sales volume, selling price, and standard quantities and costs then it should be a relatively simple exercise to update the 2019 budget for 2020: Standard price/ Quantity per overall Item cost Sale volume NA 10% more than the 2019 actual volume. Selling price Denim material $45.50 $5.25 per metre $25.50 per box of 50 buttons $127.50 for 50 boxes $60,000 NA 2.45 metres Buttons 8 items Packaging Machine operating NA costs NA $13,500 Thread Needles NA $7.000