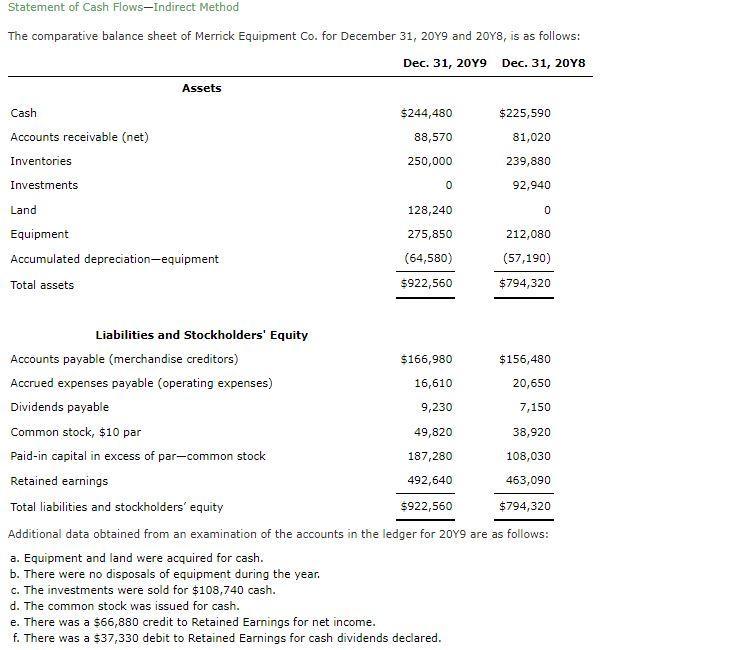

Statement of Cash Flows-Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31,

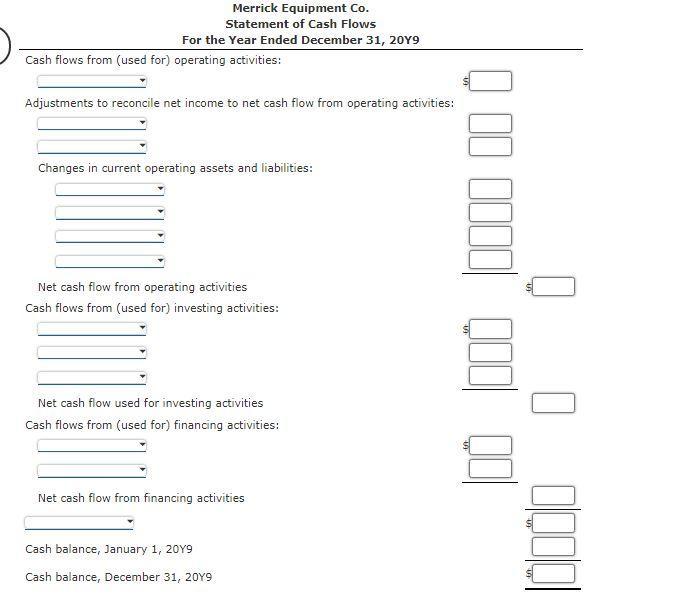

Statement of Cash Flows-Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Cash. Accounts receivable (net) Inventories Investments Assets Land Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $244,480 88,570 250,000 0 128,240 275,850 (64,580) $922,560 $225,590 81,020 239,880 92,940 0 212,080 (57,190) $794,320 $156,480 20,650 7,150 $166,980 16,610 9,230 49,820 38,920 187,280 108,030 492,640 463,090 $922,560 $794,320 Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $108,740 cash. d. The common stock was issued for cash. e. There was a $66,880 credit to Retained Earnings for net income. f. There was a $37,330 debit to Retained Earnings for cash dividends declared. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 20Y9 Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash balance, January 1, 20Y9 Cash balance, December 31, 20Y9

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Merrick Equipment Co Statement of Cash Flows For the Year Ended December 31 20Y9 Cash flows from ope...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started