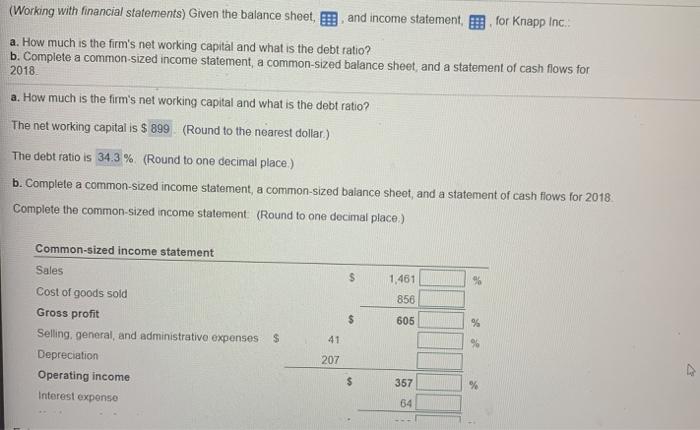

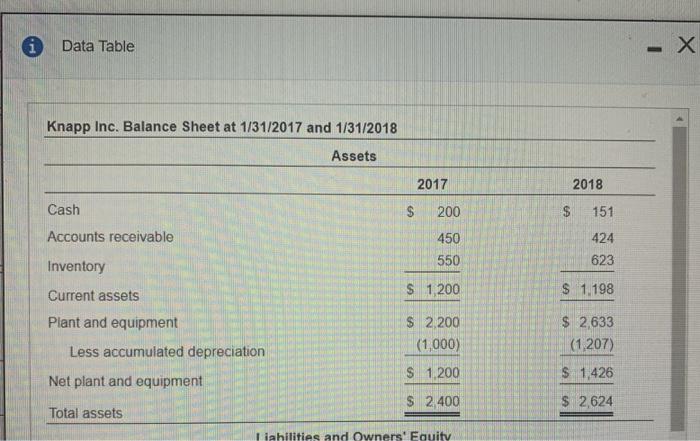

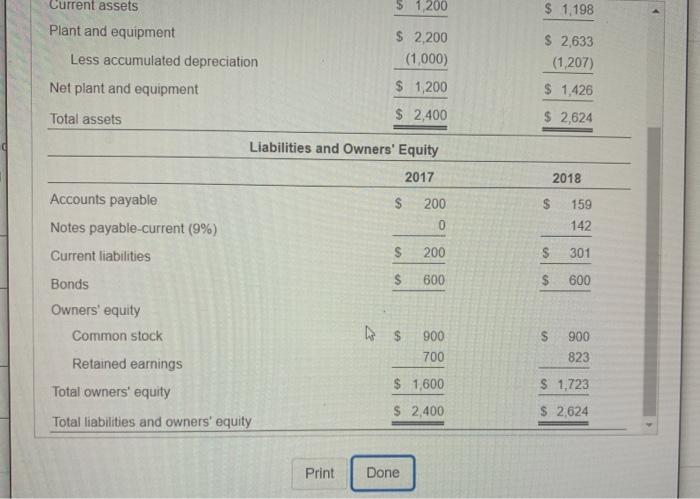

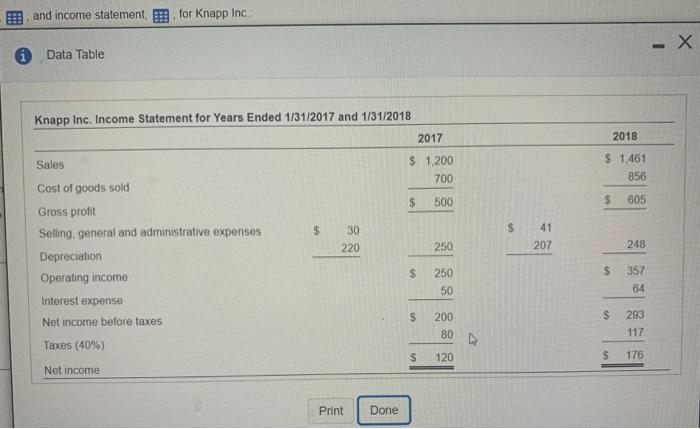

(Working with financial statements) Given the balance sheet, and income statement for Knapp Inc. a. How much is the firm's net working capital and what is the debt ratio? b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 2018 a. How much is the firm's net working capital and what is the debt ratio? The net working capital is $ 899 (Round to the nearest dollar) The debt ratio is 34.3 % (Round to one decimal place) b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 2018 Complete the common-sized income statement (Round to one decimal place) Common-sized income statement $ 1,461 26 856 Sales Cost of goods sold Gross profit Selling, general, and administrative expenses Depreciation Operating income $ 605 % $ 41 % 207 $ 357 % Interest expense 64 * Data Table Knapp Inc. Balance Sheet at 1/31/2017 and 1/31/2018 Assets 2017 2018 Cash $ 200 $ 151 Accounts receivable 450 550 424 623 Inventory Current assets $ 1.200 $ 1.198 Plant and equipment $ 2200 (1,000) $ 2,633 (1 207) Less accumulated depreciation $ 1.200 $ 1,426 Net plant and equipment $ 2.400 $ 2,624 Total assets Liabilities and Owners' Equity Current assets $ 1.200 $ 1,198 Plant and equipment Less accumulated depreciation Net plant and equipment $ 2,200 (1,000) $ 1,200 $ 2,633 (1,207) $ 1,426 Total assets $ 2,400 $ 2,624 Liabilities and Owners' Equity 2017 2018 S 200 $ Accounts payable Notes payable-current (9%) Current liabilities 159 142 0 $ 200 $ 301 $ 600 $ 600 Bonds Owners' equity Common stock S 900 700 900 823 Retained earnings Total owners' equity $ 1,600 $ 1,723 $ 2,400 $ 2,624 Total liabilities and owners' equity Print Done E and income statement for Knapp Inc -X Data Table 2018 $ 1.461 856 Knapp Inc. Income Statement for Years Ended 1/31/2017 and 1/31/2018 2017 Sales $ 1,200 700 Cost of goods sold $ 500 Gross profit Selling, general and administrative expenses $ 30 220 250 Depreciation Operating income S 250 S 605 $ s 41 207 248 $ 357 64 50 Interest expense S S Net income before taxes 200 80 293 117 Taxes (40%) D. $ 120 $ 176 Net income Print Done