would really appreciate journal entries for government and nonprofit accounting class (encumbrances, expenditures) if you cant do all I would really like if you could do problems 3, 4, 12, 18, 19, 20, 25

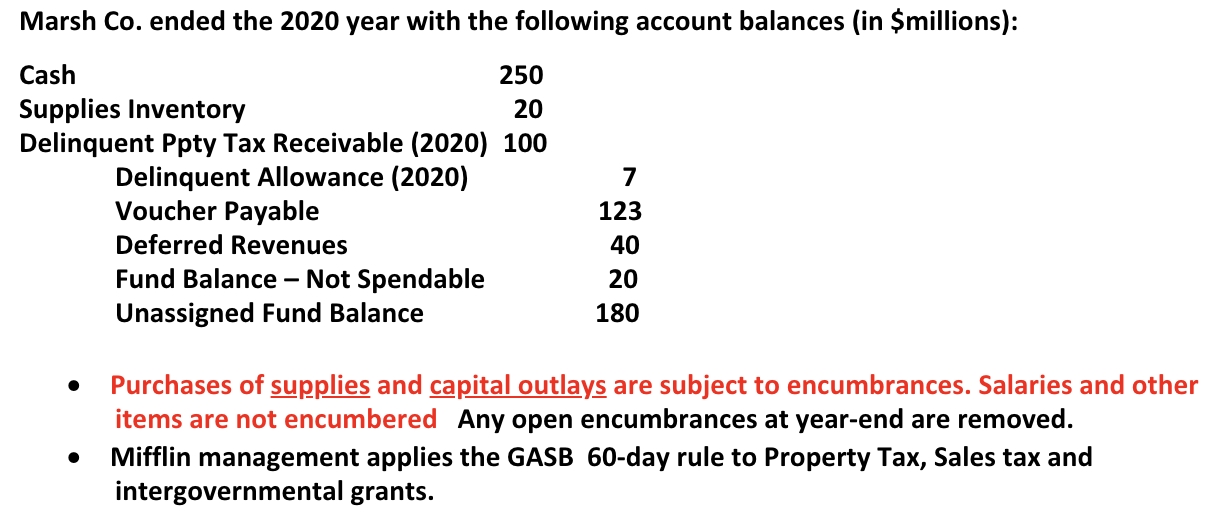

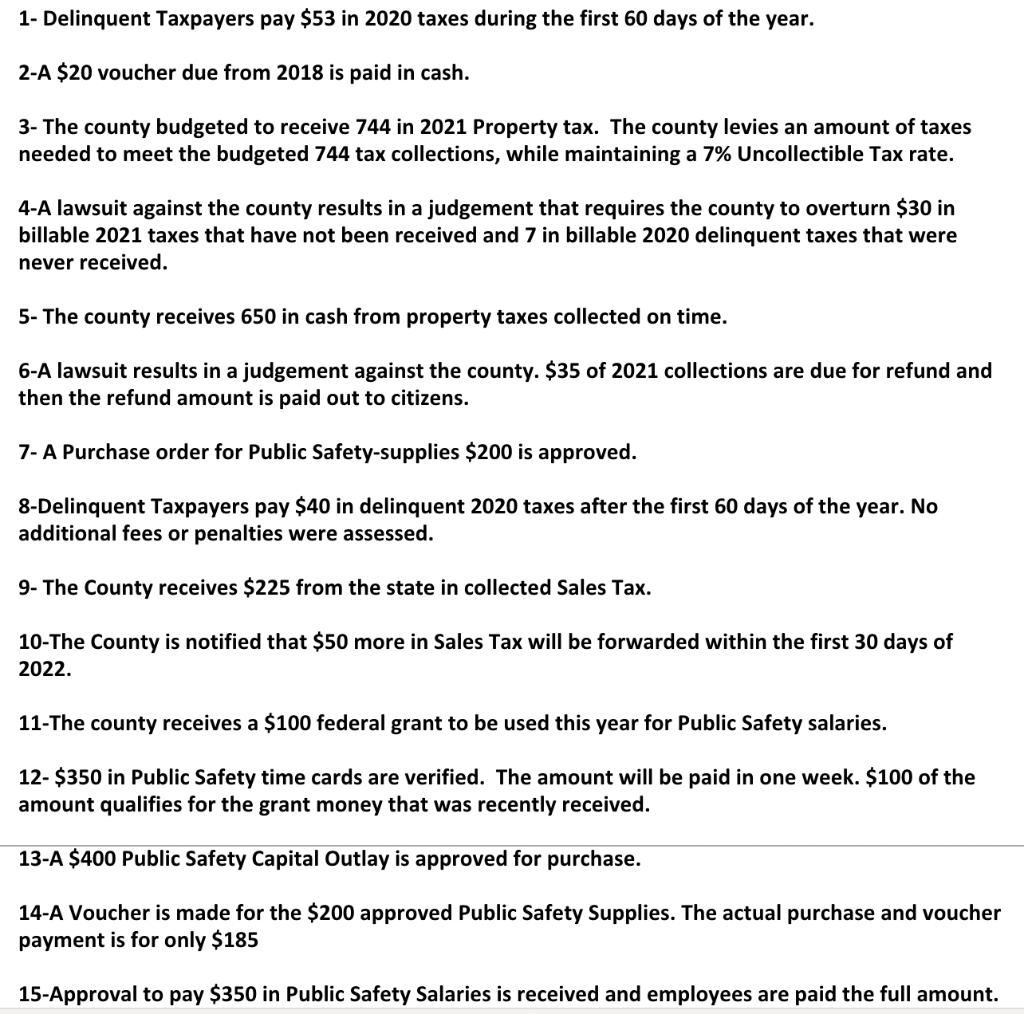

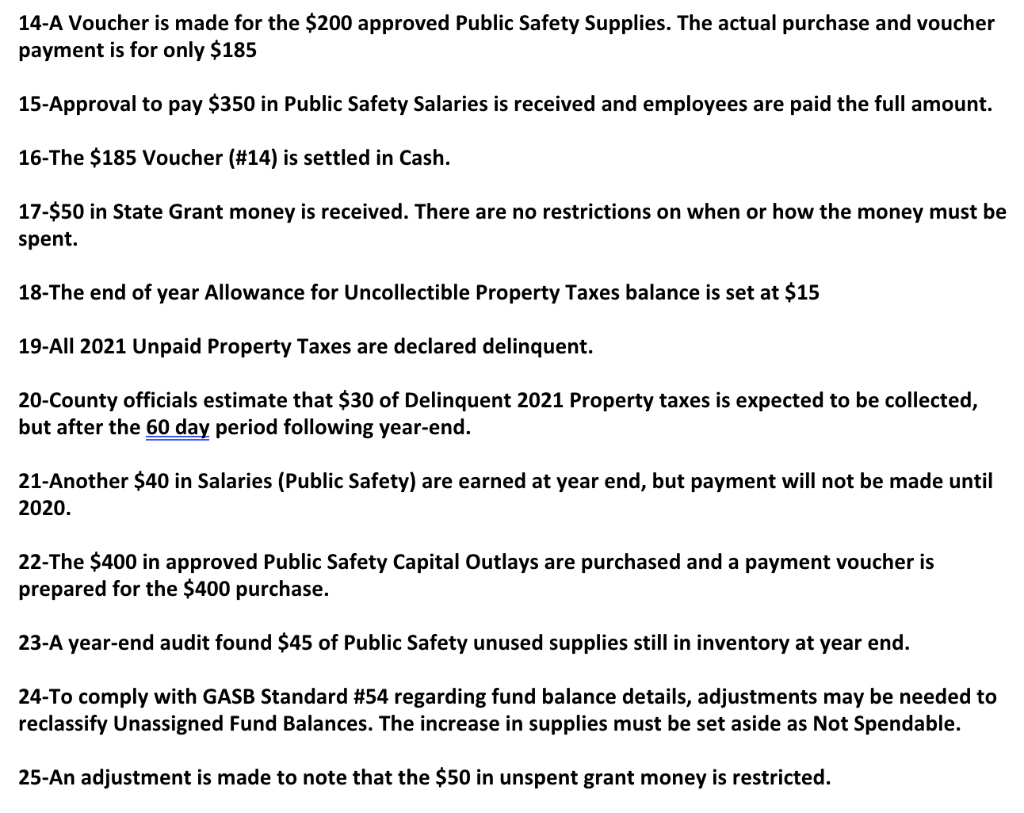

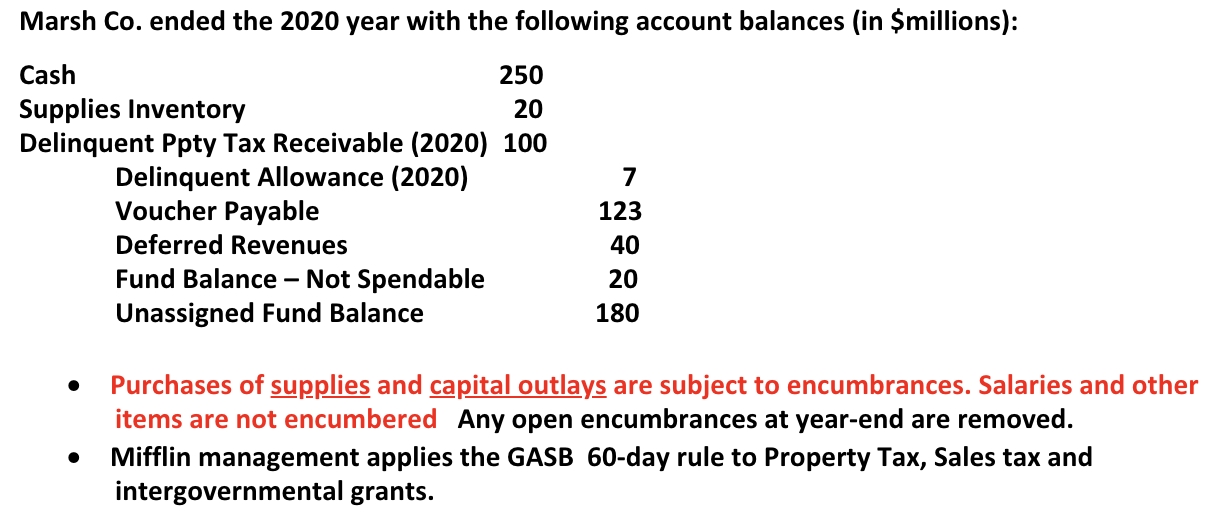

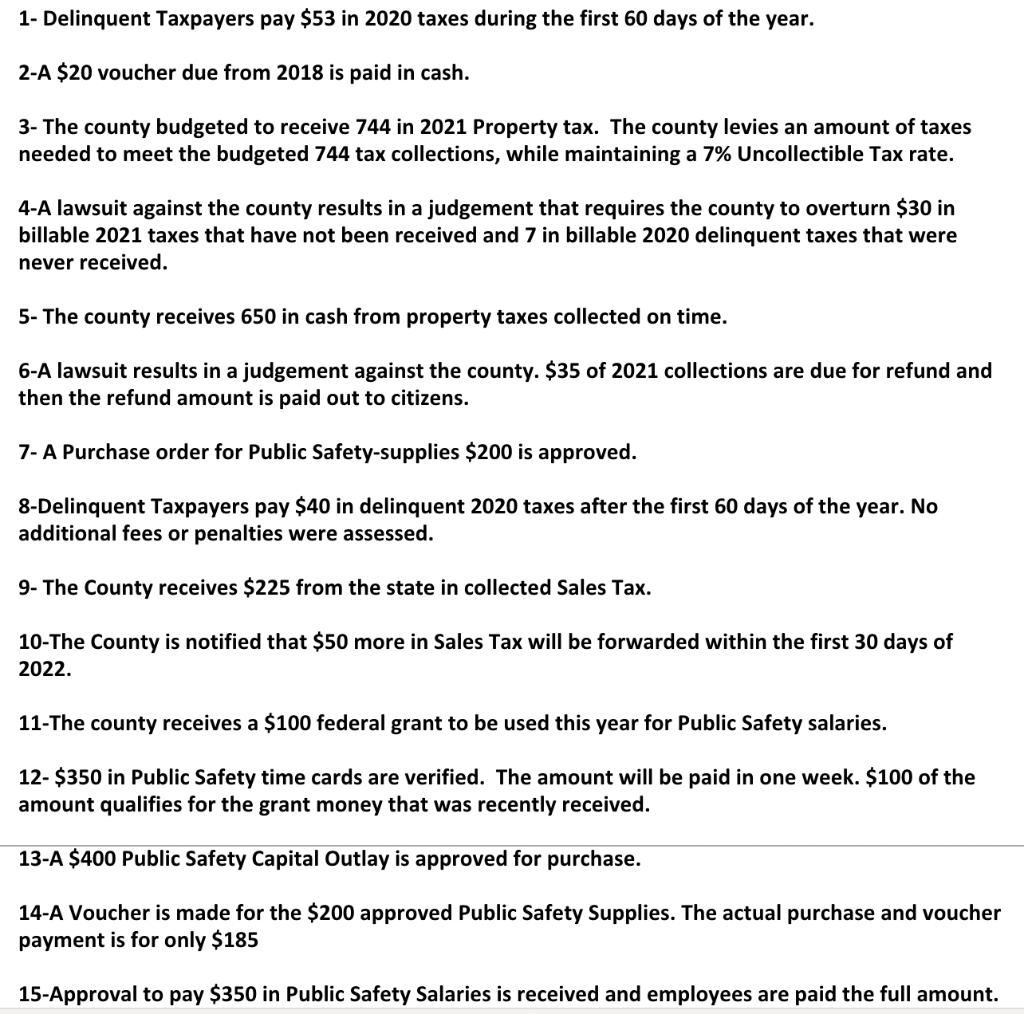

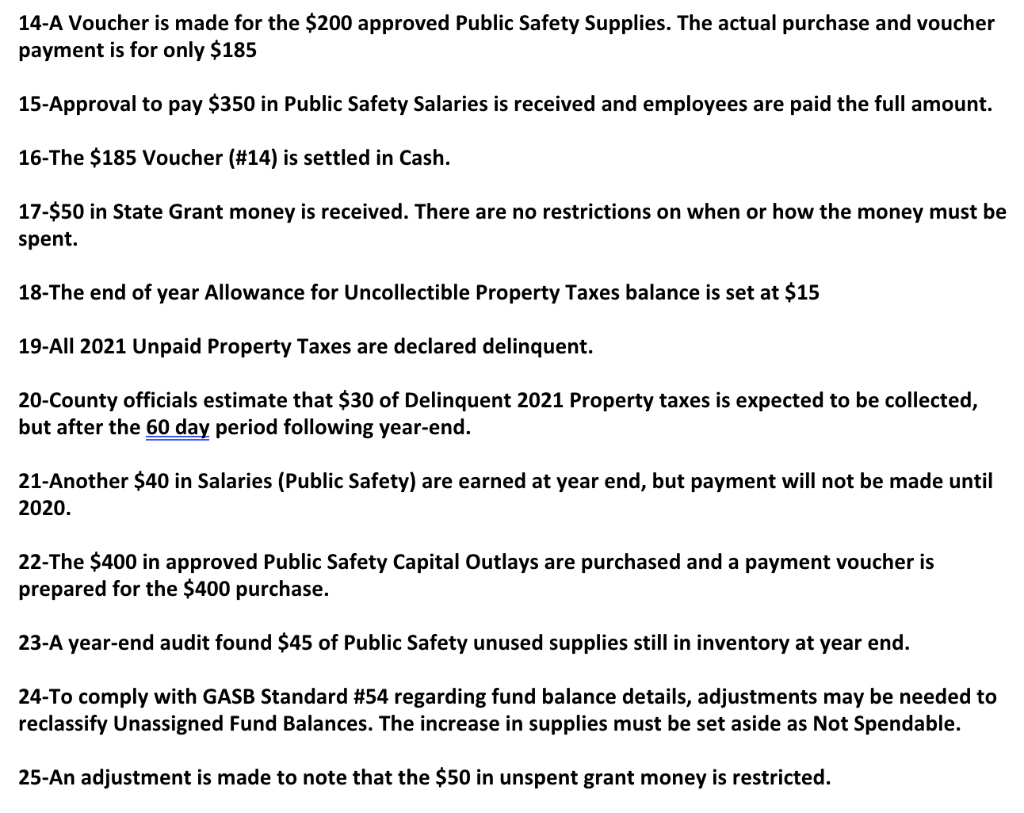

Marsh Co. ended the 2020 year with the following account balances (in $millions): Cash 250 Supplies Inventory 20 Delinquent Ppty Tax Receivable (2020) 100 Delinquent Allowance (2020) Voucher Payable Deferred Revenues Fund Balance - Not Spendable Unassigned Fund Balance 7 123 40 20 180 Purchases of supplies and capital outlays are subject to encumbrances. Salaries and other items are not encumbered Any open encumbrances at year-end are removed. Mifflin management applies the GASB 60-day rule to Property Tax, Sales tax and intergovernmental grants. . 1- Delinquent Taxpayers pay $53 in 2020 taxes during the first 60 days of the year. 2-A $20 voucher due from 2018 is paid in cash. 3- The county budgeted to receive 744 in 2021 Property tax. The county levies an amount of taxes needed to meet the budgeted 744 tax collections, while maintaining a 7% Uncollectible Tax rate. 4-A lawsuit against the county results in a judgement that requires the county to overturn $30 in billable 2021 taxes that have not been received and 7 in billable 2020 delinquent taxes that were never received. 5- The county receives 650 in cash from property taxes collected on time. 6-A lawsuit results in a judgement against the county. $35 of 2021 collections are due for refund and then the refund amount is paid out to citizens. 7- A Purchase order for Public Safety-supplies $200 is approved. 8-Delinquent Taxpayers pay $40 in delinquent 2020 taxes after the first 60 days of the year. No additional fees or penalties were assessed. 9- The County receives $225 from the state in collected Sales Tax. 10-The County is notified that $50 more in Sales Tax will be forwarded within the first 30 days of 2022. 11-The county receives a $100 federal grant to be used this year for Public Safety salaries. 12- $350 in Public Safety time cards are verified. The amount will be paid in one week. $100 of the amount qualifies for the grant money that was recently received. 13-A $400 Public Safety Capital Outlay is approved for purchase. 14-A Voucher is made for the $200 approved Public Safety Supplies. The actual purchase and voucher payment is for only $185 15-Approval to pay $350 in Public Safety Salaries is received and employees are paid the full amount. 14-A Voucher is made for the $200 approved Public Safety Supplies. The actual purchase and voucher payment is for only $185 15-Approval to pay $350 in Public Safety Salaries is received and employees are paid the full amount. 16-The $185 Voucher (#14) is settled in Cash. 17-$50 in State Grant money is received. There are no restrictions on when or how the money must be spent. 18-The end of year Allowance for Uncollectible Property Taxes balance is set at $15 19-All 2021 Unpaid Property Taxes are declared delinquent. 20-County officials estimate that $30 of Delinquent 2021 Property taxes is expected to be collected, but after the 60 day period following year-end. 21-Another $40 in Salaries (Public Safety) are earned at year end, but payment will not be made until 2020. 22-The $400 in approved Public Safety Capital Outlays are purchased and a payment voucher is prepared for the $400 purchase. 23-A year-end audit found $45 of Public Safety unused supplies still in inventory at year end. 24-To comply with GASB Standard #54 regarding fund balance details, adjustments may be needed to reclassify Unassigned Fund Balances. The increase in supplies must be set aside as Not Spendable. 25-An adjustment is made to note that the $50 in unspent grant money is restricted. Marsh Co. ended the 2020 year with the following account balances (in $millions): Cash 250 Supplies Inventory 20 Delinquent Ppty Tax Receivable (2020) 100 Delinquent Allowance (2020) Voucher Payable Deferred Revenues Fund Balance - Not Spendable Unassigned Fund Balance 7 123 40 20 180 Purchases of supplies and capital outlays are subject to encumbrances. Salaries and other items are not encumbered Any open encumbrances at year-end are removed. Mifflin management applies the GASB 60-day rule to Property Tax, Sales tax and intergovernmental grants. . 1- Delinquent Taxpayers pay $53 in 2020 taxes during the first 60 days of the year. 2-A $20 voucher due from 2018 is paid in cash. 3- The county budgeted to receive 744 in 2021 Property tax. The county levies an amount of taxes needed to meet the budgeted 744 tax collections, while maintaining a 7% Uncollectible Tax rate. 4-A lawsuit against the county results in a judgement that requires the county to overturn $30 in billable 2021 taxes that have not been received and 7 in billable 2020 delinquent taxes that were never received. 5- The county receives 650 in cash from property taxes collected on time. 6-A lawsuit results in a judgement against the county. $35 of 2021 collections are due for refund and then the refund amount is paid out to citizens. 7- A Purchase order for Public Safety-supplies $200 is approved. 8-Delinquent Taxpayers pay $40 in delinquent 2020 taxes after the first 60 days of the year. No additional fees or penalties were assessed. 9- The County receives $225 from the state in collected Sales Tax. 10-The County is notified that $50 more in Sales Tax will be forwarded within the first 30 days of 2022. 11-The county receives a $100 federal grant to be used this year for Public Safety salaries. 12- $350 in Public Safety time cards are verified. The amount will be paid in one week. $100 of the amount qualifies for the grant money that was recently received. 13-A $400 Public Safety Capital Outlay is approved for purchase. 14-A Voucher is made for the $200 approved Public Safety Supplies. The actual purchase and voucher payment is for only $185 15-Approval to pay $350 in Public Safety Salaries is received and employees are paid the full amount. 14-A Voucher is made for the $200 approved Public Safety Supplies. The actual purchase and voucher payment is for only $185 15-Approval to pay $350 in Public Safety Salaries is received and employees are paid the full amount. 16-The $185 Voucher (#14) is settled in Cash. 17-$50 in State Grant money is received. There are no restrictions on when or how the money must be spent. 18-The end of year Allowance for Uncollectible Property Taxes balance is set at $15 19-All 2021 Unpaid Property Taxes are declared delinquent. 20-County officials estimate that $30 of Delinquent 2021 Property taxes is expected to be collected, but after the 60 day period following year-end. 21-Another $40 in Salaries (Public Safety) are earned at year end, but payment will not be made until 2020. 22-The $400 in approved Public Safety Capital Outlays are purchased and a payment voucher is prepared for the $400 purchase. 23-A year-end audit found $45 of Public Safety unused supplies still in inventory at year end. 24-To comply with GASB Standard #54 regarding fund balance details, adjustments may be needed to reclassify Unassigned Fund Balances. The increase in supplies must be set aside as Not Spendable. 25-An adjustment is made to note that the $50 in unspent grant money is restricted