would really appreciate any help on solving these problems.

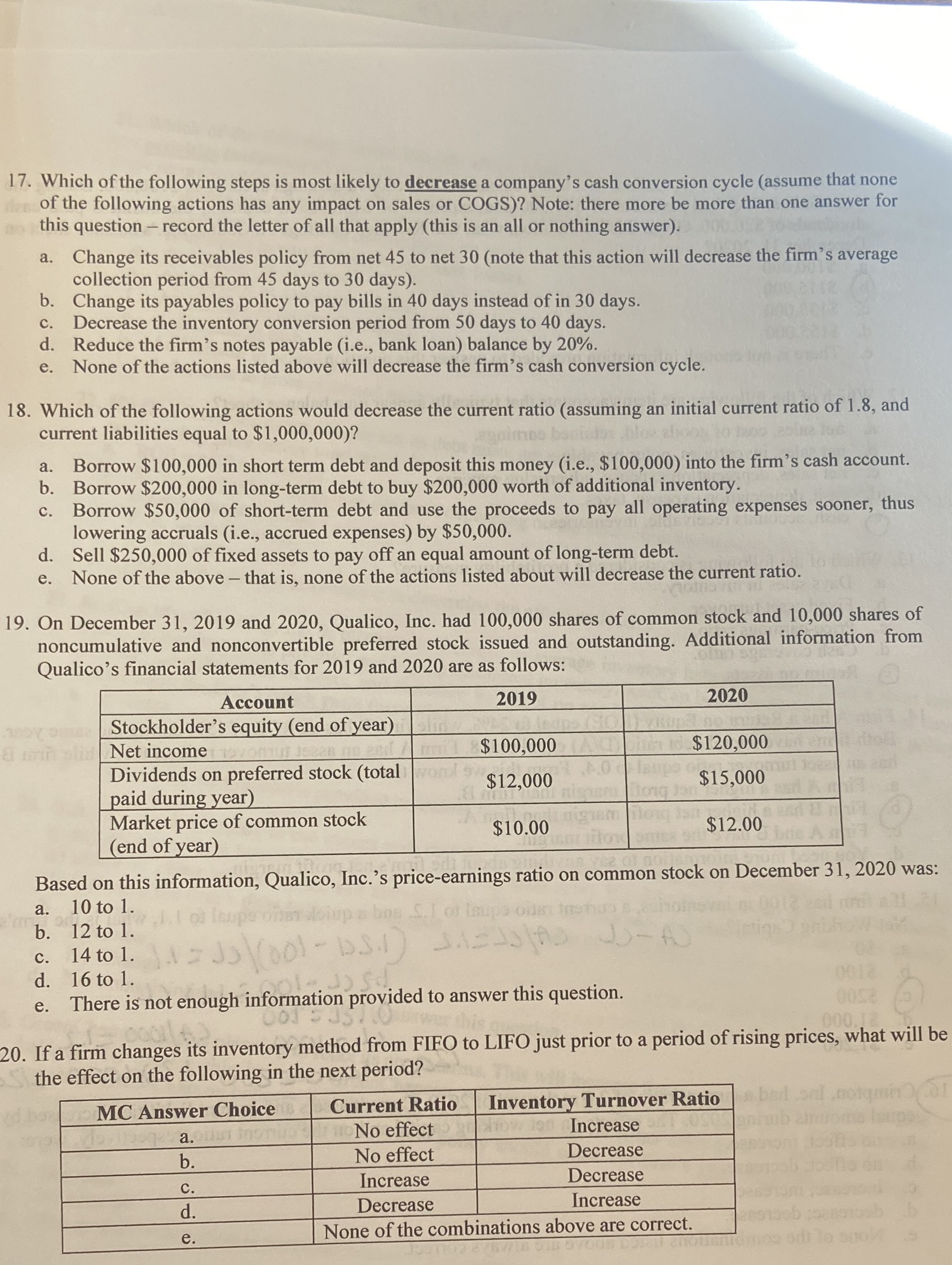

17. Which of the following steps is most likely to decrease a company's cash conversion cycle (assume that none of the following actions has any impact on sales or COGS)? Note: there more be more than one answer for this question - record the letter of all that apply (this is an all or nothing answer). a. Change its receivables policy from net 45 to net 30 (note that this action will decrease the firm's average collection period from 45 days to 30 days). b. Change its payables policy to pay bills in 40 days instead of in 30 days. c. Decrease the inventory conversion period from 50 days to 40 days. d. Reduce the firm's notes payable (i.e., bank loan) balance by 20%. e . None of the actions listed above will decrease the firm's cash conversion cycle. 18. Which of the following actions would decrease the current ratio (assuming an initial current ratio of 1.8, and current liabilities equal to $1,000,000)? a. Borrow $100,000 in short term debt and deposit this money (i.e., $100,000) into the firm's cash account. b. Borrow $200,000 in long-term debt to buy $200,000 worth of additional inventory. C . Borrow $50,000 of short-term debt and use the proceeds to pay all operating expenses sooner, thus lowering accruals (i.e., accrued expenses) by $50,000. d. Sell $250,000 of fixed assets to pay off an equal amount of long-term debt. e. None of the above - that is, none of the actions listed about will decrease the current ratio. 19. On December 31, 2019 and 2020, Qualico, Inc. had 100,000 shares of common stock and 10,000 shares of noncumulative and nonconvertible preferred stock issued and outstanding. Additional information from Qualico's financial statements for 2019 and 2020 are as follows: Account 2019 2020 Stockholder's equity (end of year) Net income $100,000 $120,000 Dividends on preferred stock (total $12,000 $15,000 paid during year) Market price of common stock $10.00 $12.00 (end of year) Based on this information, Qualico, Inc.'s price-earnings ratio on common stock on December 31, 2020 was: a. 10 to 1. b. 12 to 1. C. 14 to 1. = Jo (60) - BS.1 ) .2435 0-80 d. 16 to 1. e. There is not enough information provided to answer this question. oo58 000. 20. If a firm changes its inventory method from FIFO to LIFO just prior to a period of rising prices, what will be the effect on the following in the next period? MC Answer Choice Current Ratio Inventory Turnover Ratio a bad and . notgmina a. No effect Increase mob chmoms leups b . No effect Decrease C . Increase Decrease d. Decrease Increase 691906 tgangroub e. None of the combinations above are correct. mos adl to sgol