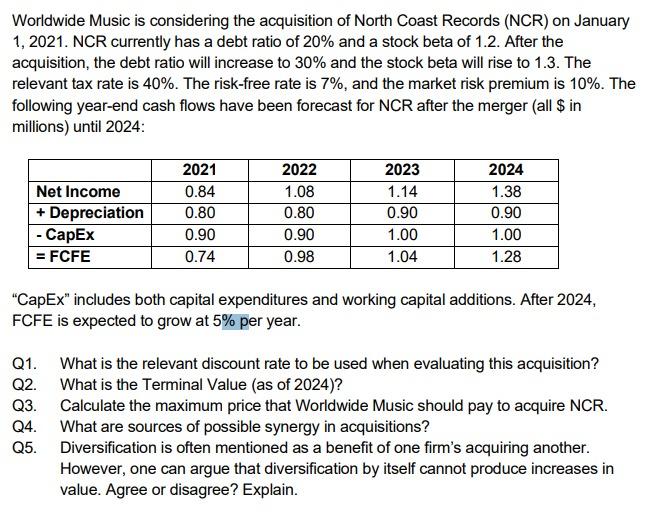

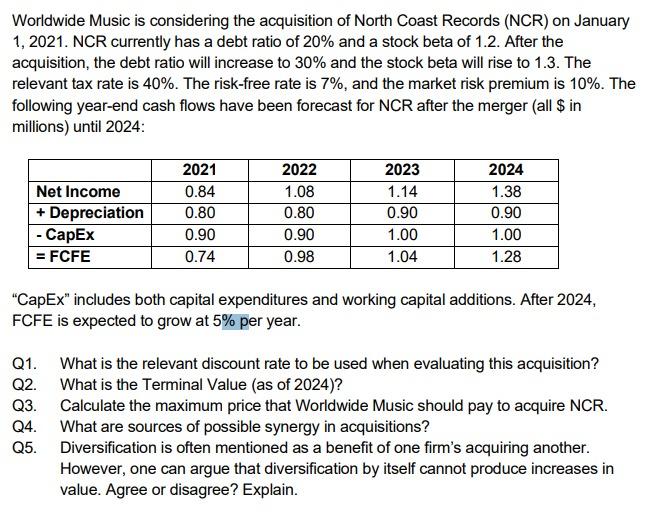

Worldwide Music is considering the acquisition of North Coast Records (NCR) on January 1, 2021. NCR currently has a debt ratio of 20% and a stock beta of 1.2. After the acquisition, the debt ratio will increase to 30% and the stock beta will rise to 1.3. The relevant tax rate is 40%. The risk-free rate is 7%, and the market risk premium is 10%. The following year-end cash flows have been forecast for NCR after the merger (all $ in millions) until 2024: Net Income + Depreciation - CapEx = FCFE 2021 0.84 0.80 0.90 0.74 2022 1.08 0.80 0.90 0.98 2023 1.14 0.90 1.00 1.04 2024 1.38 0.90 1.00 1.28 "CapEx" includes both capital expenditures and working capital additions. After 2024, FCFE is expected to grow at 5% per year. Q1. What is the relevant discount rate to be used when evaluating this acquisition? Q2. What is the Terminal Value (as of 2024)? Q3. Calculate the maximum price that Worldwide Music should pay to acquire NCR. Q4. What are sources of possible synergy in acquisitions? Q5. Diversification is often mentioned as a benefit of one firm's acquiring another. However, one can argue that diversification by itself cannot produce increases in value. Agree or disagree? Explain. Worldwide Music is considering the acquisition of North Coast Records (NCR) on January 1, 2021. NCR currently has a debt ratio of 20% and a stock beta of 1.2. After the acquisition, the debt ratio will increase to 30% and the stock beta will rise to 1.3. The relevant tax rate is 40%. The risk-free rate is 7%, and the market risk premium is 10%. The following year-end cash flows have been forecast for NCR after the merger (all $ in millions) until 2024: Net Income + Depreciation - CapEx = FCFE 2021 0.84 0.80 0.90 0.74 2022 1.08 0.80 0.90 0.98 2023 1.14 0.90 1.00 1.04 2024 1.38 0.90 1.00 1.28 "CapEx" includes both capital expenditures and working capital additions. After 2024, FCFE is expected to grow at 5% per year. Q1. What is the relevant discount rate to be used when evaluating this acquisition? Q2. What is the Terminal Value (as of 2024)? Q3. Calculate the maximum price that Worldwide Music should pay to acquire NCR. Q4. What are sources of possible synergy in acquisitions? Q5. Diversification is often mentioned as a benefit of one firm's acquiring another. However, one can argue that diversification by itself cannot produce increases in value. Agree or disagree? Explain