Answered step by step

Verified Expert Solution

Question

1 Approved Answer

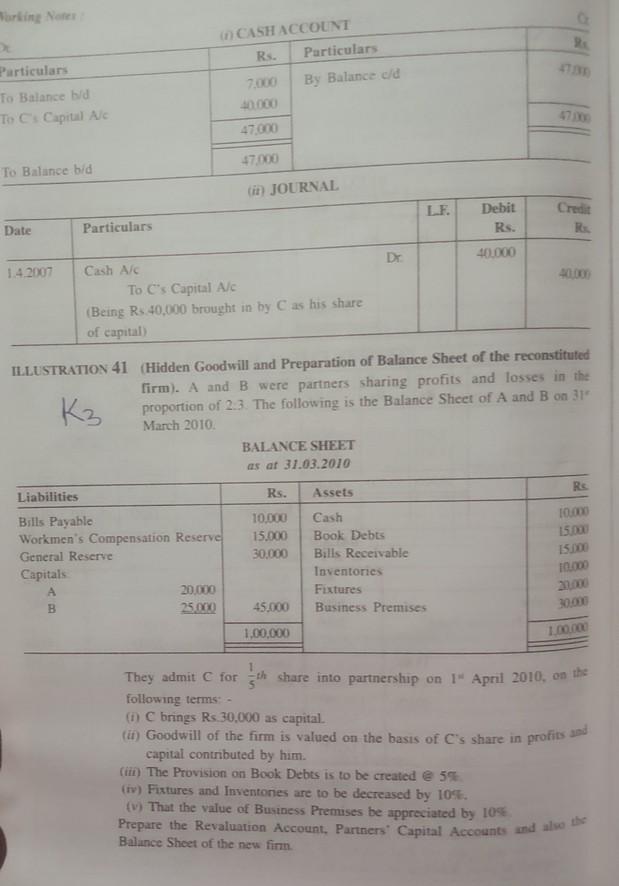

Working Notes Particulars To Balance bid To Capital Ac in CASH ACCOUNT Rs. Particulars 7.000 By Balance old anno 47.000 47.000 To Balance bid (i)

Working Notes Particulars To Balance bid To Capital Ac in CASH ACCOUNT Rs. Particulars 7.000 By Balance old anno 47.000 47.000 To Balance bid (i) JOURNAL LF. Credit Debit Rs. Date Particulars Dr 40.000 1.4.2007 Cash A/C To C's Capital A/C (Being Rs 40.000 brought in by C as his share of capital) ILLUSTRATION 41 (Hidden Goodwill and Preparation of Balance Sheet of the reconstituted firm). A and B were partners sharing profits and losses in the K3 proportion of 2.3. The following is the Balance Sheet of A and B on 31 March 2010 BALANCE SHEET as at 31.03.2010 Liabilities Rs. Assets Re 10.000 10,000 15.000 30,000 Bills Payable Workmen's Compensation Reserve General Reserve Capitals 20.000 B 25.000 Cash Book Debts Bills Receivable Inventories Fixtures Business Premises 15.000 15.000 10.000 20.000 3001 45.000 1,00,000 1.60.000 They admit C for the share into partnership on 1 April 2010, on the following terms (1) C brings Rs 30,000 as capital. ti) Goodwill of the firm is valued on the basis of C's share in profits and capital contributed by him. (i) The Provision on Book Debts is to be created @ 5 (iv) Fixtures and Inventories are to be decreased by 10%. () That the value of Business Premises be appreciated by 10% Prepare the Revaluation Account Partners Capital Accounts and also the Balance Sheet of the new fin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started