Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Write a client letter to Sam providing your recommendation regarding vehicle deductions for business use Supplemental Information Year 1 (20Y1) When Sam met with the

Write a client letter to Sam providing your recommendation regarding vehicle deductions for business use

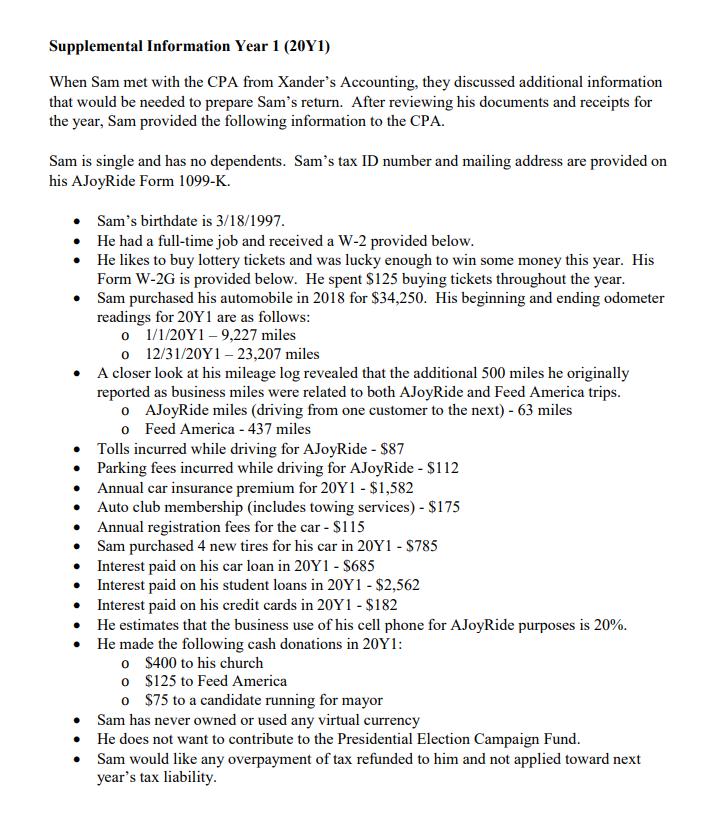

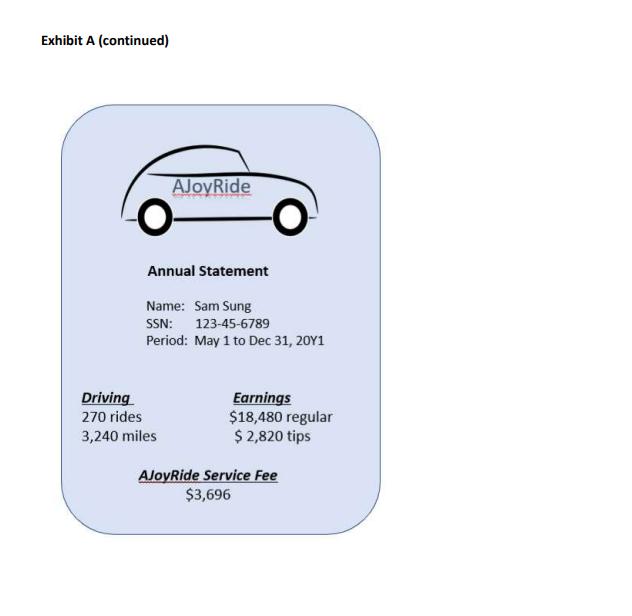

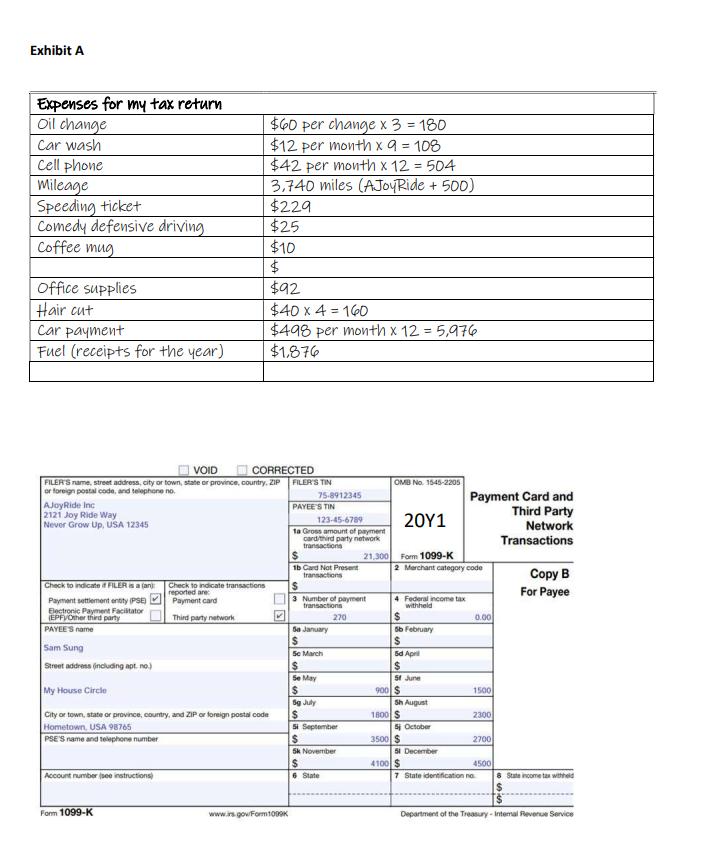

Supplemental Information Year 1 (20Y1) When Sam met with the CPA from Xander's Accounting, they discussed additional information that would be needed to prepare Sam's return. After reviewing his documents and receipts for the year, Sam provided the following information to the CPA. Sam is single and has no dependents. Sam's tax ID number and mailing address are provided on his AJoyRide Form 1099-K. Sam's birthdate is 3/18/1997. He had a full-time job and received a W-2 provided below. He likes to buy lottery tickets and was lucky enough to win some money this year. His Form W-2G is provided below. He spent $125 buying tickets throughout the year. Sam purchased his automobile in 2018 for $34,250. His beginning and ending odometer readings for 20Y1 are as follows: o 1/1/20Y1-9,227 miles o 12/31/20Y1-23,207 miles A closer look at his mileage log revealed that the additional 500 miles he originally reported as business miles were related to both AJoyRide and Feed America trips. o AJoyRide miles (driving from one customer to the next) - 63 miles o Feed America - 437 miles Tolls incurred while driving for AJoyRide - $87 Parking fees incurred while driving for AJoyRide - $112 Annual car insurance premium for 20Y1 - $1,582 Auto club membership (includes towing services) - $175 Annual registration fees for the car - $115 Sam purchased 4 new tires for his car in 20Y1 - $785 Interest paid on his car loan in 20Y1 - $685 Interest paid on his student loans in 20Y1 - $2,562 Interest paid on his credit cards in 20Y1 - $182 He estimates that the business use of his cell phone for AJoyRide purposes is 20%. He made the following cash donations in 20Y1: o $400 to his church o $125 to Feed America o $75 to a candidate running for mayor Sam has never owned or used any virtual currency He does not want to contribute to the Presidential Election Campaign Fund. Sam would like any overpayment of tax refunded to him and not applied toward next year's tax liability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Your Name Your Address City State ZIP Code Email Address Phone Number Date Sam Sung Clients Address City State ZIP Code Dear Sam RE Vehicle Deductions for Business Use I hope this letter finds you wel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started