Worldwide Incorporated bought a machine for $75,000 cash . The estimated useful life was five years and the estimated residual value was $9,000. Assume that the estimated useful life in productive units is 162,000. Units actually produced were 43,200 in year 1 and 48,600 in year 2

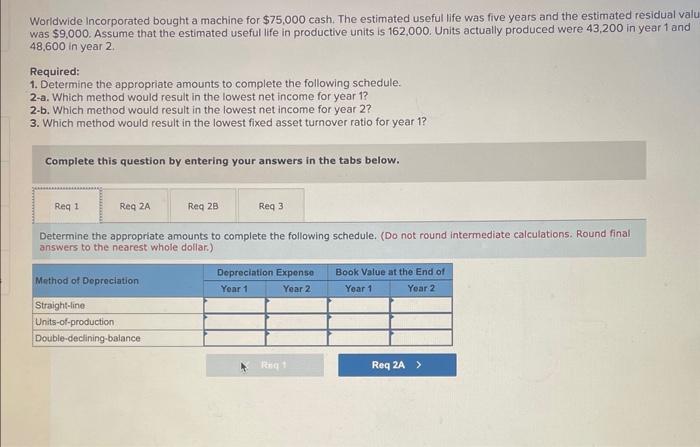

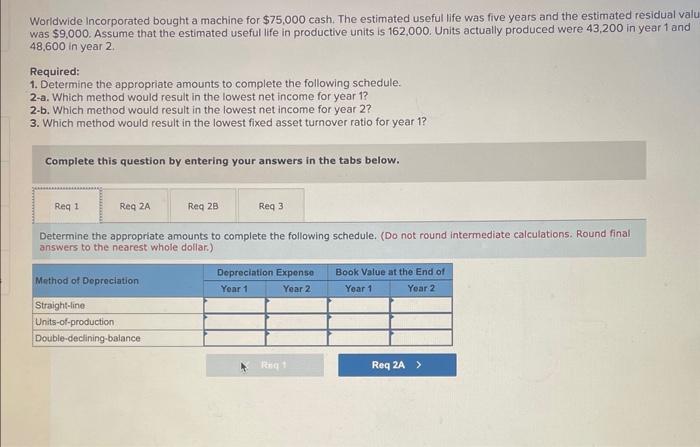

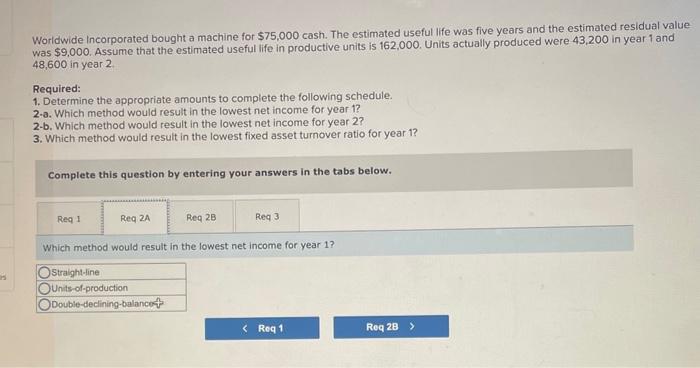

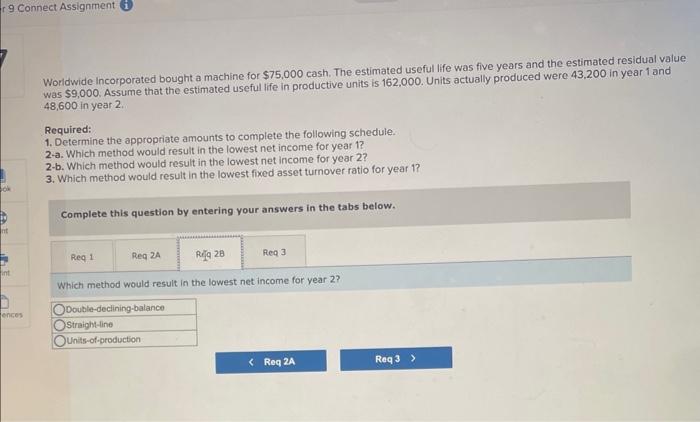

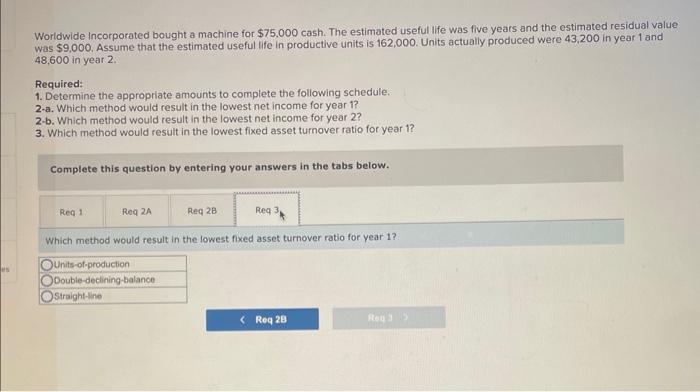

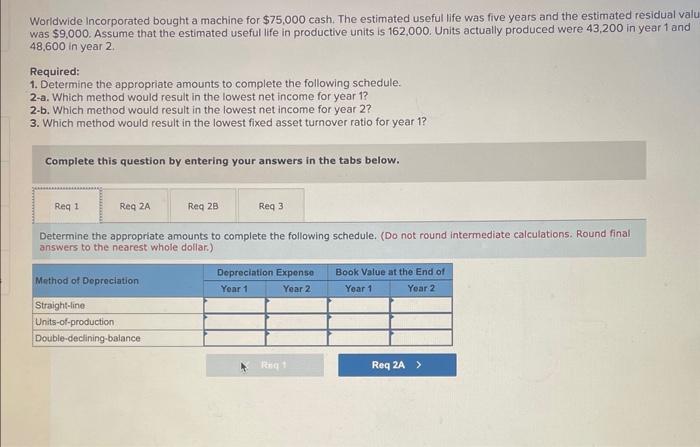

Worldwide incorporated bought a machine for $75,000 cash. The estimated useful life was five years and the estimated residual val was $9,000. Assume that the estimated useful life in productive units is 162,000 . Units actually produced were 43,200 in year 1 and 48,600 in year 2. Required: 1. Determine the appropriate amounts to complete the following schedule. 2-a. Which method would result in the lowest net income for year 1 ? 2-b. Which method would result in the lowest net income for year 2? 3. Which method would result in the lowest fixed asset turnover ratio for year 1 ? Complete this question by entering your answers in the tabs below. Determine the appropriate amounts to complete the following schedule, (Do not round intermediate calculations. Round final answers to the nearest whole dollar.) Worldwide Incorporated bought a machine for $75,000 cash. The estimated useful life was five years and the estimated residual value was $9,000. Assume that the estimated useful life in productive units is 162,000 . Units actually produced were 43,200 in year 1 and 48,600 in year 2 . Required: 1. Determine the appropriate amounts to complete the following schedule. 2-a. Which method would result in the lowest net income for year 1 ? 2-b. Which method would result in the lowest net income for year 2? 3. Which method would result in the lowest fixed asset turnover ratio for year 1 ? Complete this question by entering your answers in the tabs below. Which method would result in the lowest net income for year 1 ? Woridwide incorporated bought a machine for $75,000 cash. The estimated useful life was five years and the estimated residual value was $9,000. Assume that the estimated useful life in productive units is 162,000 . Units actually produced were 43,200 in year 1 and 48,600 in year 2 Required: 1. Determine the appropriate amounts to complete the following schedule. 2-a. Which method would result in the lowest net income for year 1 ? 2-b. Which method would result in the lowest net income for year 2? 3. Which method would result in the lowest fixed asset turnover ratio for year 1 ? Complete this question by entering your answers in the tabs below. Which method would result in the lowest net income for year 2 ? Worldwide incorporated bought a machine for $75,000 cash. The estimated useful life was five years and the estimated residual value Was $9,000. Assume that the estimated useful life in productive units is 162,000 . Units actually produced were 43,200 in year 1 and 48,600 in year 2 . Required: 1. Determine the appropriate amounts to complete the following schedule. 2-a. Which method would result in the lowest net income for year 1 ? 2-b. Which method would result in the lowest net income for year 2 ? 3. Which method would result in the lowest fixed asset turnover ratio for year 1 ? Complete this question by entering your answers in the tabs below. Which method would result in the lowest fixed asset turnover ratio for year 1