Would be much appreciated if someone could work out 6,19&20 for me please !

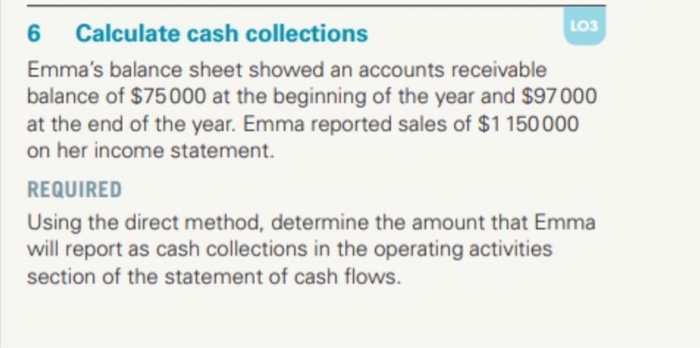

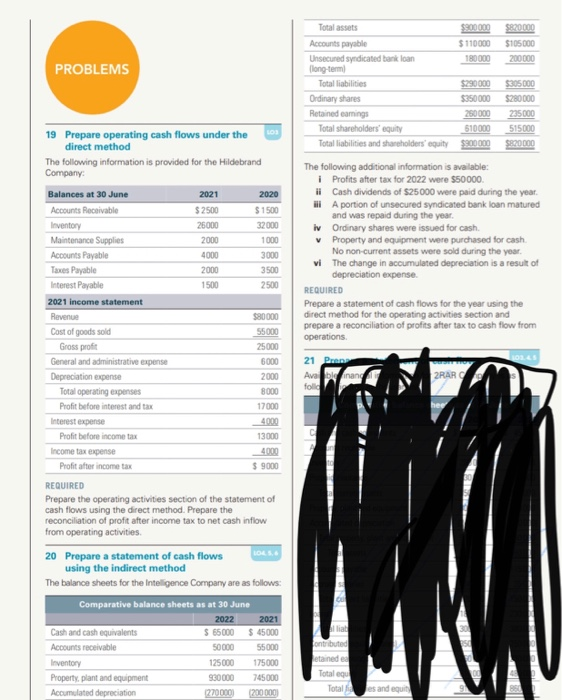

6 Calculate cash collections LO3 Emma's balance sheet showed an accounts receivable balance of $75000 at the beginning of the year and $97 000 at the end of the year. Emma reported sales of $1 150 000 on her income statement. REQUIRED Using the direct method, determine the amount that Emma will report as cash collections in the operating activities section of the statement of cash flows. PROBLEMS Total assets $200.000 $820.000 Accounts payable $ 110000 $105000 Unsecured syndicated bank loan 180000 200000 long term Total liabilities $290000 $305000 Ordinary shares $350 000 $280000 Retained coming 250000 25000 Total shareholders' equity 510000 515000 Total liabilities and shareholders' equity $900.000 $20.000 The following additional information is available: i Profits after tax for 2022 were $50000 ii Cash dividends of S25 000 were paid during the year. A portion of unsecured syndicated bank loan matured and was repaid during the year. iv Ordinary shares were issued for cash. V Property and equipment were purchased for cash No non-current assets were sold during the year, vi The change in accumulated depreciation is a result of depreciation expense. REQUIRED Prepare a statement of cash flows for the year using the direct method for the operating activities section and prepare a reconciliation of profits after tax to cash flow from operations 21 Pm Ava Finang folic 2RAR 19 Prepare operating cash flows under the direct method The following information is provided for the Hildebrand Company Balances at 30 June 2021 2020 Accounts Receivable $ 2500 $ 1500 Inventory 26000 32000 Maintenance Supplies 2000 1000 Accounts Payable 4000 3000 Taxes Payable 2000 3500 Interest Payable 1500 2500 2021 income statement Revenue $80 000 Cost of goods sold 55000 Gross profit 25000 General and administrative expense 6000 Depreciation expense 2000 Total operating expenses 8000 Profit before interest and tax 17000 Interest expense 4000 Profit before income tax 13000 Income tax expense 4000 Profit after income tax $ 9000 REQUIRED Prepare the operating activities section of the statement of cash flows using the direct method. Prepare the reconciliation of profit after income tax to net cash inflow from operating activities 20 Prepare a statement of cash flows 105. using the indirect method The balance sheets for the Intelligence Company are as follows: Comparative balance sheets as at 30 June 2022 2021 Cash and cash equivalents $ 65000 $ 45000 Accounts receivable 50000 55000 Inventory 125000 175000 Property, plant and equipment 930000 745000 Accumulated depreciation 200.000 liat Contributed etained Total Totals and equity